Get the free Mortgage Insurance: What It Is, How It Works, Types

Show details

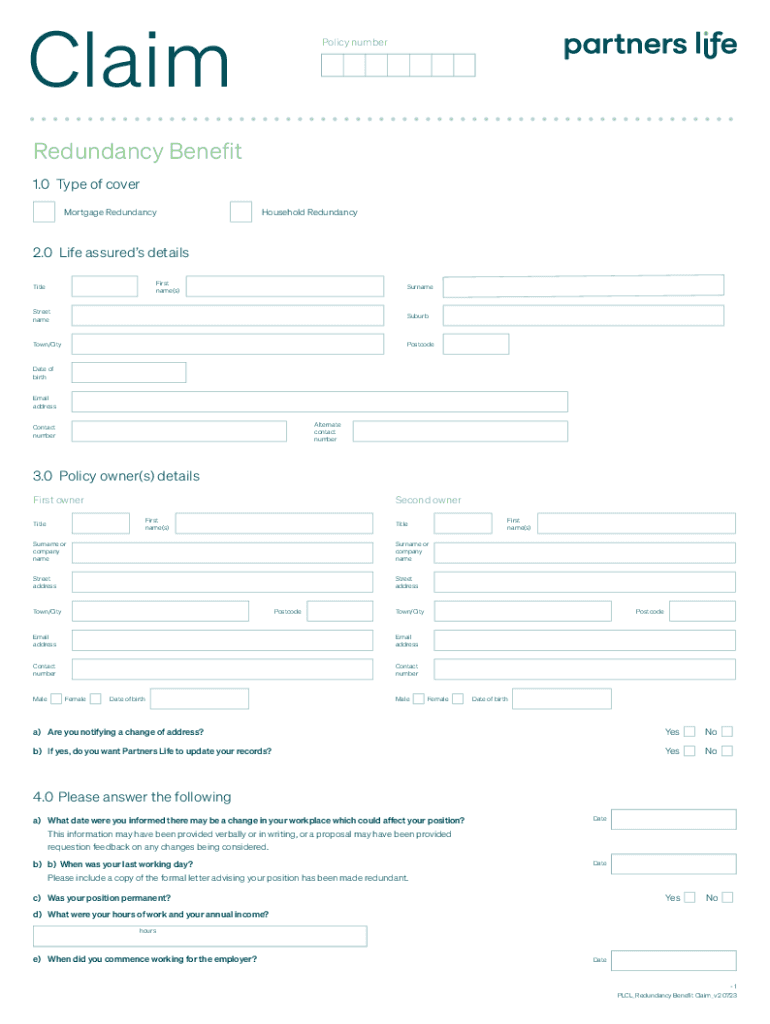

ClaimPolicy numberRedundancy Benefit 1.0 Type of cover Mortgage RedundancyHousehold Redundancy2.0 Life assureds details First name(s)TitleSurnameStreet nameSuburbTown/CityPostcodeDate of birth Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage insurance what it

Edit your mortgage insurance what it form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage insurance what it form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage insurance what it online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage insurance what it. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage insurance what it

How to fill out mortgage insurance what it

01

To fill out mortgage insurance, follow these steps:

02

Determine the type of mortgage insurance you need. There are different types of mortgage insurance depending on factors such as loan type, loan-to-value ratio, and credit score.

03

Research and compare mortgage insurance providers. Look for reputable insurance companies that offer competitive rates and good customer service.

04

Gather the necessary documents. This may include proof of income, employment verification, credit history, and property information.

05

Contact the chosen mortgage insurance provider. This can usually be done online, over the phone, or in person.

06

Fill out the application form provided by the insurance provider. Provide accurate and complete information to ensure a smooth process.

07

Submit the required documents along with the application form. Make sure to include all necessary paperwork to avoid delays.

08

Pay the required premiums. Mortgage insurance premiums can be paid monthly, annually, or upfront, depending on the terms of the policy.

09

Review the terms and conditions of the mortgage insurance policy before accepting it. Make sure you understand the coverage, exclusions, and any additional fees or penalties.

10

Sign the mortgage insurance agreement if you are satisfied with the terms and conditions.

11

Keep a copy of the completed application form and insurance policy for your records.

12

Remember to consult with a mortgage professional or insurance agent for personalized guidance and advice.

Who needs mortgage insurance what it?

01

Mortgage insurance is typically required for borrowers who have a down payment of less than 20% when buying a home or obtaining a mortgage. It provides protection to the lender in case the borrower defaults on the loan.

02

In addition to borrowers with low down payments, mortgage insurance may also be required for those with a high loan-to-value ratio or borrowers with a lower credit score.

03

It is important to note that mortgage insurance benefits the lender, not the borrower. It allows lenders to offer loans with lower down payment requirements or to borrowers with less-than-ideal credit profiles.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage insurance what it for eSignature?

Once your mortgage insurance what it is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in mortgage insurance what it?

The editing procedure is simple with pdfFiller. Open your mortgage insurance what it in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the mortgage insurance what it form on my smartphone?

Use the pdfFiller mobile app to complete and sign mortgage insurance what it on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is mortgage insurance?

Mortgage insurance is a type of insurance that protects lenders against the risk of default on a mortgage loan. It is typically required for borrowers who make a down payment of less than 20%.

Who is required to file mortgage insurance?

Mortgage insurance is generally required for borrowers with a low down payment, usually those who put down less than 20% of the home's purchase price.

How to fill out mortgage insurance?

Filling out mortgage insurance typically involves completing a form provided by the lender or mortgage insurer, which includes personal and financial information, details about the property, and the mortgage amount.

What is the purpose of mortgage insurance?

The purpose of mortgage insurance is to protect lenders from financial loss in the event that a borrower defaults on their mortgage payments.

What information must be reported on mortgage insurance?

Information that must be reported on mortgage insurance includes the borrower's identity, the mortgage amount, property details, and the terms of the insurance policy.

Fill out your mortgage insurance what it online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Insurance What It is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.