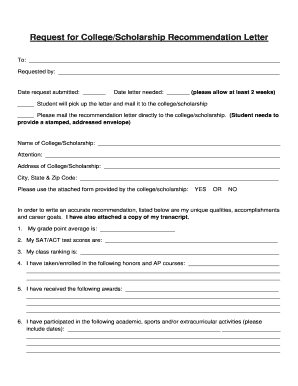

Get the free NHS Mortgage Understanding Study Questionnaire. NHS Mortgage Understanding Study Que...

Show details

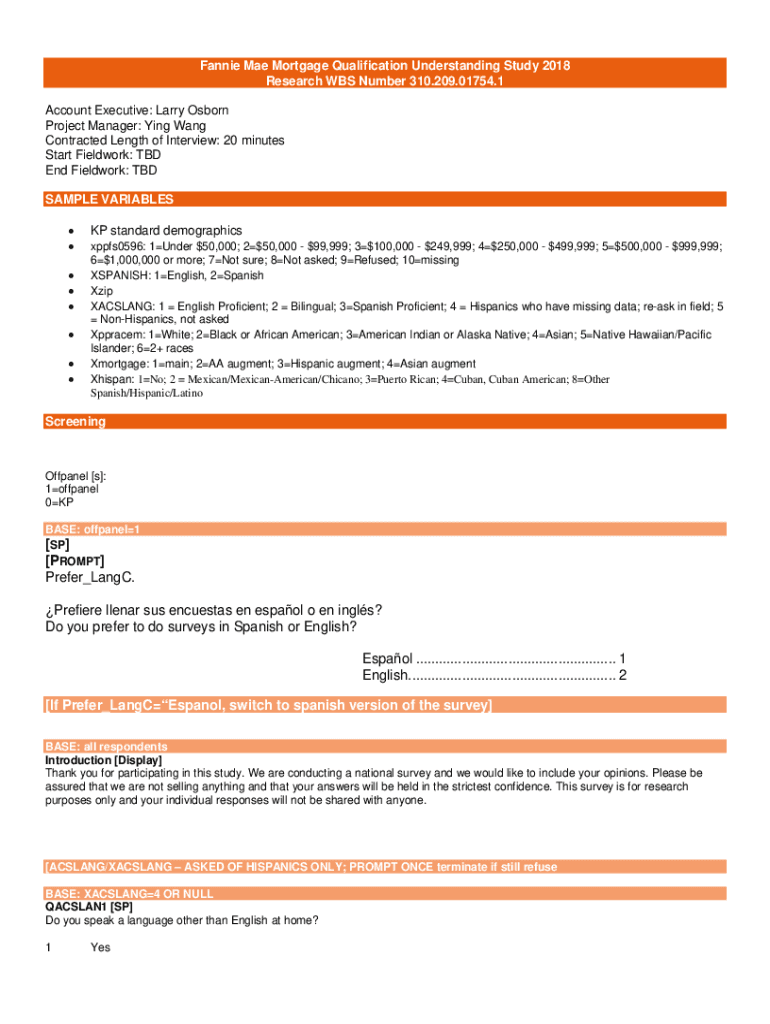

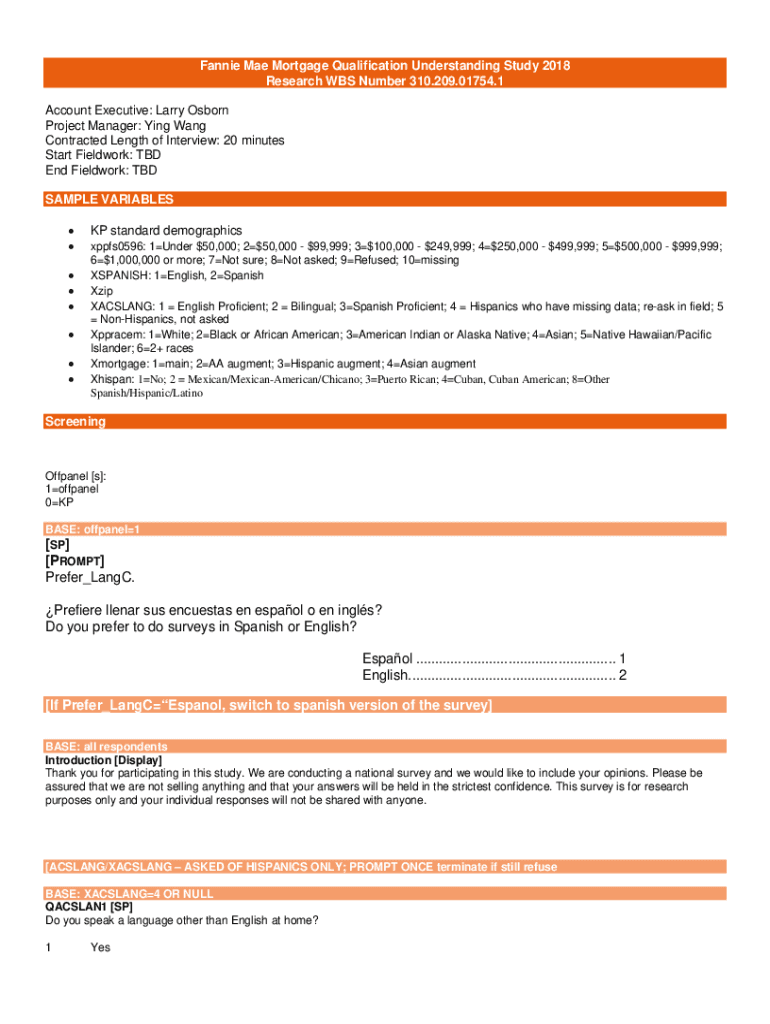

Fannie Mae Mortgage Qualification Understanding Study 2018 Research WBS Number 310.209.01754.1 Account Executive: Larry Osborn Project Manager: Ying Wang Contracted Length of Interview: 20 minutes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nhs mortgage understanding study

Edit your nhs mortgage understanding study form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nhs mortgage understanding study form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nhs mortgage understanding study online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nhs mortgage understanding study. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nhs mortgage understanding study

How to fill out nhs mortgage understanding study

01

Start by gathering all the necessary documents required for the NHS mortgage understanding study. This includes your income statements, bank statements, and any other relevant financial documents.

02

Next, carefully review the terms and conditions of the NHS mortgage understanding study. Make sure you understand all the terms, eligibility requirements, and any potential fees or penalties associated with the study.

03

Fill out the application form for the NHS mortgage understanding study. Provide accurate and complete information to ensure a smooth processing of your application.

04

Submit your application along with all the required documents to the designated NHS mortgage understanding study authority. Follow the instructions provided for submission.

05

Wait for the approval of your application. This may take some time depending on the volume of applications received.

06

Once your application is approved, you will receive a notification. Review the terms of the study again to ensure you fully understand your obligations and rights.

07

If you have any further questions or need clarification, contact the NHS mortgage understanding study authority for assistance.

08

Make timely payments and adhere to the terms of the study. Failure to comply may result in penalties or termination of the study.

09

Keep track of your progress in the NHS mortgage understanding study and regularly review your financial situation to ensure you are meeting your goals.

10

Upon completion of the study, evaluate the outcome and determine if it has been beneficial for your mortgage understanding. If necessary, seek further guidance or assistance.

11

Finally, utilize the knowledge and understanding gained from the NHS mortgage understanding study to make informed decisions regarding your mortgage and financial future.

Who needs nhs mortgage understanding study?

01

Individuals or households who are planning to apply for a mortgage and want to enhance their understanding of the process.

02

People who are new to the mortgage market and want to familiarize themselves with the terms, requirements, and potential risks associated with a mortgage.

03

Homebuyers who are interested in exploring special mortgage programs or studies offered by the NHS.

04

Those who want to make informed decisions and properly manage their financial obligations associated with a mortgage.

05

Individuals who have previously faced difficulties in mortgage repayment and want to improve their understanding and ensure successful repayment in the future.

06

Anyone who wants to stay updated and knowledgeable about the mortgage market and related studies in order to make informed choices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nhs mortgage understanding study for eSignature?

Once your nhs mortgage understanding study is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the nhs mortgage understanding study electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit nhs mortgage understanding study on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign nhs mortgage understanding study on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is nhs mortgage understanding study?

The NHS Mortgage Understanding Study is a research initiative aimed at analyzing the mortgage patterns and trends among healthcare professionals in the NHS sector.

Who is required to file nhs mortgage understanding study?

Healthcare professionals who are participating in the NHS mortgage program or those who have taken a mortgage under this initiative are required to file the NHS Mortgage Understanding Study.

How to fill out nhs mortgage understanding study?

To fill out the NHS Mortgage Understanding Study, participants need to gather relevant financial information, follow the provided guidelines or templates, and submit their completed forms to the designated authority.

What is the purpose of nhs mortgage understanding study?

The purpose of the NHS Mortgage Understanding Study is to assess the financial needs of NHS employees regarding mortgages and to inform future policies or support programs.

What information must be reported on nhs mortgage understanding study?

Participants must report details such as income, existing mortgage details, housing situation, demographics, and any relevant financial obligations.

Fill out your nhs mortgage understanding study online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nhs Mortgage Understanding Study is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.