Get the free Basic Concepts of Income Tax

Show details

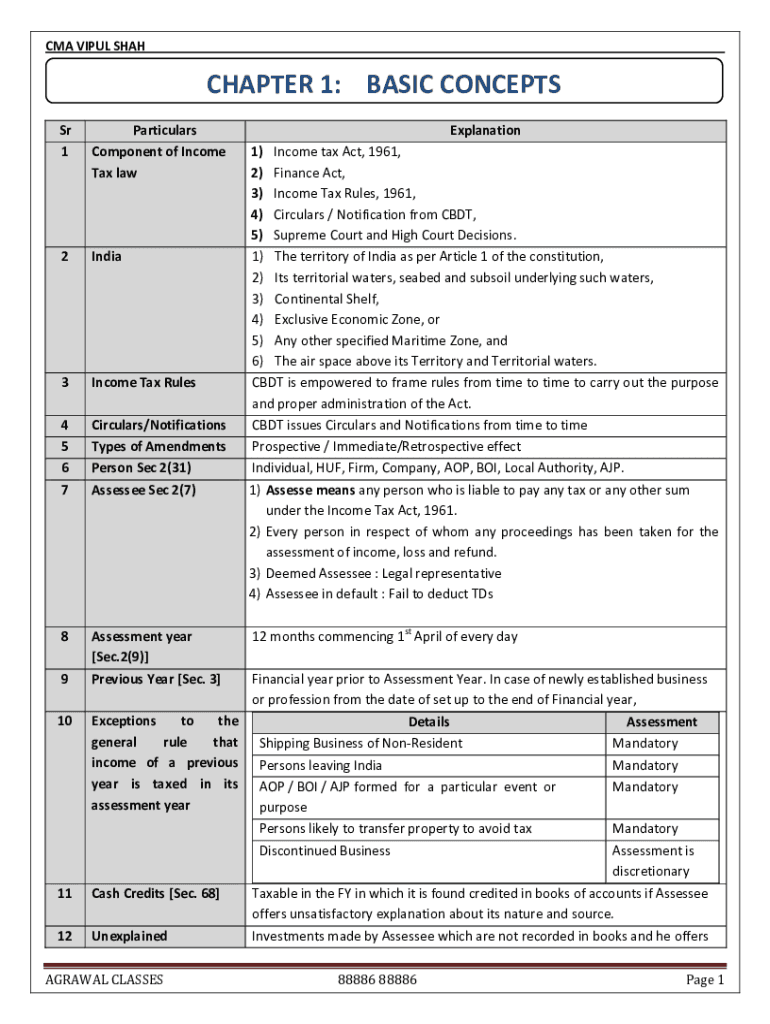

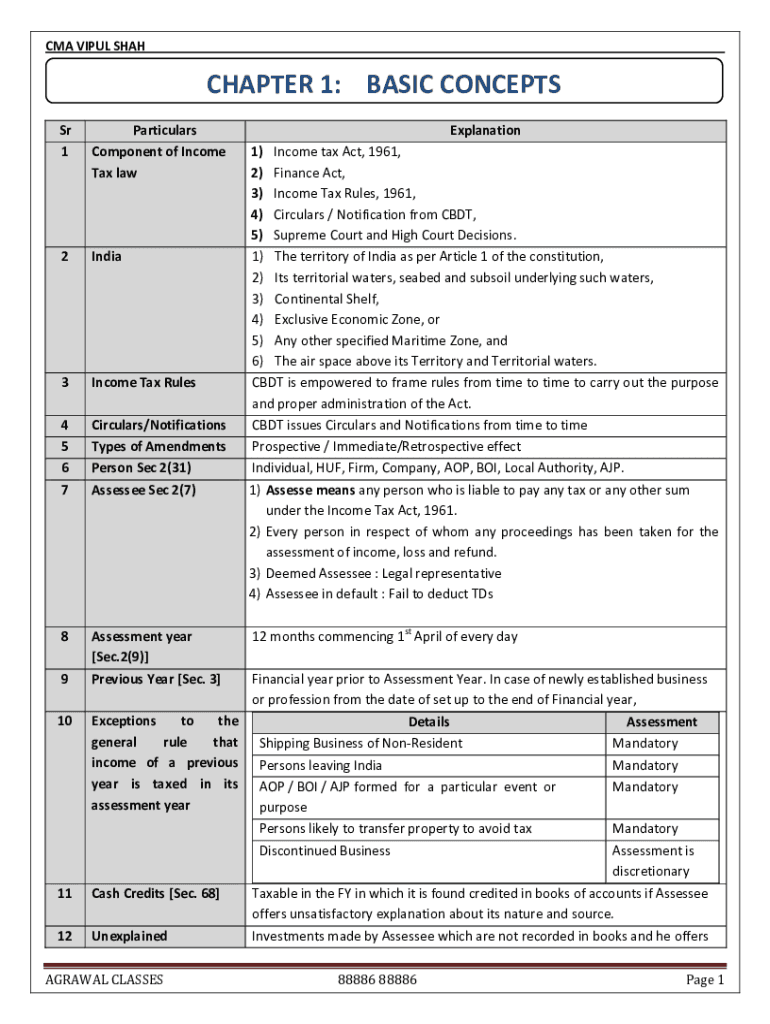

CMA VI PUL SUBCHAPTER 1: BASIC CONCEPTS

Sr

1Particulars

Component of Income

Tax law2India3Income Tax Rules4

5

6

7Circulars/Notifications

Types of Amendments

Person Sec 2(31)

Assessed Sec 2(7)8Assessment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basic concepts of income

Edit your basic concepts of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basic concepts of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit basic concepts of income online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit basic concepts of income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basic concepts of income

How to fill out basic concepts of income

01

To fill out the basic concepts of income, follow these steps:

02

Identify all sources of income: Start by listing all the different sources of income you have. This can include salary, wages, rental income, dividends, interest, and any other income you receive.

03

Categorize the income: Once you have identified the sources, categorize them into different types such as earned income, passive income, or investment income. This will help in understanding the nature of the income and its tax implications.

04

Calculate the amount: Determine the amount of income you receive from each source. It can be helpful to collect supporting documents like pay stubs, bank statements, or investment statements.

05

Record the details: Record the details of each income source along with the corresponding amount in a document or spreadsheet. Make sure to include the date of receipt and any relevant notes or descriptions.

06

Summarize the total income: Finally, add up all the income amounts to calculate your total income for a specific period, such as a month, quarter, or year. This will give you a comprehensive view of your overall income.

Who needs basic concepts of income?

01

Basic concepts of income are needed by individuals, businesses, and governments alike.

02

Individuals: Understanding basic concepts of income helps individuals to manage their personal finances, budget effectively, and plan for the future. It also enables them to accurately report their income for tax purposes.

03

Businesses: Basic concepts of income are crucial for businesses to assess their financial performance, determine profitability, and make informed decisions regarding investments, pricing, and expansion.

04

Governments: Governments need a clear understanding of basic concepts of income to establish tax policies, assess the overall economic health of a country, and allocate resources effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify basic concepts of income without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including basic concepts of income. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit basic concepts of income online?

With pdfFiller, the editing process is straightforward. Open your basic concepts of income in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out basic concepts of income using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign basic concepts of income and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is basic concepts of income?

Basic concepts of income refer to the fundamental principles and components used to calculate an individual's or a company's taxable income. These concepts include various sources of income, deductions, exemptions, and credits that affect the overall tax liability.

Who is required to file basic concepts of income?

Any individual or entity that earns taxable income beyond a certain threshold is required to file basic concepts of income. The specific requirements may vary based on the jurisdiction and tax laws in place.

How to fill out basic concepts of income?

To fill out basic concepts of income, you need to gather all relevant financial information and documentation, such as income statements, expenses, and deductions. You can then use this information to calculate your total income, apply deductions and exemptions, and determine your taxable income. Finally, you need to report this information on the appropriate tax forms or software as required by the tax authorities.

What is the purpose of basic concepts of income?

The purpose of basic concepts of income is to determine the taxable income of individuals or entities. By understanding and applying these concepts, tax authorities can assess the tax liability of taxpayers accurately and ensure compliance with tax laws.

What information must be reported on basic concepts of income?

The information that must be reported on basic concepts of income includes all sources of income, such as wages, salaries, investments, rental income, and self-employment earnings. Additionally, deductions, expenses, exemptions, and credits that are applicable to reduce the taxable income should also be reported.

Fill out your basic concepts of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basic Concepts Of Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.