Get the free Financial Disclosure - Resources for Ethics Officials

Show details

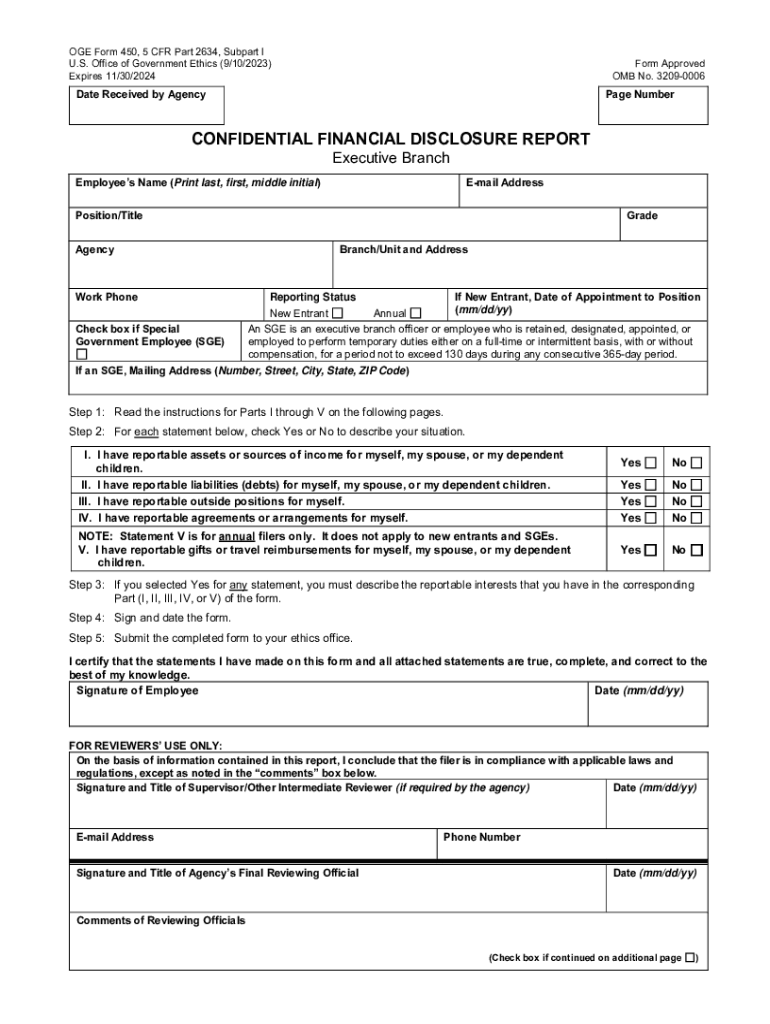

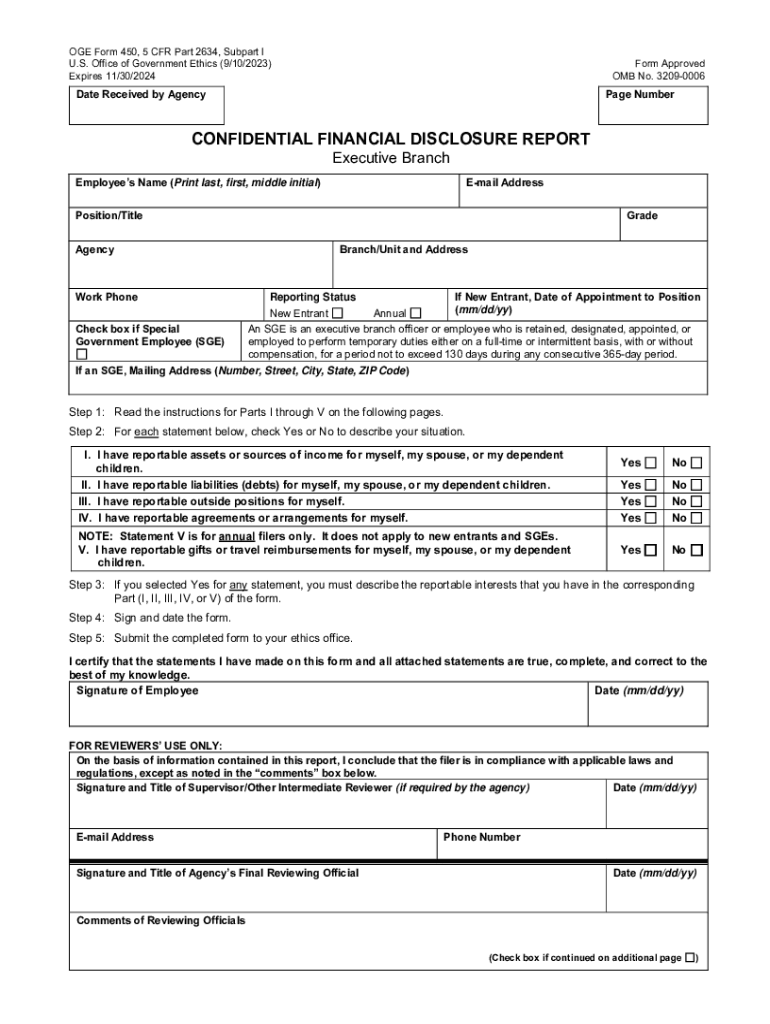

OGE Form 450, 5 CFR Part 2634, Subpart I U.S. Office of Government Ethics (9/10/2023) Expires 11/30/24Form Approved OMB No. 32090006CONFIDENTIAL FINANCIAL DISCLOSURE REPORT Executive BranchWhy Must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial disclosure - resources

Edit your financial disclosure - resources form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial disclosure - resources form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial disclosure - resources online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial disclosure - resources. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial disclosure - resources

How to fill out financial disclosure - resources

01

To fill out financial disclosure, follow these steps:

02

Gather all the necessary financial documents, such as bank statements, tax returns, investment statements, and loan records.

03

Identify the disclosure forms required in your jurisdiction. These forms may vary depending on the purpose of the financial disclosure.

04

Read and understand the instructions provided with the disclosure forms.

05

Begin by providing your personal information, such as your name, address, and contact details.

06

List all your sources of income, including your employment salary, investments, rental income, and any other income sources.

07

Report all your assets, such as real estate properties, vehicles, bank accounts, retirement accounts, and valuable possessions.

08

Disclose all your liabilities, including mortgages, loans, credit card debts, and other financial obligations.

09

Provide details of any financial interests or connections that may pose a conflict of interest.

10

Be thorough and accurate with your financial disclosures, ensuring that all information provided is up to date and complete.

11

Review your completed financial disclosure forms for any errors or omissions before submitting them.

12

Submit the filled out financial disclosure forms to the appropriate authority or organization as required.

13

It is recommended to consult with a financial advisor or legal professional to ensure compliance with all applicable laws and regulations.

Who needs financial disclosure - resources?

01

Financial disclosure is needed by various individuals and organizations, including:

02

- Government officials and public servants

03

- Candidates running for public office

04

- Corporate executives and board members

05

- Non-profit organizations receiving public funding

06

- Individuals involved in legal proceedings, such as divorce or bankruptcy

07

- Individuals applying for loans or mortgages

08

These individuals and organizations often require financial disclosure to promote transparency, prevent conflicts of interest, and ensure compliance with financial regulations.

09

The specific requirements and regulations regarding financial disclosure may vary depending on the jurisdiction and purpose of disclosure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure - resources for eSignature?

When you're ready to share your financial disclosure - resources, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find financial disclosure - resources?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific financial disclosure - resources and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete financial disclosure - resources online?

With pdfFiller, you may easily complete and sign financial disclosure - resources online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is financial disclosure - resources?

Financial disclosure refers to the process of revealing details about an individual's financial status, including assets, liabilities, income, and expenditures, typically required for public officials to ensure transparency and accountability.

Who is required to file financial disclosure - resources?

Public officials, government employees, and certain individuals in positions of public trust are required to file financial disclosures to promote transparency and prevent conflicts of interest.

How to fill out financial disclosure - resources?

To fill out financial disclosure forms, individuals should gather accurate financial information, fill out the designated forms accurately, and submit them to the appropriate regulatory authority, ensuring compliance with guidelines.

What is the purpose of financial disclosure - resources?

The purpose of financial disclosure is to provide transparency about the financial interests of public officials, mitigate potential conflicts of interest, and foster trust in public institutions.

What information must be reported on financial disclosure - resources?

Typically, financial disclosures must include information about personal assets, income sources, liabilities, investments, business affiliations, and other financial interests.

Fill out your financial disclosure - resources online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Disclosure - Resources is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.