TX Comptroller AP-204 2009 free printable template

Show details

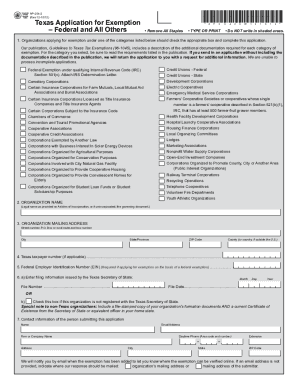

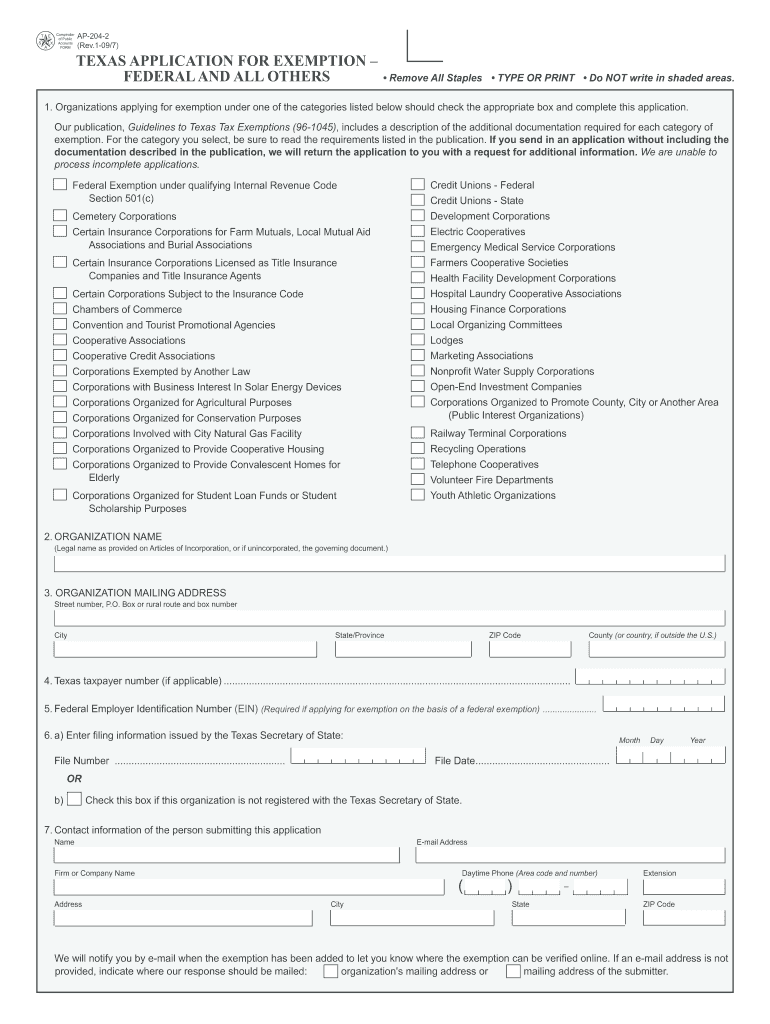

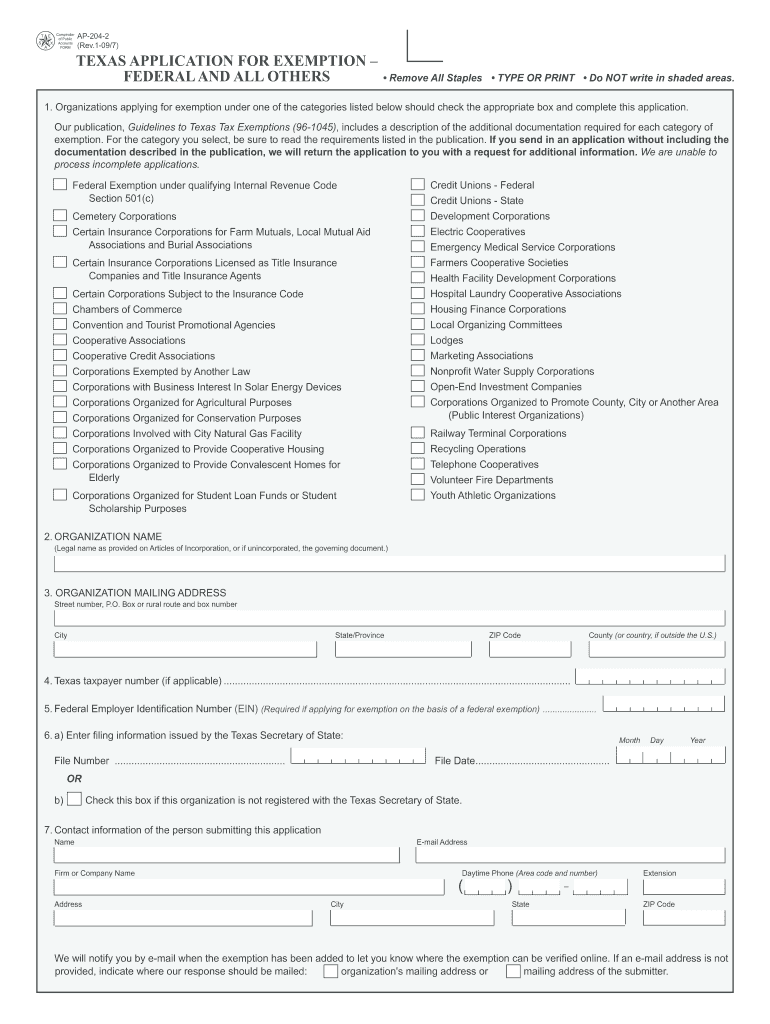

Contact us at the address or toll-free number listed on this form. AP-204-1 Rev.1-09/7 AP-204-2 Rev.1-09/7 PRINT FORM FEDERAL AND ALL OTHERS CLEAR FIELDS Remove All Staples TYPE OR PRINT Do NOT write in shaded areas. Please use this application Form AP-204 to apply for exemption if you are applying on the basis of the organization s designation as a qualifying 501 c organization or applying on any basis OTHER THAN as a religious charitable educational organization or a homeowners...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-204

Edit your TX Comptroller AP-204 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-204 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller AP-204 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX Comptroller AP-204. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-204 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-204

How to fill out TX Comptroller AP-204

01

Obtain the TX Comptroller AP-204 form from the Texas Comptroller's website or local office.

02

Fill out the 'Vendor Information' section with the name, address, and phone number of the vendor.

03

Enter the 'Taxpayer Identification Number' (TIN) of the vendor in the applicable field.

04

Provide details such as the 'Date of Transaction' and 'Amount Paid' for the transaction.

05

Indicate the reason for exemption in the 'Reason for Exemption' section.

06

Include any additional information or comments relevant to the form in the designated area.

07

Review all entries for accuracy and completeness before submission.

08

Sign and date the form at the bottom.

09

Submit the completed AP-204 form to the appropriate Texas Comptroller's office.

Who needs TX Comptroller AP-204?

01

Businesses or individuals engaged in purchasing goods or services in Texas.

02

Vendors who are exempt from paying sales and use tax under specific exemptions recognized by the Texas Comptroller.

03

Tax preparers and accountants who assist clients in handling sales tax exemption requests.

Fill

form

: Try Risk Free

People Also Ask about

What exemptions are allowed in Texas?

Texas Personal Property Exemptions Home furnishings, including family heirlooms. Clothing and food. Farming and ranching vehicles and implements. Tools of the trade, books, equipment, commercial boat, or vehicles. Jewelry is limited to $12,500 for a single filer and $25,000 for a family. Two firearms.

Who qualifies for Texas tax exemption?

To apply for exemption, complete AP-204. Include any additional documentation to show the corporation meets the requirements. Non-Texas corporations must also include a copy of the corporation's formation documents and a current Certificate of Existence issued by their state of incorporation.

What is the Texas tax exempt form?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

How do you qualify for Texas exemptions?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How do I get an exemption in Texas?

You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

How do I fill out Texas sales and use tax exemption certificate?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How much is the disability exemption in Texas?

In Texas, a disabled adult has a right to a special homestead exemption. If you qualify, this exemption can reduce your taxes substantially. By law, school districts must provide a $10,000 disability exemption. Other taxing entities have the option to offer disability exemptions of at least $3,000.

How do I apply for disability exemption in Texas?

To claim the exemption, you must file an application with the appraisal district. The application must include documentation of your disability. The application form is entitled “Application for Residential Homestead Exemption. You can contact the appraisal district for the application.

How do I file for tax exemption in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TX Comptroller AP-204?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific TX Comptroller AP-204 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit TX Comptroller AP-204 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your TX Comptroller AP-204 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in TX Comptroller AP-204 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing TX Comptroller AP-204 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is TX Comptroller AP-204?

TX Comptroller AP-204 is a form used in Texas to report certain information related to the sale of tangible personal property and services for tax purposes.

Who is required to file TX Comptroller AP-204?

Individuals or businesses engaged in sales of taxable goods or services in Texas are required to file TX Comptroller AP-204.

How to fill out TX Comptroller AP-204?

To fill out TX Comptroller AP-204, provide the business information, report sales data, calculate tax due, and follow the specific instructions provided on the form.

What is the purpose of TX Comptroller AP-204?

The purpose of TX Comptroller AP-204 is to facilitate the reporting and collection of sales taxes owed to the state of Texas.

What information must be reported on TX Comptroller AP-204?

The information that must be reported on TX Comptroller AP-204 includes the seller's details, total sales, amount of tax collected, exemptions, and any other relevant sales data.

Fill out your TX Comptroller AP-204 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-204 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.