Get the free Breaking your mortgage contract

Show details

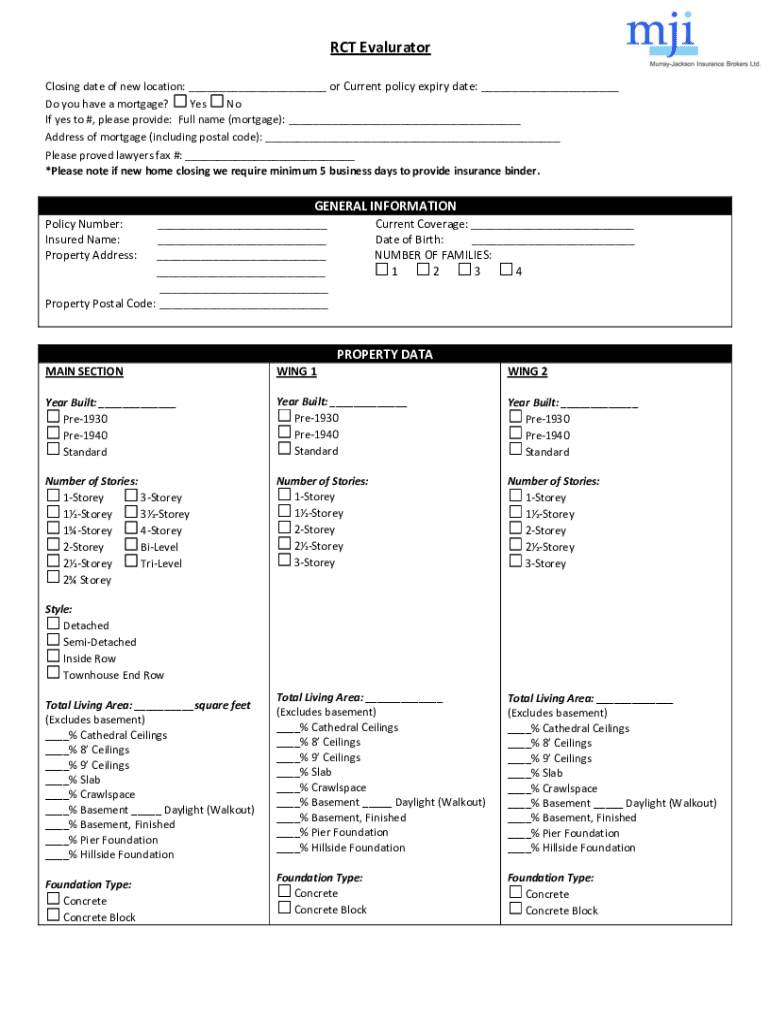

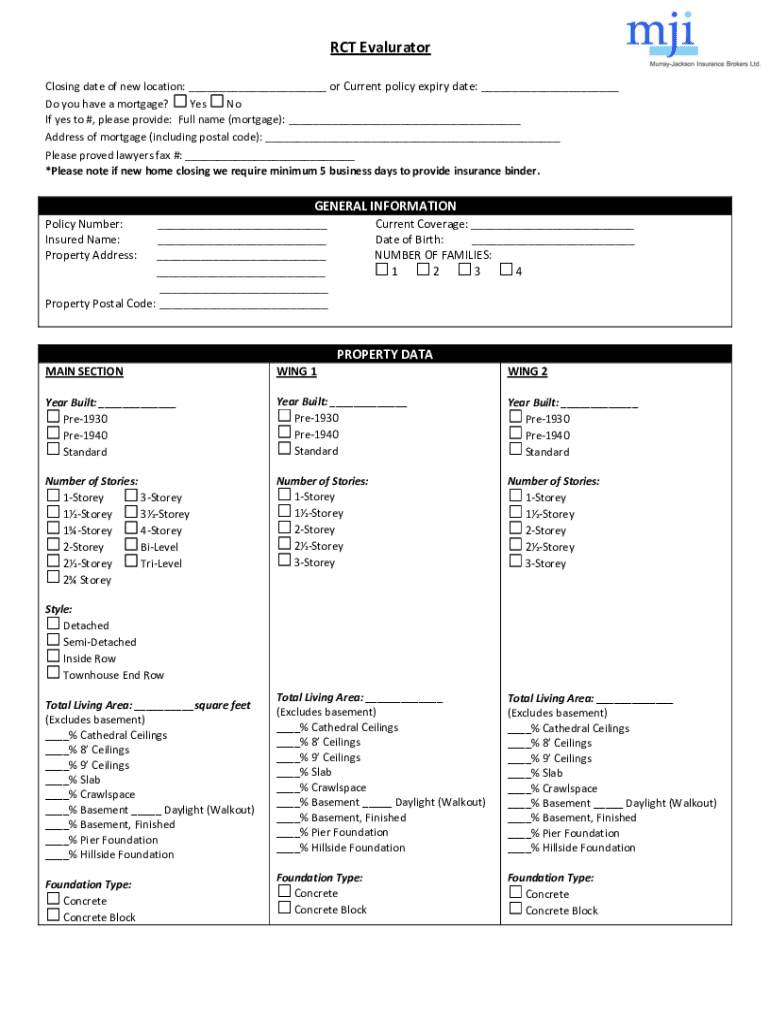

RCT Evalurator Closing date of new location: ___ or Current policy expiry date: ___ Do you have a mortgage? Yes No If yes to #, please provide: Full name (mortgage): ___ Address of mortgage (including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign breaking your mortgage contract

Edit your breaking your mortgage contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your breaking your mortgage contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing breaking your mortgage contract online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit breaking your mortgage contract. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out breaking your mortgage contract

How to fill out breaking your mortgage contract

01

To fill out breaking your mortgage contract, follow these steps:

02

Review your mortgage contract: Read your mortgage contract thoroughly to understand the terms and conditions associated with breaking the contract.

03

Contact your lender: Reach out to your mortgage lender and inform them about your intent to break the contract. They will guide you through the process and provide you with necessary forms or documents.

04

Understand penalty fees: Be aware of the penalty fees or charges that may apply for breaking your mortgage contract. These fees may vary depending on your lender and the terms of your contract.

05

Consider alternative options: Before proceeding with breaking your mortgage contract, explore alternative options such as mortgage refinancing or transferring your mortgage to another lender. These alternatives may help you avoid penalty fees.

06

Fill out the required forms: Complete the forms provided by your lender accurately and provide any necessary documentation they may request.

07

Seek legal advice: If you are uncertain about any aspect of breaking your mortgage contract, consider consulting with a legal professional who specializes in real estate or mortgage law.

08

Submit the forms: Once you have filled out the required forms and gathered all necessary documents, submit them to your lender for further processing.

09

Review the confirmation: After submitting the forms, review the confirmation provided by your lender to ensure that the breaking of your mortgage contract is proceeding as intended.

10

Follow any additional instructions: Your lender may provide you with additional instructions or requirements during the process. Make sure to follow them accordingly to avoid any delays or complications.

11

Close the existing mortgage: Once the breaking of your mortgage contract is finalized, work with your lender to close the existing mortgage account and settle any outstanding amounts.

12

Remember to carefully review all terms, conditions, and associated costs before making a decision to break your mortgage contract.

Who needs breaking your mortgage contract?

01

Breaking your mortgage contract may be needed by individuals in the following situations:

02

Financial difficulties: If you are experiencing financial hardships and find it difficult to keep up with mortgage payments, breaking the contract may be a solution.

03

Relocation: If you need to move to a different location before the mortgage term ends, breaking the contract allows you to sell your current property or transfer the mortgage to the new property.

04

Change in financial goals: If your financial goals have changed and you want to explore better mortgage options or investment opportunities, breaking the contract may be necessary.

05

Relationship changes: In case of divorce, separation, or other relationship changes, breaking the mortgage contract may be required to divide property or transfer mortgage responsibilities.

06

Renovation or rebuilding: If you plan to extensively renovate or rebuild your property, breaking the mortgage contract can provide the necessary flexibility and funding.

07

It's important to note that breaking a mortgage contract may involve penalty fees and impact your credit score. Therefore, it is recommended to carefully evaluate your situation and consider alternative options before deciding to break the contract.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find breaking your mortgage contract?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the breaking your mortgage contract in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the breaking your mortgage contract in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your breaking your mortgage contract in seconds.

How can I fill out breaking your mortgage contract on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your breaking your mortgage contract by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is breaking your mortgage contract?

Breaking your mortgage contract refers to the act of terminating or paying off your mortgage before the scheduled end of the loan term, which may incur penalties or fees.

Who is required to file breaking your mortgage contract?

Typically, the borrower who wishes to break the mortgage contract is required to file the necessary documentation with their lender.

How to fill out breaking your mortgage contract?

To fill out the breaking mortgage contract form, provide your personal information, mortgage details, reason for breaking the contract, and any other required documentation as specified by your lender.

What is the purpose of breaking your mortgage contract?

The purpose of breaking a mortgage contract can vary, but it generally involves refinancing to secure a better interest rate, selling the property, or facing financial difficulties that require early termination.

What information must be reported on breaking your mortgage contract?

Required information typically includes borrower details, mortgage account number, type of mortgage, reason for breaking the contract, and any new financing arrangements if applicable.

Fill out your breaking your mortgage contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Breaking Your Mortgage Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.