Get the free Long-Term Disability Voluntary Buy-Up Option For Faculty

Show details

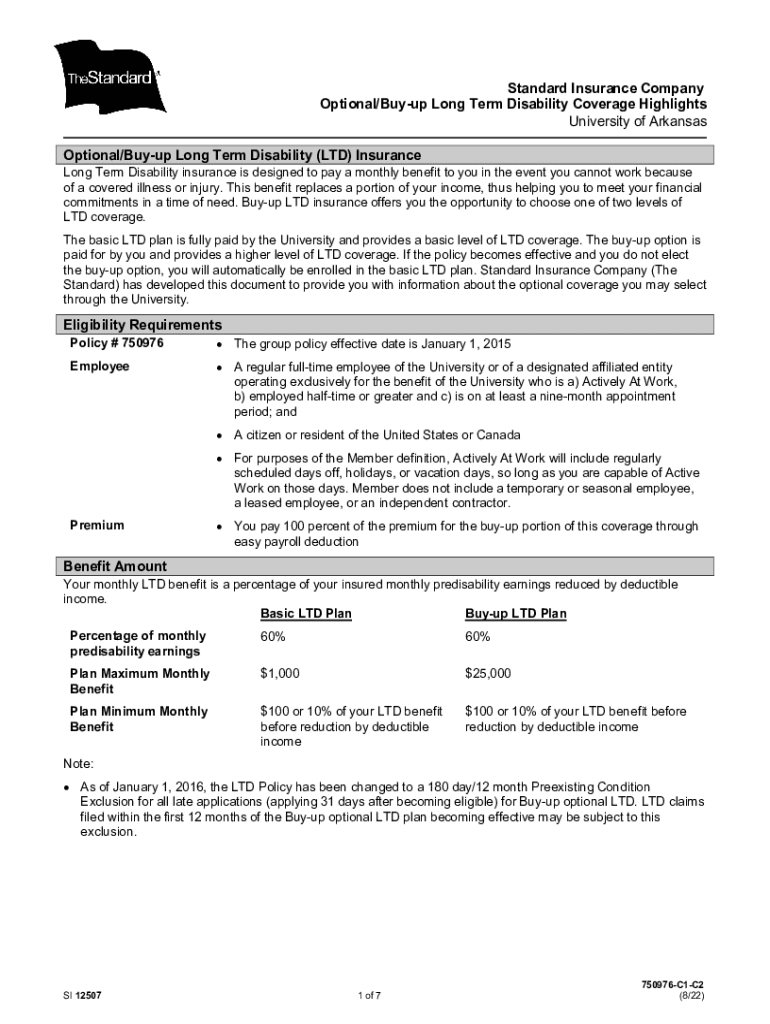

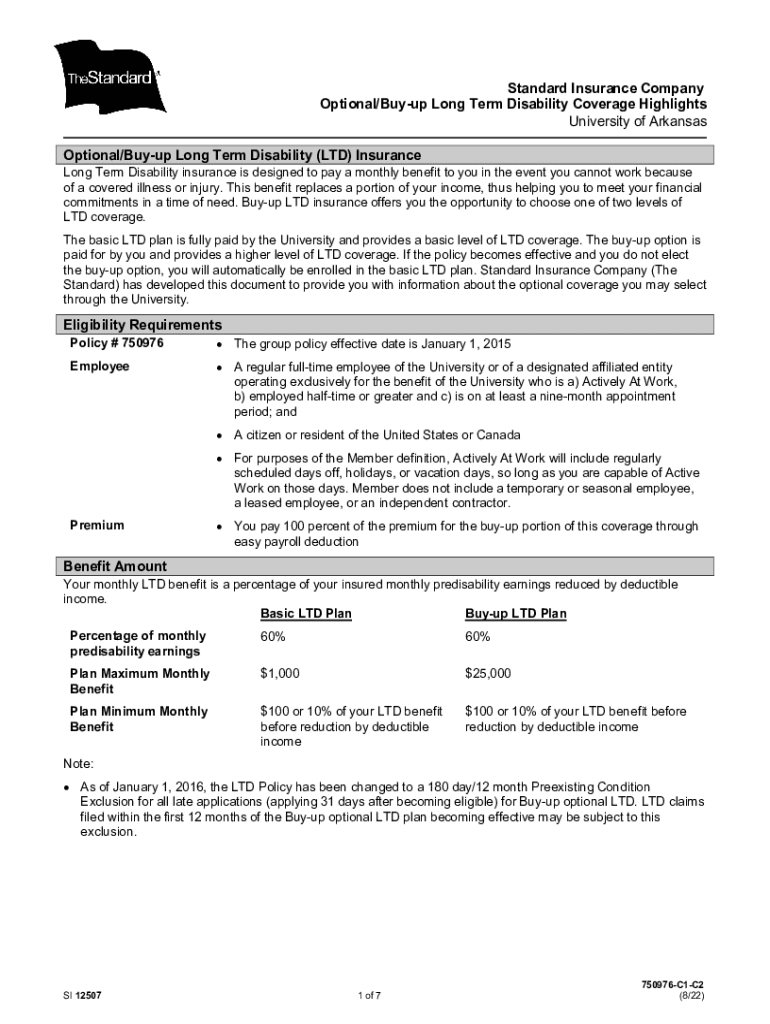

Standard Insurance Company Optional/Buyup Long Term Disability Coverage Highlights University of Arkansas Optional/Buyup Long Term Disability (LTD) InsuranceLong Term Disability insurance is designed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term disability voluntary buy-up

Edit your long-term disability voluntary buy-up form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term disability voluntary buy-up form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long-term disability voluntary buy-up online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long-term disability voluntary buy-up. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

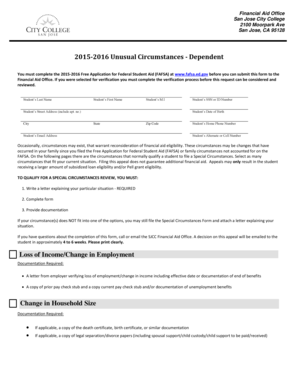

How to fill out long-term disability voluntary buy-up

How to fill out long-term disability voluntary buy-up

01

Determine if you are eligible for long-term disability voluntary buy-up. This usually depends on your employment status and the specific rules and regulations of your organization.

02

Review your current long-term disability coverage. Understand the terms, benefits, and limitations of your existing policy to assess if additional coverage is necessary.

03

Contact your human resources department or benefits administrator. Inquire about the process and requirements for enrolling in the long-term disability voluntary buy-up program.

04

Fill out the necessary forms or online application provided by your organization. Provide accurate and complete information regarding your personal details, employment, and any relevant medical history.

05

Review and understand the terms and cost of the buy-up option. Consider factors such as premium rates, waiting periods, benefit durations, and any exclusions or limitations.

06

Evaluate your budget and financial situation. Determine if the cost of the buy-up option is affordable and aligns with your long-term financial goals.

07

Submit the completed application or forms by the specified deadline. Follow any additional instructions or documentation required by your organization.

08

Await confirmation of enrollment and coverage details. It may take some time for your application to be processed and approved by the insurance provider.

09

Once enrolled, familiarize yourself with the terms and conditions of the buy-up insurance. Understand the claims process and be aware of what is covered and what is excluded.

10

Keep your long-term disability buy-up coverage active by paying the required premiums on time and promptly reporting any changes in employment or personal details.

Who needs long-term disability voluntary buy-up?

01

Long-term disability voluntary buy-up is beneficial for individuals who feel that their existing long-term disability coverage is insufficient.

02

Individuals who want additional financial protection in the case of a long-term disability may opt for the buy-up option.

03

Employees with high earning potential or those with dependents who rely on their income may find the buy-up option particularly useful.

04

Workers in occupations with higher risks of disability or those with pre-existing medical conditions may also benefit from the additional coverage.

05

Ultimately, the decision to opt for long-term disability voluntary buy-up depends on one's personal financial situation, risk tolerance, and the specific terms and options available through their employer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my long-term disability voluntary buy-up in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your long-term disability voluntary buy-up and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit long-term disability voluntary buy-up online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your long-term disability voluntary buy-up and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the long-term disability voluntary buy-up form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign long-term disability voluntary buy-up and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is long-term disability voluntary buy-up?

Long-term disability voluntary buy-up is an optional insurance policy that allows employees to increase their long-term disability coverage beyond the standard amount provided by their employer, offering greater financial protection in the event of a disabling condition.

Who is required to file long-term disability voluntary buy-up?

Typically, employees who wish to enroll in or increase their long-term disability coverage must file for the voluntary buy-up. This may require completing an application process, but there is no requirement for all employees to file unless they opt for the buy-up.

How to fill out long-term disability voluntary buy-up?

To fill out long-term disability voluntary buy-up, employees need to obtain the necessary application form from their HR department or insurance provider, provide accurate personal and employment information, indicate the desired coverage amount, and submit the form by the specified deadline.

What is the purpose of long-term disability voluntary buy-up?

The purpose of long-term disability voluntary buy-up is to provide employees with additional income protection in case they cannot work due to a long-term medical condition, ensuring they have a safety net to cover living expenses.

What information must be reported on long-term disability voluntary buy-up?

The information that must be reported typically includes the employee's personal details, employment status, current benefit elections, the desired level of additional coverage, and any other requirements specified by the insurance provider.

Fill out your long-term disability voluntary buy-up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Disability Voluntary Buy-Up is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.