Get the free Minor Individual Retirement Account (IRA) to IRA Conversion Application-TDA 0521

Show details

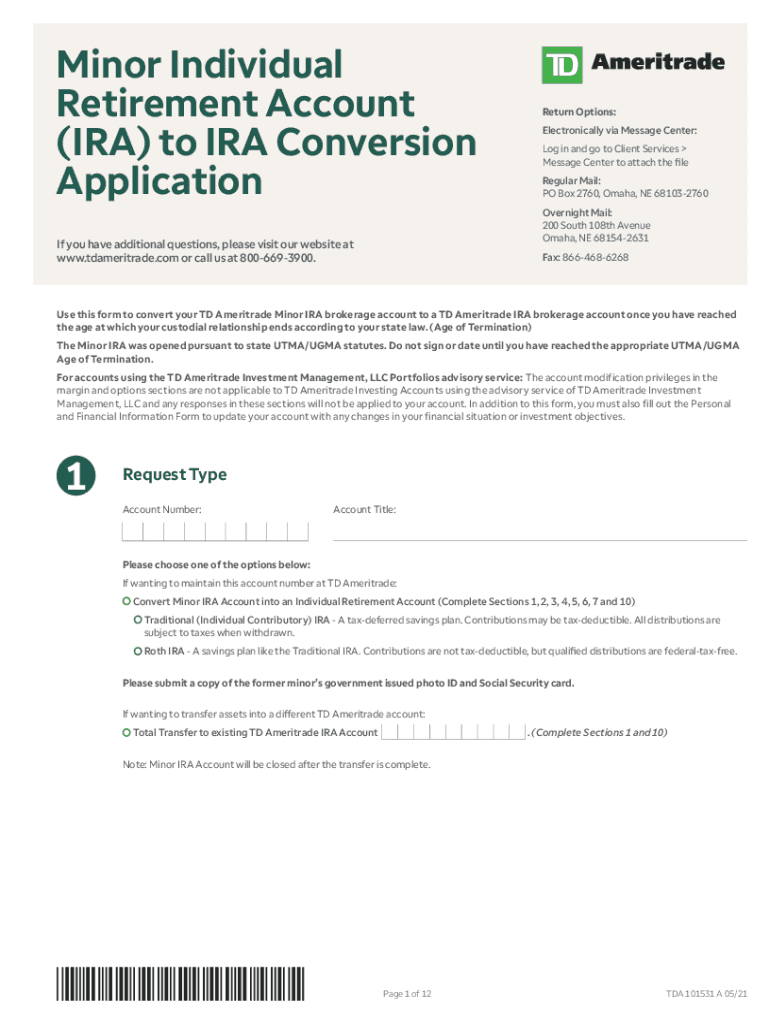

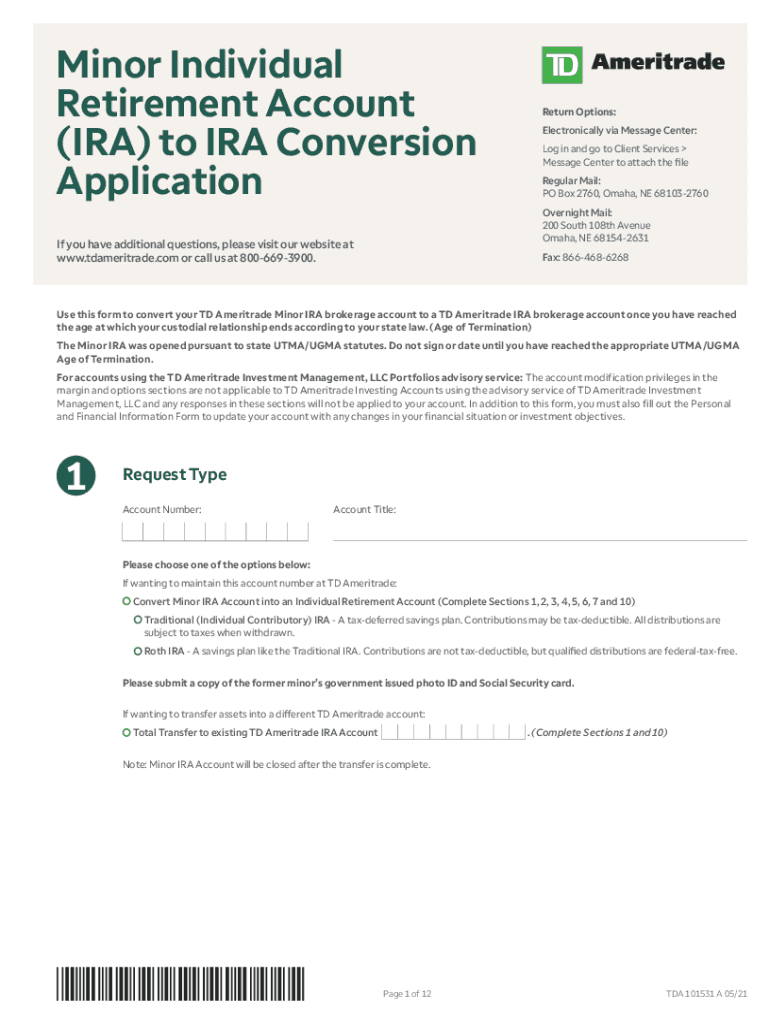

Minor Individual Retirement Account (IRA) to IRA Conversion ApplicationReset FormReturn Options: Electronically via Message Center: Log in and go to Client Services Message Center to attach the file

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign minor individual retirement account

Edit your minor individual retirement account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minor individual retirement account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit minor individual retirement account online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit minor individual retirement account. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minor individual retirement account

How to fill out minor individual retirement account

01

To fill out a minor individual retirement account (IRA), follow these steps:

02

Determine the type of IRA you want to open for the minor. Traditional and Roth IRAs are popular options.

03

Research and select a financial institution that offers IRAs for minors. Make sure they provide the necessary custodial services for minor accounts.

04

Contact the chosen financial institution and inquire about their specific requirements and documentation needed to open a minor IRA.

05

Gather the necessary documents such as the minor's identification (birth certificate or Social Security card), custodial documentation, and your own identification if you are the custodian.

06

Complete the necessary application forms provided by the financial institution. This may include information about the custodian, minor's personal details, and investment choices.

07

Review the terms and conditions of the IRA account carefully. Understand the contribution limits, tax implications, and withdrawal rules associated with minor IRAs.

08

Submit the completed application form, along with any required documents, to the financial institution.

09

Fund the minor IRA account by making an initial contribution. The amount will depend on the financial institution's minimum requirement.

10

Monitor the minor IRA account regularly and make periodic contributions as allowed by the IRS and the financial institution.

11

As the minor grows older, educate them about the importance of saving for retirement and involve them in the decision-making process regarding their IRA investments.

12

Remember, it is essential to consult with a financial advisor or tax professional for personalized guidance based on your specific situation.

Who needs minor individual retirement account?

01

A minor individual retirement account (IRA) can be beneficial for:

02

- Minors who have earned income from jobs, such as part-time employment or self-employment.

03

- Parents or legal guardians who want to teach their children about financial responsibility and saving for the future.

04

- Families who want to minimize the tax burden on the minor's earnings by taking advantage of the tax benefits associated with IRAs.

05

- Individuals who want to provide financial support to a minor by contributing to their retirement savings.

06

It's important to note that the eligibility and suitability of a minor IRA may vary based on individual circumstances. Consulting with a financial advisor or tax professional can help determine if a minor IRA is appropriate.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my minor individual retirement account directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your minor individual retirement account and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit minor individual retirement account from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including minor individual retirement account, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute minor individual retirement account online?

pdfFiller has made it easy to fill out and sign minor individual retirement account. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is minor individual retirement account?

A minor individual retirement account (IRA) is a type of retirement savings account specifically designed for individuals under the age of 18, allowing them to save for retirement while benefiting from tax advantages.

Who is required to file minor individual retirement account?

The custodian or guardian of the minor, typically a parent or legal guardian, is required to file on behalf of the minor individual retirement account.

How to fill out minor individual retirement account?

To fill out a minor individual retirement account, the custodian must complete the application form provided by the financial institution, providing the minor's information and the custodian's information, and submit required identification documents.

What is the purpose of minor individual retirement account?

The purpose of a minor individual retirement account is to help minors save for their future retirement, teaching them the importance of saving early while offering tax-advantaged growth on their investments.

What information must be reported on minor individual retirement account?

The information that must be reported includes the minor's name, Social Security number, date of birth, and the custodial details of the account holder, along with any contributions made to the account.

Fill out your minor individual retirement account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minor Individual Retirement Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.