Get the free FISCAL IMPACT STATEMENT Notice of Motion. FISCAL IMPACT STATEMENT Notice of Motion

Show details

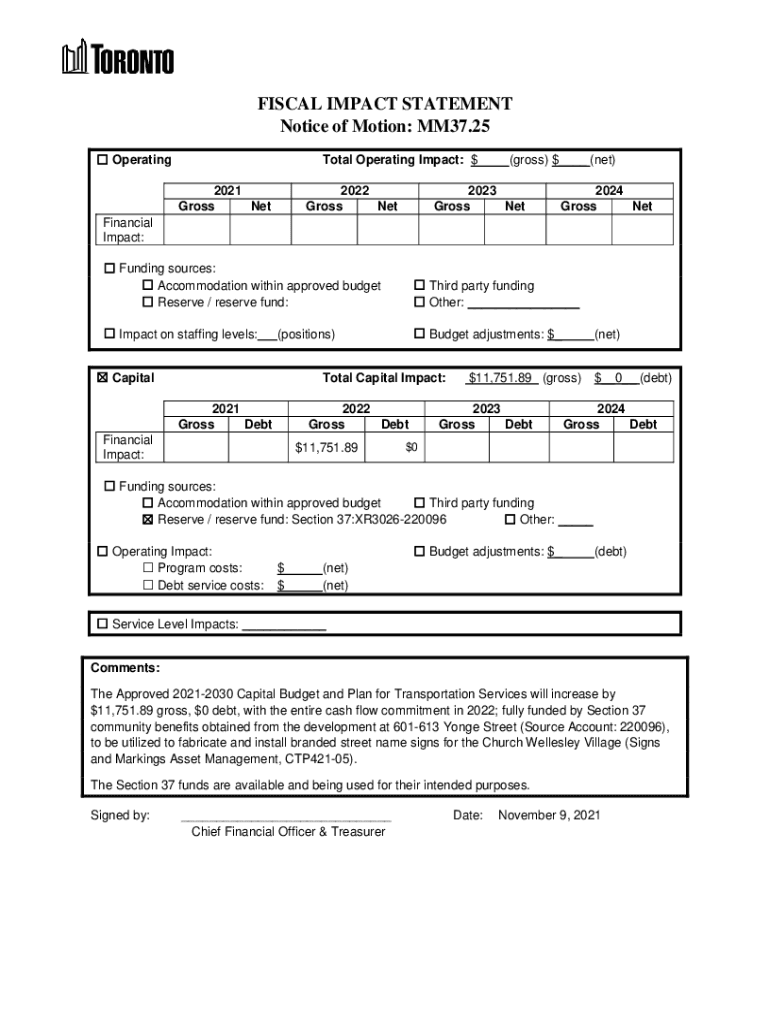

FISCAL IMPACT STATEMENT Notice of Motion: MM37.25 OperatingTotal Operating Impact: $ 2021 Gross Net2022 Gross Net(gross) $___ (net)2023 Gross Net2024 Gross NetFinancial Impact: Funding sources: Accommodation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal impact statement notice

Edit your fiscal impact statement notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal impact statement notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal impact statement notice online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal impact statement notice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal impact statement notice

How to fill out fiscal impact statement notice

01

Begin by providing the necessary information at the top of the fiscal impact statement notice form. This includes the name of the organization preparing the notice, the name of the person responsible for the notice, and the date of preparation.

02

Clearly state the purpose of the notice and provide a brief background on the proposed project or action that will have a fiscal impact.

03

Describe the potential direct and indirect fiscal impacts of the project or action. Include information on any additional costs that may be incurred, any anticipated revenue changes, and potential long-term financial implications.

04

Identify and quantify the impacts on different stakeholders or groups that may be affected by the project or action, such as government agencies, local businesses, or the general public.

05

Use clear and concise language to explain the methodology used to calculate the fiscal impacts. Make sure to include any assumptions or limitations of the analysis.

06

Provide a summary of the key findings of the fiscal impact assessment and any recommended actions or mitigation measures.

07

Include any supporting documents or data that are relevant to the fiscal impact assessment. This could include financial reports, economic forecasts, or other relevant studies.

08

Conclude the fiscal impact statement notice with contact information for the organization responsible for the notice. This should include a name, phone number, and email address where interested parties can reach out with any questions or comments.

09

Review the completed fiscal impact statement notice for accuracy and completeness before finalizing and distributing it to the relevant parties.

Who needs fiscal impact statement notice?

01

Government agencies and departments that are proposing projects or actions that may have a fiscal impact require a fiscal impact statement notice.

02

Public and private organizations that are involved in major infrastructure projects, policy changes, or other initiatives that could affect public finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in fiscal impact statement notice?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your fiscal impact statement notice to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the fiscal impact statement notice electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit fiscal impact statement notice on an iOS device?

Create, edit, and share fiscal impact statement notice from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is fiscal impact statement notice?

A fiscal impact statement notice is a document that assesses the financial effects of legislation or policy changes on government budgets.

Who is required to file fiscal impact statement notice?

Entities such as government agencies, departments, or legislative committees proposing a new law or policy typically need to file a fiscal impact statement notice.

How to fill out fiscal impact statement notice?

To fill out a fiscal impact statement notice, one must provide details on the proposed legislation, its expected financial implications, cost estimates, funding sources, and any potential impact on current budgets.

What is the purpose of fiscal impact statement notice?

The purpose of a fiscal impact statement notice is to inform decision-makers and the public about the economic consequences of legislative proposals and to ensure accountability in financial planning.

What information must be reported on fiscal impact statement notice?

Reported information generally includes the estimated costs, expected revenue changes, budgetary effects, potential economic impacts, and any assumptions made in the analysis.

Fill out your fiscal impact statement notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Impact Statement Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.