Get the free Risk Assessment of Insurance Form

Show details

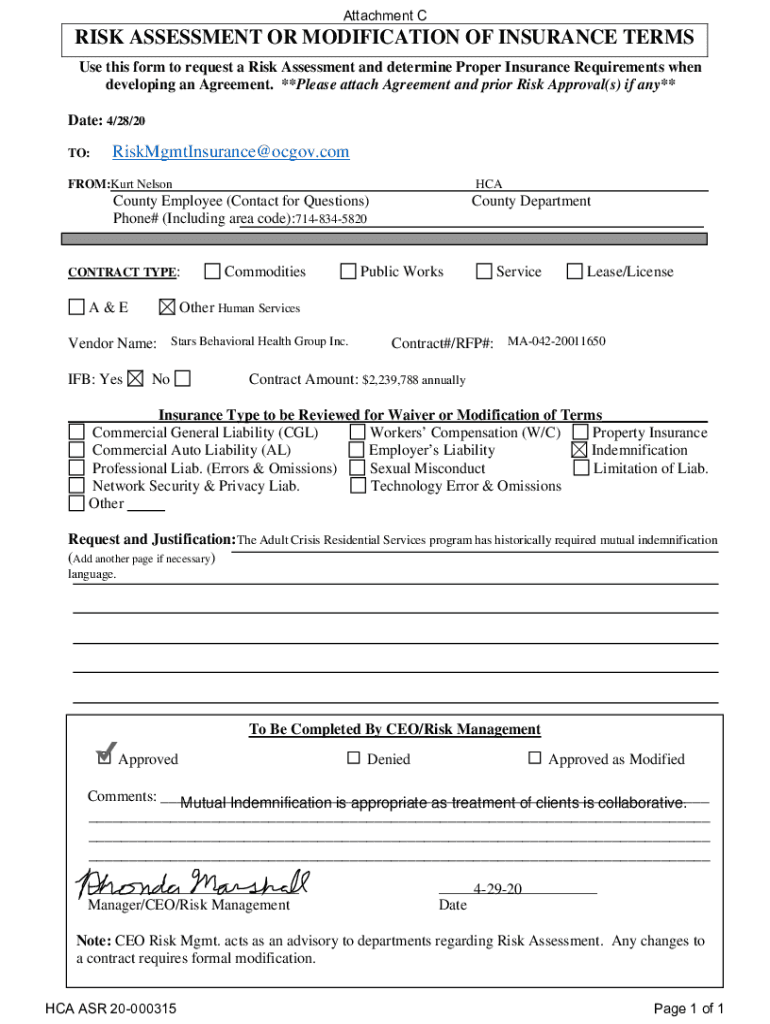

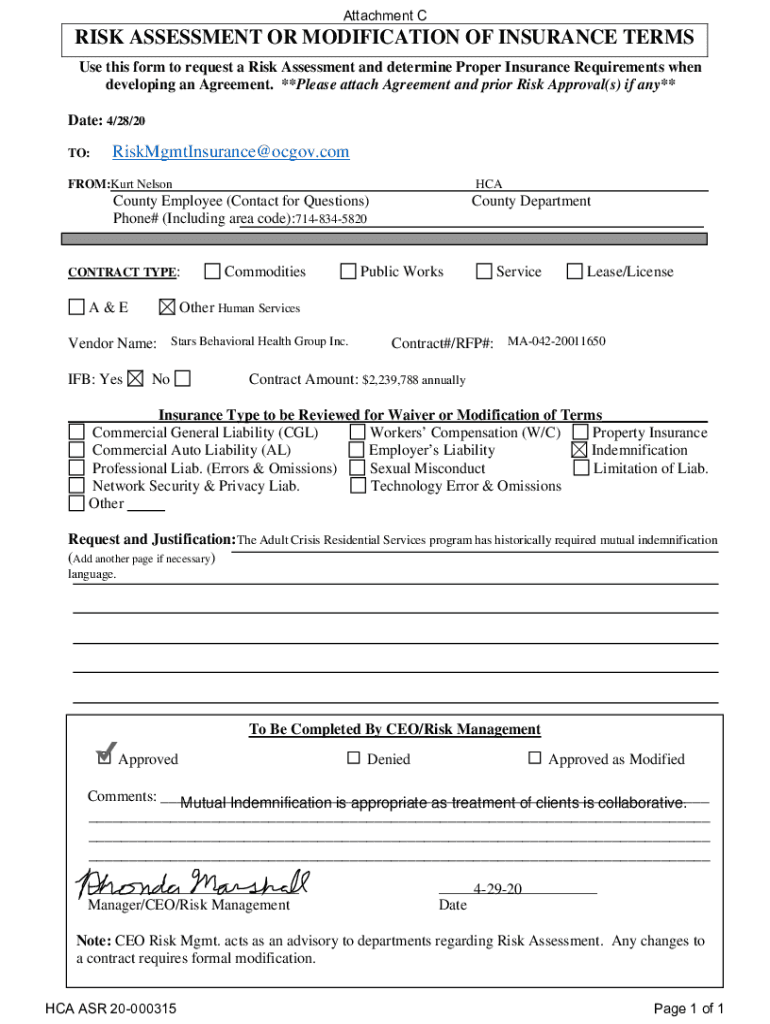

Attachment CRISK ASSESSMENT OR MODIFICATION OF INSURANCE TERMS Use this form to request a Risk Assessment and determine Proper Insurance Requirements when developing an Agreement. **Please attach

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk assessment of insurance

Edit your risk assessment of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk assessment of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk assessment of insurance online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk assessment of insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk assessment of insurance

How to fill out risk assessment of insurance

01

To fill out a risk assessment of insurance, you should follow these steps:

02

Identify the risks: Begin by identifying all the potential risks your insurance policy covers. This may include risks related to property damage, liability, or business interruption.

03

Determine the likelihood: Assess the likelihood of each identified risk occurring. Consider factors such as past occurrences, industry trends, and external factors that may increase or decrease the likelihood of a risk.

04

Evaluate the impact: Evaluate the potential impact of each risk on your business or personal assets. Consider the financial costs, reputation damage, and potential disruption to operations.

05

Assign risk levels: Assign a risk level to each identified risk based on its likelihood and impact. This can be done using a risk matrix or a similar method.

06

Implement risk mitigation measures: Develop strategies to mitigate or reduce the identified risks. This may involve implementing safety protocols, purchasing additional insurance coverage, or transferring risks through contracts or agreements.

07

Monitor and review: Regularly review and update your risk assessment to ensure it remains relevant. Monitor changes in your business or external factors that may affect the risks identified.

08

Seek professional advice: If needed, consult with insurance professionals or risk management experts to ensure your risk assessment is thorough and accurate.

09

By following these steps, you can effectively fill out a risk assessment of insurance.

Who needs risk assessment of insurance?

01

Anyone who owns valuable assets, operates a business, or faces potential liabilities can benefit from a risk assessment of insurance. This includes:

02

- Individuals who own homes, cars, or other valuable properties and want to protect them against potential risks such as theft, natural disasters, or accidents.

03

- Businesses of all sizes in various industries that want to identify and mitigate risks that could cause financial losses, damage reputation, or disrupt operations.

04

- Professionals, such as doctors, lawyers, or consultants, who want to safeguard themselves against potential claims or lawsuits related to their services.

05

- Non-profit organizations and government entities that aim to protect their assets, fulfill their mission, and ensure the well-being of their stakeholders.

06

In summary, risk assessment of insurance is beneficial for individuals, businesses, and organizations that want to proactively manage risks and protect their assets and interests.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send risk assessment of insurance for eSignature?

When your risk assessment of insurance is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get risk assessment of insurance?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific risk assessment of insurance and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit risk assessment of insurance online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your risk assessment of insurance to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is risk assessment of insurance?

Risk assessment of insurance is the process of identifying, evaluating, and prioritizing risks related to insurance policies in order to determine the appropriate level of coverage and premium.

Who is required to file risk assessment of insurance?

Insurance providers, underwriters, and certain regulatory bodies are required to file risk assessments to comply with industry standards and regulations.

How to fill out risk assessment of insurance?

To fill out a risk assessment of insurance, gather relevant data about the insured entity, evaluate potential risks, complete the assessment form by providing information on risk factors, and submit it to the respective authority or organization.

What is the purpose of risk assessment of insurance?

The purpose of risk assessment of insurance is to analyze potential risks, ensure that appropriate measures are in place to manage those risks, and inform insurance underwriting and pricing decisions.

What information must be reported on risk assessment of insurance?

Required information typically includes details about the insured, types of coverage, identified risks, risk mitigation strategies, and historical claims data.

Fill out your risk assessment of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Assessment Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.