Get the Free Mortgage Calculator - Estimate PaymentsTax & ...

Show details

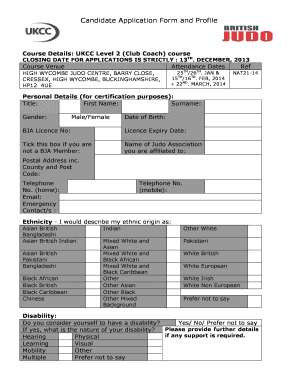

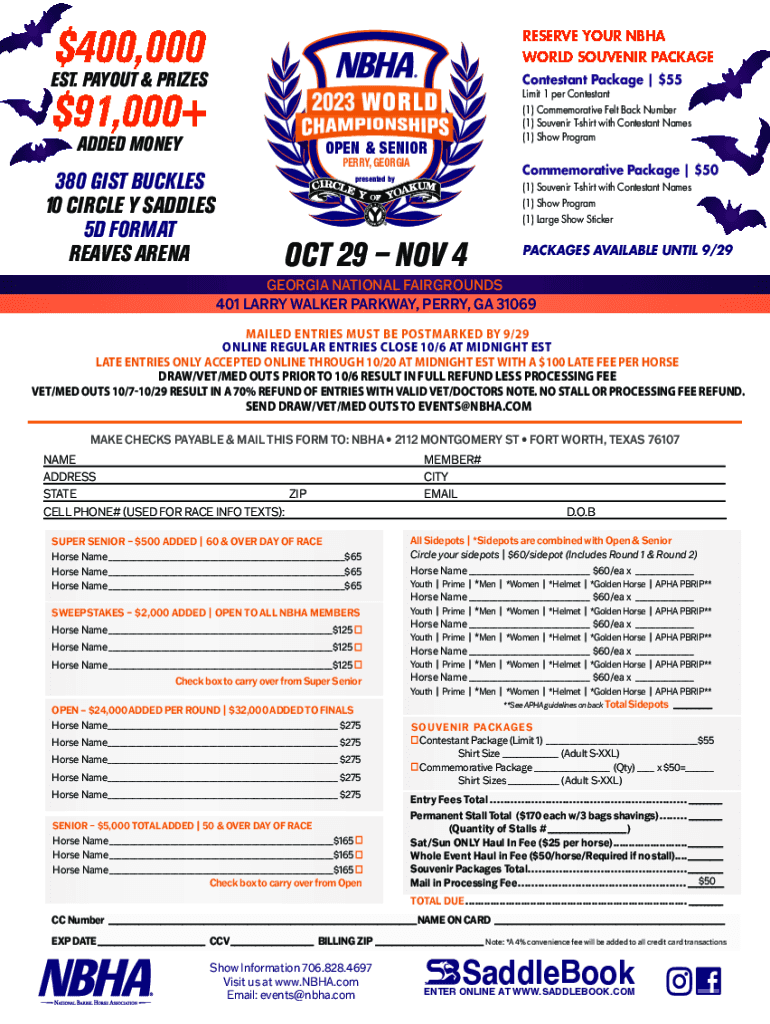

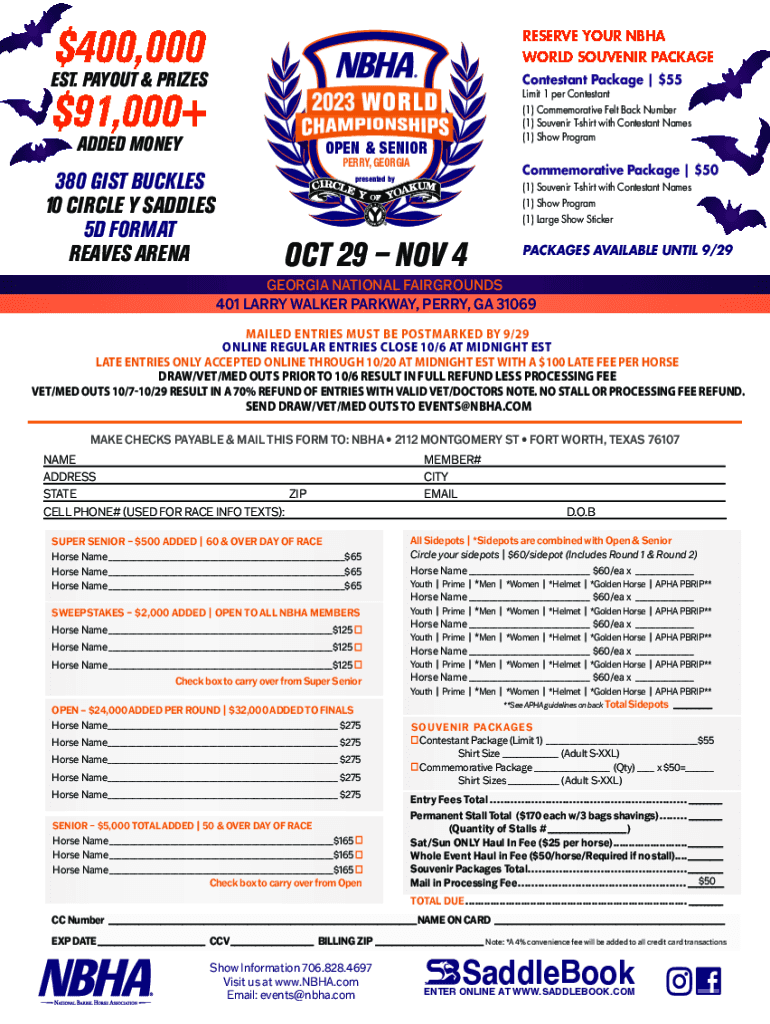

$400,000 EST. PAYOUT & PRIZES $91,000+RESERVE YOUR NBHA WORLD SOUVENIR PACKAGE Contestant Package | $552023ADDED MONEYLimit 1 per Contestant (1) Commemorative Felt Back Number (1) Souvenir Tshirt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage calculator - estimate

Edit your mortgage calculator - estimate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage calculator - estimate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage calculator - estimate online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage calculator - estimate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage calculator - estimate

How to fill out mortgage calculator - estimate

01

To fill out a mortgage calculator - estimate, follow these steps:

02

Enter the loan amount: Start by entering the total loan amount you are seeking for your mortgage.

03

Input the interest rate: Provide the interest rate associated with your mortgage loan.

04

Specify the loan term: Select the number of years you have chosen or plan for the loan repayment.

05

Include property taxes: If applicable, add the estimated yearly property taxes for the mortgaged property.

06

Add homeowners insurance: If required, input the annual cost of homeowners insurance for the property.

07

Include any additional costs: If there are any extra costs associated with the mortgage, such as private mortgage insurance (PMI) or homeowner association (HOA) fees, add those as well.

08

Calculate: Once all the necessary inputs are filled, click on the 'Calculate' button to estimate the monthly mortgage payment, including principal and interest.

09

Interpret the results: Review the results provided by the mortgage calculator, which will typically include the estimated monthly payment, the total amount paid over the loan term, and the interest paid.

10

Refine the calculation: If desired, try adjusting different parameters, such as the loan term or interest rate, to see how they affect the mortgage payment and overall cost.

11

Repeat as needed: Feel free to repeat the process with different loan amounts or scenarios to explore various mortgage options.

12

Note: The mortgage calculator - estimate is a tool to provide an approximation of your potential mortgage payment and should not be considered an official mortgage offer or approval.

Who needs mortgage calculator - estimate?

01

Anyone considering applying for a mortgage can benefit from using a mortgage calculator - estimate. This includes:

02

- Prospective homebuyers: People looking to purchase a property can use the calculator to estimate their monthly mortgage payment and assess affordability.

03

- Homeowners planning to refinance: Individuals planning to refinance their existing mortgage can utilize the calculator to compare different options and determine potential savings.

04

- Real estate investors: Investors interested in buying properties for rental or investment purposes can use the calculator to analyze potential cash flow and returns.

05

- Mortgage professionals: Loan officers, mortgage brokers, or financial advisors can leverage the calculator to assist clients in understanding different mortgage scenarios.

06

- Anyone curious about mortgage payments: Even if you are not currently in the market for a mortgage, using the calculator can provide insight into the potential costs of homeownership and help with financial planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage calculator - estimate from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your mortgage calculator - estimate into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit mortgage calculator - estimate online?

The editing procedure is simple with pdfFiller. Open your mortgage calculator - estimate in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out mortgage calculator - estimate on an Android device?

Complete mortgage calculator - estimate and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is mortgage calculator - estimate?

A mortgage calculator - estimate is a tool that helps individuals estimate their monthly mortgage payments, including principal, interest, taxes, and insurance based on factors like loan amount and interest rate.

Who is required to file mortgage calculator - estimate?

Individuals applying for a mortgage or refinancing a mortgage are often required to use a mortgage calculator - estimate to provide an accurate representation of their potential loan costs.

How to fill out mortgage calculator - estimate?

To fill out a mortgage calculator - estimate, input the loan amount, interest rate, loan term, property tax rate, and any applicable insurance and HOA fees. The calculator will then provide an estimated monthly payment.

What is the purpose of mortgage calculator - estimate?

The purpose of a mortgage calculator - estimate is to help borrowers understand their potential mortgage costs, make informed financial decisions, and budget effectively for home ownership.

What information must be reported on mortgage calculator - estimate?

The information that must be reported on a mortgage calculator - estimate includes loan amount, interest rate, loan term, property tax rate, homeowners insurance, and mortgage insurance, if applicable.

Fill out your mortgage calculator - estimate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Calculator - Estimate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.