Get the free Receivables due from officers , directors , trustees, and other

Show details

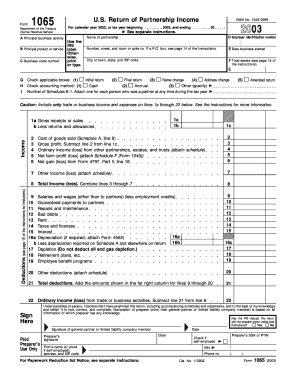

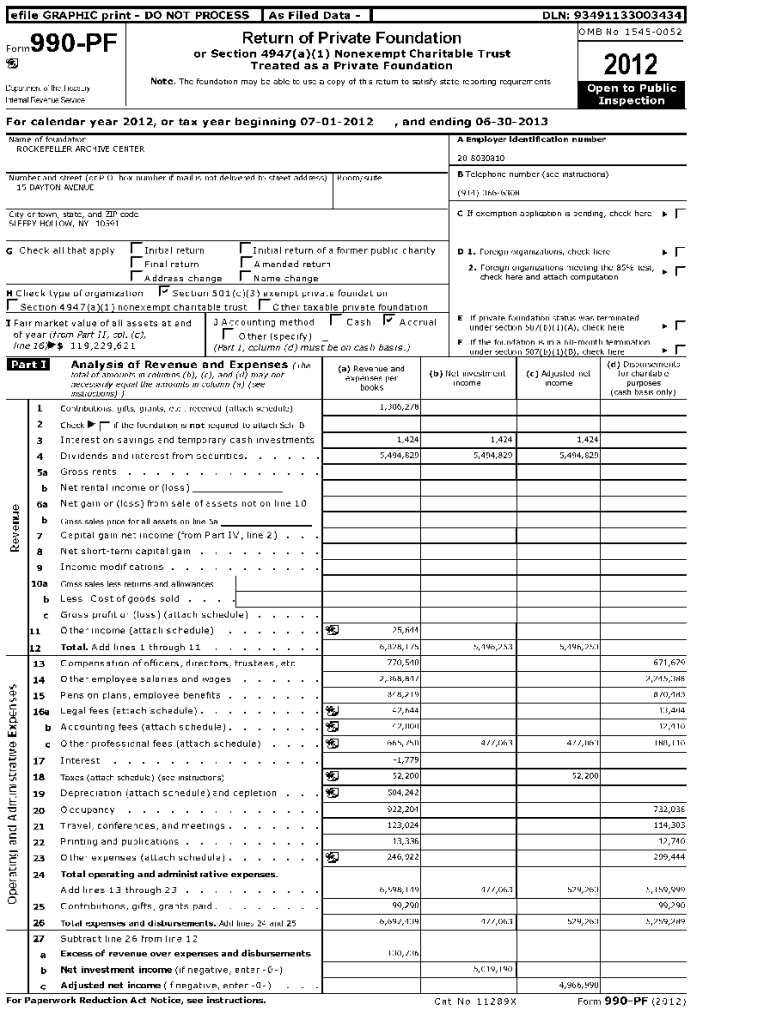

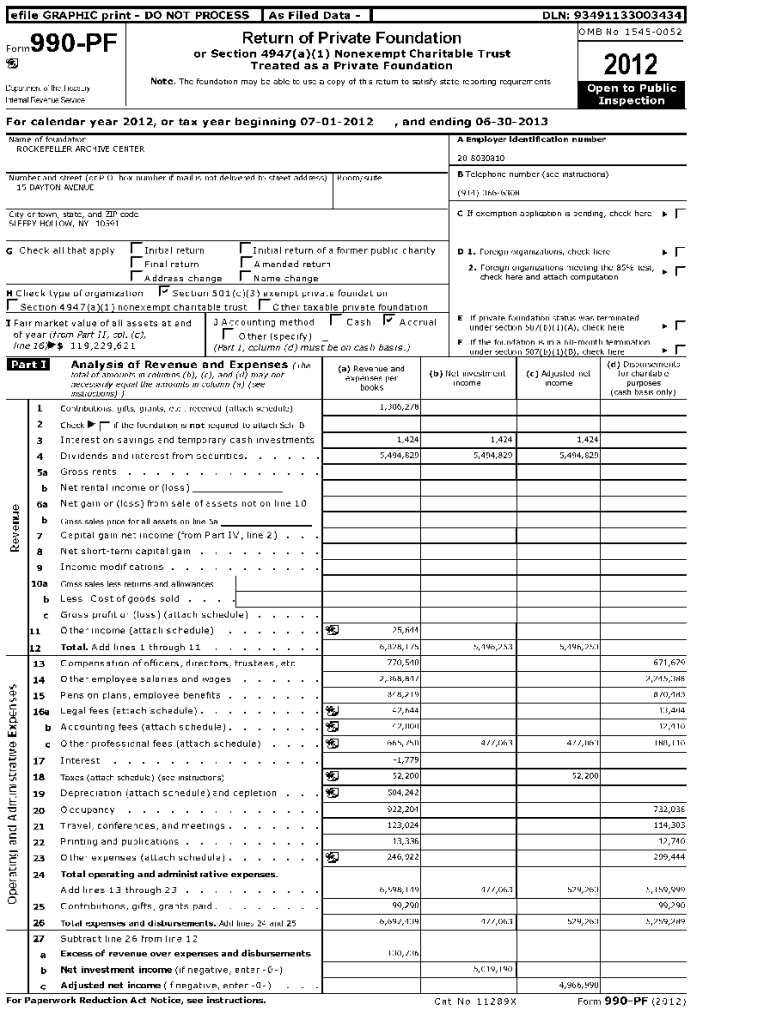

l efile GRAPHIC p rint DO NOT PROCESSFormAs Filed Data DLN: 93491133003434 OMB No 15450052Return of Private Foundation990 PFor Section 4947(a)(1) Nonexempt Charitable Trust`Treated as a Private Foundation2012Note

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receivables due from officers

Edit your receivables due from officers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receivables due from officers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing receivables due from officers online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit receivables due from officers. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receivables due from officers

How to fill out receivables due from officers

01

Gather all relevant documentation, such as invoices, payment receipts, and any agreements or contracts that outline the amount owed by the officers.

02

Verify the accuracy of the receivables by cross-checking the documentation and contacting the officers if necessary.

03

Create a detailed account of the receivables due from officers, including the name of the officers, the amount owed, and the due date.

04

Record the receivables in your financial records, such as in the accounts receivable ledger or accounting software.

05

Follow up on the receivables regularly, sending reminders and invoices to the officers to ensure timely payment.

06

If the officers fail to make the payment within the agreed-upon timeframe, consider taking appropriate actions, such as sending formal demand letters or pursuing legal options.

07

Keep track of the status of the receivables and update the records accordingly once payment is received.

08

Conduct periodic reviews of the outstanding receivables to identify any potential issues or delays in collection and take necessary actions to resolve them.

Who needs receivables due from officers?

01

Organizations or businesses that have provided goods or services to officers

02

Financial departments or accounting professionals responsible for maintaining accurate financial records

03

Legal teams or professionals involved in legal actions related to officers' debts

04

Auditors or tax advisors who need to review and verify the receivables due from officers

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find receivables due from officers?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the receivables due from officers in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the receivables due from officers in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your receivables due from officers in seconds.

How do I fill out the receivables due from officers form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign receivables due from officers and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is receivables due from officers?

Receivables due from officers refers to amounts owed to a company by its officers or directors, typically arising from loans, advances, or expenses paid on behalf of these individuals.

Who is required to file receivables due from officers?

Entities that are required to file receivables due from officers typically include corporations and organizations that have officers with outstanding loans or amounts owed to the company.

How to fill out receivables due from officers?

To fill out receivables due from officers, provide detailed information such as the officer's name, the amount owed, the terms of repayment, and any applicable interest rates.

What is the purpose of receivables due from officers?

The purpose of receivables due from officers is to account for and track amounts owed by corporate officers, ensuring transparency in financial reporting and compliance with regulations.

What information must be reported on receivables due from officers?

Information that must be reported includes the officer's name, the outstanding balance, transaction dates, purpose of the loan, and any terms related to repayment.

Fill out your receivables due from officers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receivables Due From Officers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.