Get the free Non-Admitted Insurance - Premium Tax FAQs - OCI.GA.gov

Show details

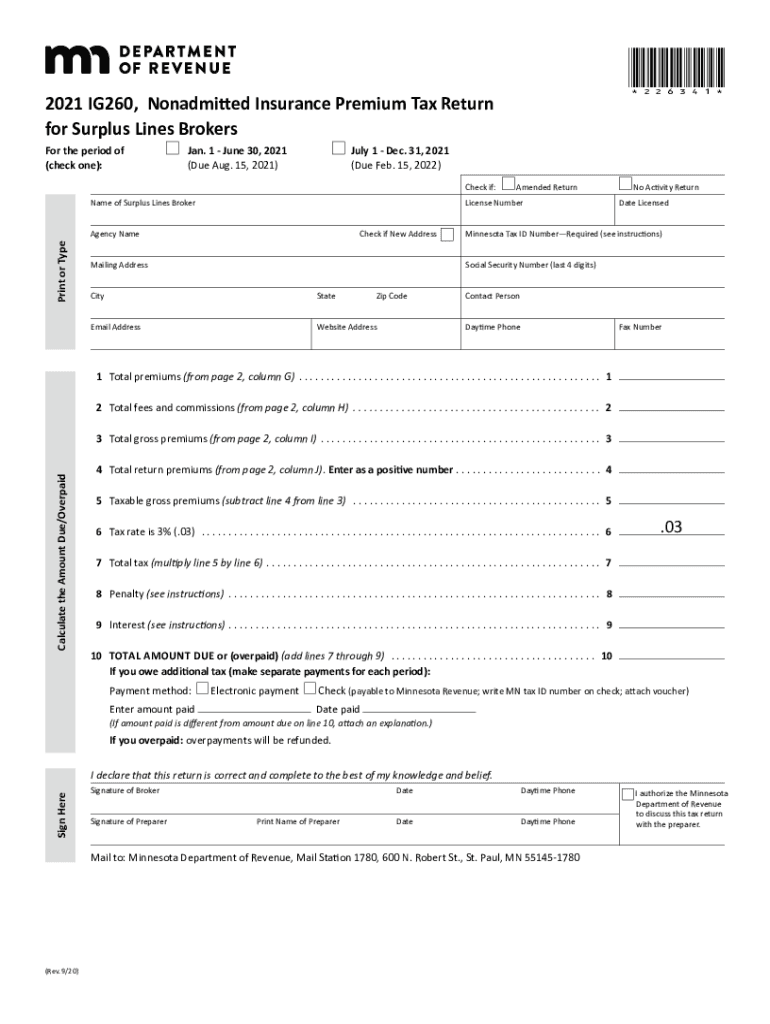

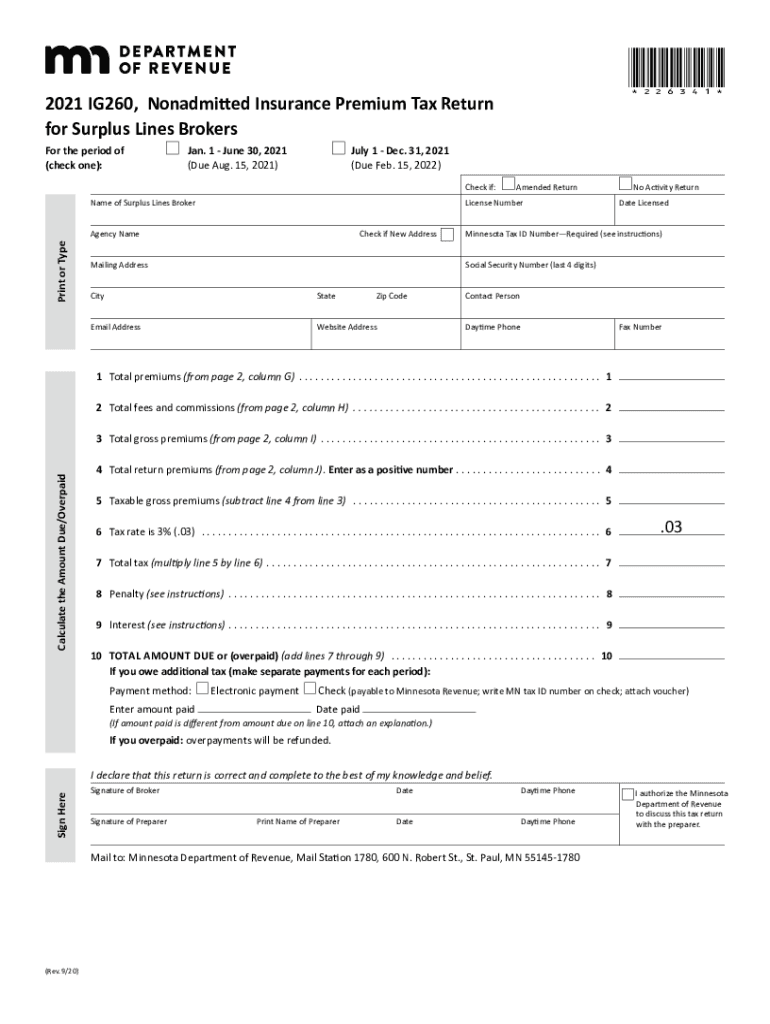

*226341*2021 IG260, Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers For the period ofJan. 1 June 30, 2021July 1 Dec. 31, 2021 (check one):(Due Aug. 15, 2021)(Due Feb. 15, 2022)Check

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-admitted insurance - premium

Edit your non-admitted insurance - premium form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-admitted insurance - premium form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-admitted insurance - premium online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-admitted insurance - premium. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-admitted insurance - premium

How to fill out non-admitted insurance - premium

01

To fill out a non-admitted insurance premium, follow these steps:

02

Gather all the necessary information about the insured property or risk.

03

Identify the coverage needed and the specific risks that the non-admitted insurance policy will cover.

04

Contact a licensed surplus lines broker or an insurance agent who specializes in non-admitted insurance to obtain a quote.

05

Provide all the requested information to the broker or agent, including details about the insured property, desired coverage limits, and any additional endorsements or policy forms needed.

06

Review the quote and policy terms provided by the broker or agent.

07

If satisfied with the terms and conditions, complete the application form provided by the broker or agent.

08

Submit the completed application along with any required supporting documents and payment.

09

Review the issued policy to ensure all the coverage purchased and specified terms and conditions are accurately reflected.

10

Keep a copy of the policy for your records and communicate any changes or updates to the broker or agent as necessary.

11

Note: The process may vary slightly depending on the jurisdiction and specific requirements of the insurance company or surplus lines market.

Who needs non-admitted insurance - premium?

01

Non-admitted insurance is typically necessary for individuals or businesses that have risks or properties that are not covered by traditional admitted insurance carriers.

02

Specific examples of who may need non-admitted insurance - premium include:

03

- High-risk properties or projects that do not meet the underwriting guidelines of standard insurance companies.

04

- Businesses operating in unique or hazardous industries, such as oil and gas exploration or aviation.

05

- Events or activities with high liability exposures, such as concerts or extreme sports competitions.

06

- Companies or individuals facing significant regulatory or legal risks.

07

It is important to consult with a knowledgeable insurance professional who can assess your unique situation and recommend the appropriate type of coverage, including non-admitted insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-admitted insurance - premium to be eSigned by others?

Once you are ready to share your non-admitted insurance - premium, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find non-admitted insurance - premium?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the non-admitted insurance - premium in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit non-admitted insurance - premium straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing non-admitted insurance - premium.

What is non-admitted insurance - premium?

Non-admitted insurance premium refers to the premium charged for insurance policies written by insurers that are not licensed or admitted in a specific state but are allowed to operate there under certain conditions. These insurers are typically less regulated and may offer coverage for risks that admitted insurers cannot or will not cover.

Who is required to file non-admitted insurance - premium?

Insurance producers, brokers, or agents who facilitate non-admitted insurance transactions are required to file the non-admitted insurance premium. Additionally, insurers that write non-admitted policies must also report these premiums to the appropriate regulatory authority.

How to fill out non-admitted insurance - premium?

To fill out a non-admitted insurance premium filing, one must provide the policyholder's information, details about the policy including coverage types and limits, the premium amount, the insurer's details, and any required endorsements. This typically involves completing specific forms provided by the regulatory authority in the respective state.

What is the purpose of non-admitted insurance - premium?

The purpose of reporting non-admitted insurance premiums is to ensure that insurance transactions are documented for regulatory oversight, to monitor the financial stability of non-admitted insurers, and to collect premium taxes where applicable.

What information must be reported on non-admitted insurance - premium?

The information that must be reported includes the policyholder's name and address, details of the non-admitted insurer, the type of insurance coverage, policy limits, premium amounts, and the effective dates of the policy.

Fill out your non-admitted insurance - premium online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Admitted Insurance - Premium is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.