Get the free Recognizing Your Gift - SDSU College of Sciences

Show details

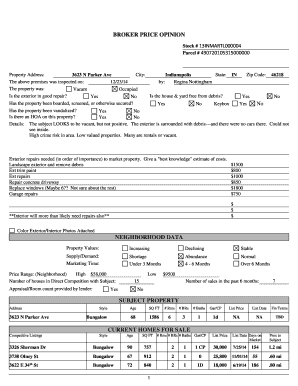

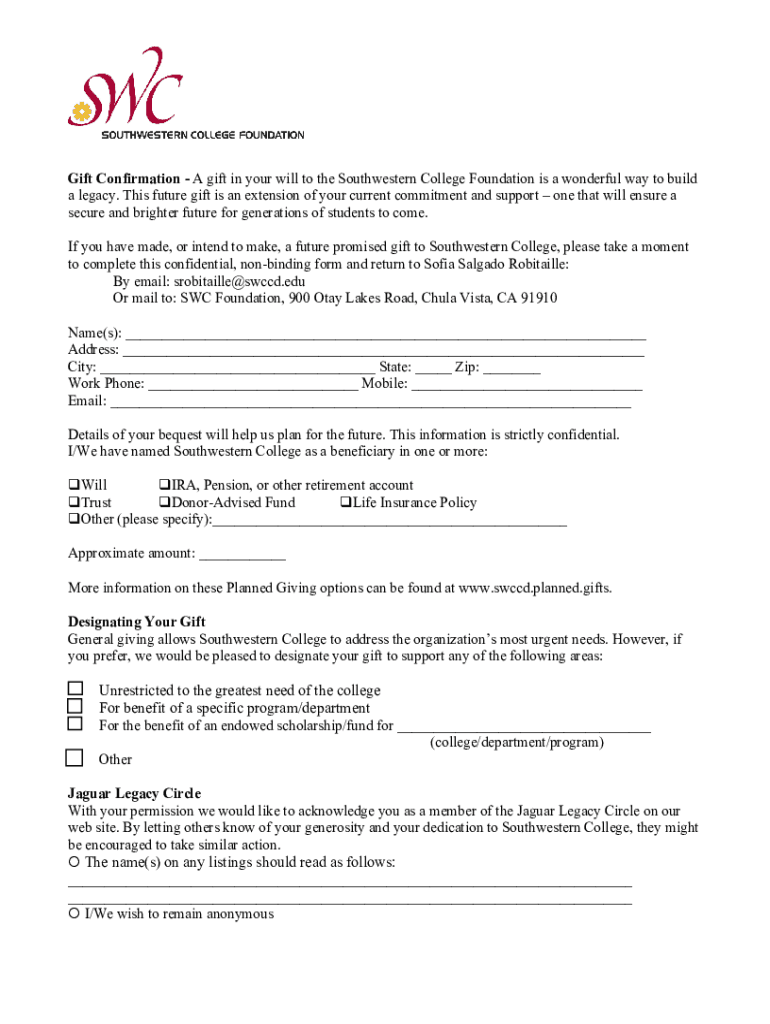

Gift Confirmation A gift in your will to the Southwestern College Foundation is a wonderful way to build a legacy. This future gift is an extension of your current commitment and support one that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recognizing your gift

Edit your recognizing your gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recognizing your gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit recognizing your gift online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit recognizing your gift. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out recognizing your gift

How to fill out recognizing your gift

01

Start by reflecting on your interests and passions. What activities or subjects do you enjoy and excel in?

02

Pay attention to the feedback and compliments you receive from others. What do people often praise you for?

03

Explore different areas and try new things. Sometimes, you may discover your gift through experimentation and exploration.

04

Take note of the activities that bring you joy and fulfillment. What do you find yourself naturally drawn to?

05

Seek guidance from mentors, friends, or career counselors who can provide insight and help you identify your gifts.

06

Practice self-reflection and introspection. What activities make you lose track of time and immerse yourself completely?

07

Trust your instincts and listen to your inner voice. Sometimes, your intuition can guide you towards realizing your true gifts.

08

Embrace failure and setbacks as learning opportunities. Sometimes, it takes trial and error to discover your unique talents.

Who needs recognizing your gift?

01

Recognizing your gift is beneficial for anyone who is looking to find their true calling or purpose in life.

02

It can be advantageous for individuals who feel lost or are searching for a sense of fulfillment and direction.

03

People who are interested in personal growth and self-development can benefit from recognizing their gifts.

04

It is especially valuable for those who want to make meaningful contributions to society and utilize their talents effectively.

05

Recognizing your gift can also aid in career development and choosing the right path that aligns with your strengths.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit recognizing your gift from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including recognizing your gift. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute recognizing your gift online?

pdfFiller has made it simple to fill out and eSign recognizing your gift. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete recognizing your gift on an Android device?

Use the pdfFiller mobile app to complete your recognizing your gift on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is recognizing your gift?

Recognizing your gift refers to the process of acknowledging and reporting the value of gifts and transfers made to individuals or organizations for tax purposes.

Who is required to file recognizing your gift?

Individuals who make gifts exceeding the annual exclusion amount are required to file recognizing your gift.

How to fill out recognizing your gift?

To fill out recognizing your gift, you will need to use IRS Form 709, provide details of the gifts made, including the value and recipient information, and any applicable deductions.

What is the purpose of recognizing your gift?

The purpose of recognizing your gift is to ensure compliance with tax regulations and to report any significant transfers that may impact tax liability.

What information must be reported on recognizing your gift?

The information that must be reported includes the names of the donor and recipient, the date of the gift, a description of the gift, its fair market value, and any deducted exclusions.

Fill out your recognizing your gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recognizing Your Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.