Get the free Taxable General Obligation Bond Anticipation Notes

Show details

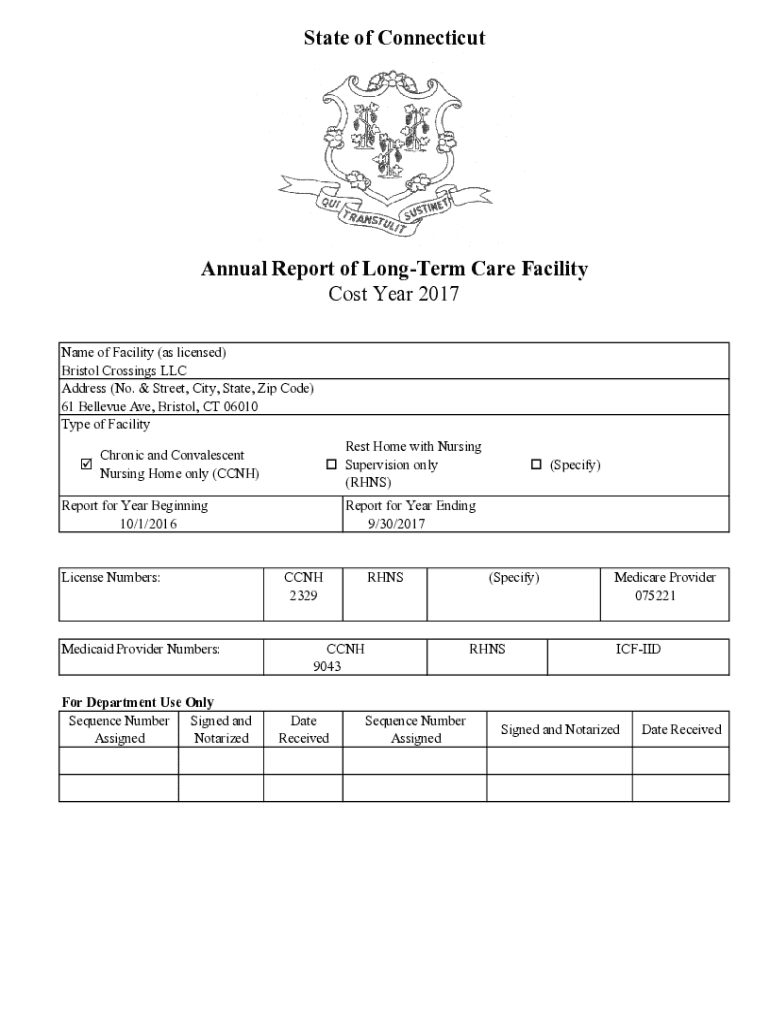

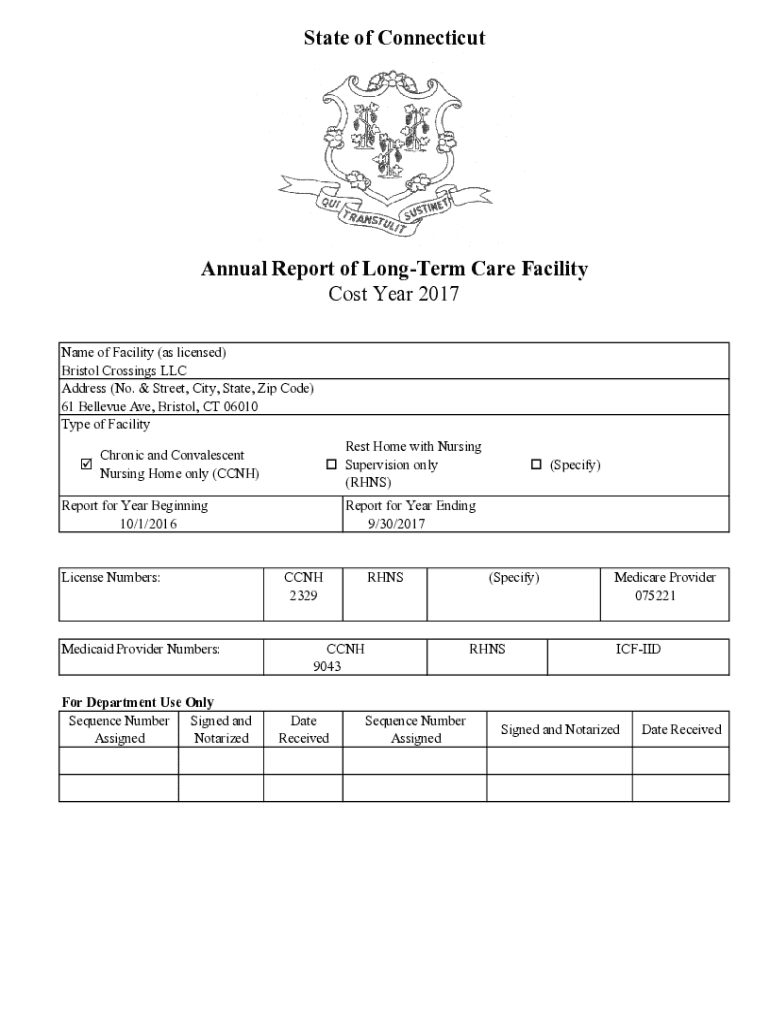

State of ConnecticutAnnual Report of LongTerm Care Facility Cost Year 2017 Name of Facility (as licensed) Bristol Crossings LLC Address (No. & Street, City, State, Zip Code) 61 Bellevue Ave, Bristol,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxable general obligation bond

Edit your taxable general obligation bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxable general obligation bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxable general obligation bond online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit taxable general obligation bond. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxable general obligation bond

How to fill out taxable general obligation bond

01

To fill out a taxable general obligation bond, follow the steps below:

02

Gather all the required information and documents, such as the bond issuer's name, principal amount, interest rate, maturity date, and payment terms.

03

Review the bond form or documentation provided by the issuer to understand the specific sections and fields that need to be filled out.

04

Fill in the issuer's name and contact information in the designated fields.

05

Enter the principal amount of the bond, which is the initial investment or loan amount.

06

Specify the interest rate at which the bond will accrue interest.

07

Provide the maturity date or the date on which the bond will be fully repaid.

08

Include any additional terms or conditions related to payments, call provisions, or other relevant clauses.

09

Review the filled-out bond form for accuracy and completeness.

10

Sign the form as the issuer, indicating your agreement to the terms and conditions mentioned in the bond.

11

Submit the filled-out bond form to the appropriate authorities or parties involved in the bond issuance process.

Who needs taxable general obligation bond?

01

Taxable general obligation bonds may be needed by various entities, including:

02

- Governments at different levels, such as federal, state, or local governments, who require funds for infrastructure development, public projects, or other capital investments.

03

- Municipalities or city councils that aim to finance public improvement projects, schools, hospitals, or other community-related initiatives.

04

- Public utilities or transportation authorities seeking funding for infrastructure upgrades, expansion, or maintenance.

05

- Private companies or corporations issuing bonds to raise capital for business expansions, acquisitions, or refinancing existing debts.

06

- Investors or individuals looking for relatively safer investment options with fixed interest payments and a promised return of principal amount at maturity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my taxable general obligation bond in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your taxable general obligation bond and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify taxable general obligation bond without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including taxable general obligation bond. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in taxable general obligation bond without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing taxable general obligation bond and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is taxable general obligation bond?

A taxable general obligation bond is a type of municipal bond that is not exempt from federal income tax and is typically issued to fund public projects that do not qualify for tax-exempt financing.

Who is required to file taxable general obligation bond?

Entities that issue taxable general obligation bonds are required to file; this typically includes state and local governments seeking to raise funds through the issuance of such bonds.

How to fill out taxable general obligation bond?

Filling out a taxable general obligation bond typically involves completing a bond form with pertinent details such as the issuer's information, bond amount, interest rate, maturity date, and any other required disclosures.

What is the purpose of taxable general obligation bond?

The purpose of a taxable general obligation bond is to raise funds for public projects and infrastructure improvements that may not be eligible for tax-exempt bonds, allowing municipalities to finance important services and capital needs.

What information must be reported on taxable general obligation bond?

Information that must be reported includes the amount of the bond, interest rate, maturity date, issuer details, and the intended use of proceeds, along with any specific disclosures required by law.

Fill out your taxable general obligation bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxable General Obligation Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.