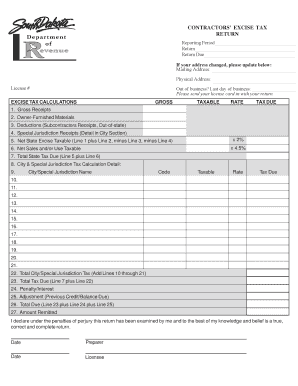

SD Contractor's Excise Tax Return (formerly RV-011) 2023-2026 free printable template

Show details

$0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SD Contractors Excise Tax Return formerly

Edit your SD Contractors Excise Tax Return formerly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SD Contractors Excise Tax Return formerly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SD Contractors Excise Tax Return formerly online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SD Contractors Excise Tax Return formerly. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SD Contractor's Excise Tax Return (formerly RV-011) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SD Contractors Excise Tax Return formerly

How to fill out SD Contractor's Excise Tax Return (formerly RV-011)

01

Gather your business information, including your federal employer identification number (EIN) and South Dakota sales tax license number.

02

Obtain a copy of the SD Contractor's Excise Tax Return form (formerly RV-011) from the South Dakota Department of Revenue website.

03

Fill in the header section with your business name, address, and contact information.

04

Provide the reporting period for which you are filing, typically a quarterly basis.

05

Calculate your total gross receipts for the period from contracting services performed in South Dakota.

06

Determine the appropriate tax rate to apply and calculate the excise tax owed based on your gross receipts.

07

Fill in any deductions or exemptions if applicable and calculate the net tax due.

08

Provide payment information and submit the completed return along with any payment by the due date.

Who needs SD Contractor's Excise Tax Return (formerly RV-011)?

01

Any contractor doing business in South Dakota who has received payments for services must file the SD Contractor's Excise Tax Return.

02

Businesses operating as general contractors, subcontractors, or non-residential construction service providers are required to file this return.

Fill

form

: Try Risk Free

People Also Ask about

Is it EOB or EOD?

End of day (EOD), end of business (EOB), close of business (COB), close of play (COP), or end of play (EOP) is the end of the trading day in financial markets, the point when trading ceases.

What is COB vs EOD?

So be clear and communicate: COB means the completion of the traditional business day relative to the sender's time zone and EOD means the conclusion of the calendar day relative to the sender's time zone.

How do you say end of business day?

Close of business (COB) and end of day (EOD) refer to a business day.

What is EOD in finance?

End of day (EOD), end of business (EOB), close of business (COB), close of play (COP) or end of play (EOP) is the end of the trading day in financial markets, the point when trading ceases.

What does EOD mean in business?

EOD refers to the end of the business day. The exact time that constitutes the end of the day varies from business to business, but it is typically around 5:00 or 6:00 pm. Any deadlines or tasks that need to be completed by the end of the day should be finished by this time.

What does EOD stand for in employment?

What is EOD? EOD stands for "end of the day," which refers to the end of the business day. Some employers may use EOD and COB interchangeably, but they have a few key differences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SD Contractors Excise Tax Return formerly without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including SD Contractors Excise Tax Return formerly, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get SD Contractors Excise Tax Return formerly?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SD Contractors Excise Tax Return formerly in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the SD Contractors Excise Tax Return formerly form on my smartphone?

Use the pdfFiller mobile app to fill out and sign SD Contractors Excise Tax Return formerly on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is SD Contractor's Excise Tax Return (formerly RV-011)?

The SD Contractor's Excise Tax Return (formerly known as RV-011) is a tax form used by contractors in South Dakota to report and pay the state's excise tax on their gross receipts from construction projects.

Who is required to file SD Contractor's Excise Tax Return (formerly RV-011)?

Any contractor or subcontractor who engages in construction activities in South Dakota and exceeds the threshold for gross receipts is required to file the SD Contractor's Excise Tax Return.

How to fill out SD Contractor's Excise Tax Return (formerly RV-011)?

To fill out the SD Contractor's Excise Tax Return, contractors must provide their business information, report gross receipts from taxable projects, calculate the tax due, and submit the return along with payment to the South Dakota Department of Revenue.

What is the purpose of SD Contractor's Excise Tax Return (formerly RV-011)?

The purpose of the SD Contractor's Excise Tax Return is to provide a mechanism for the state to collect excise tax on construction work, ensuring that contractors contribute to state revenue based on their gross receipts.

What information must be reported on SD Contractor's Excise Tax Return (formerly RV-011)?

The information that must be reported includes the contractor's name and contact information, total gross receipts from construction projects, the applicable tax rate, and the total excise tax owed.

Fill out your SD Contractors Excise Tax Return formerly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SD Contractors Excise Tax Return Formerly is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.