Get the free ca intermediate direct tax

Show details

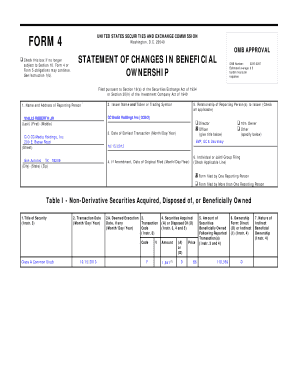

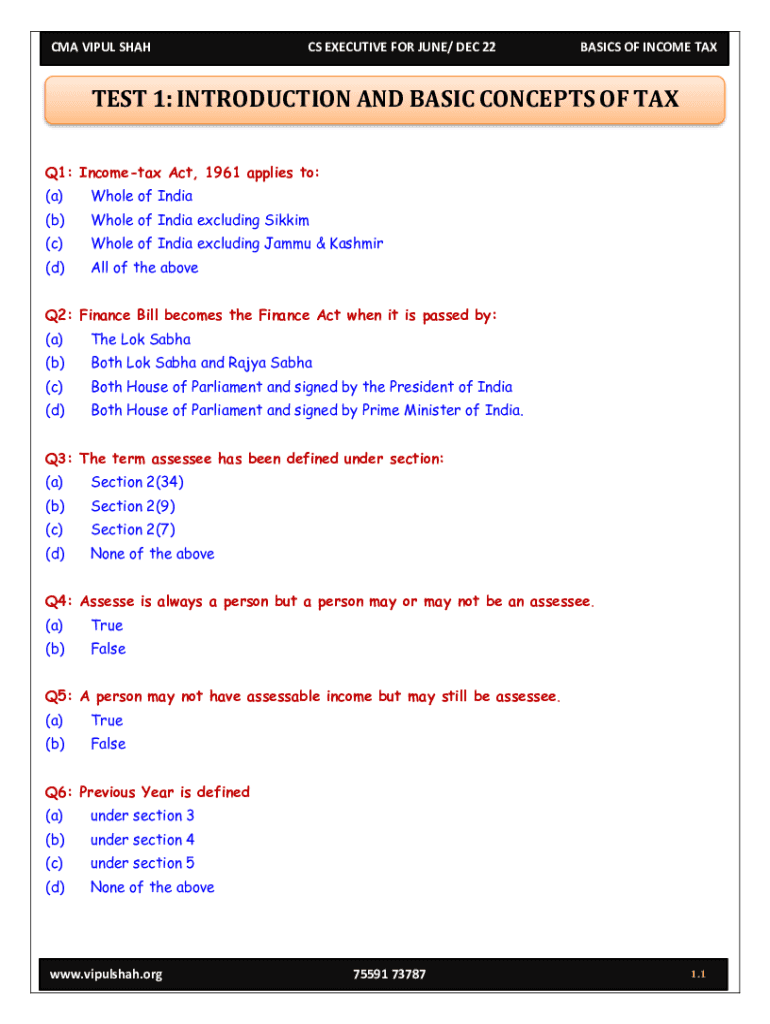

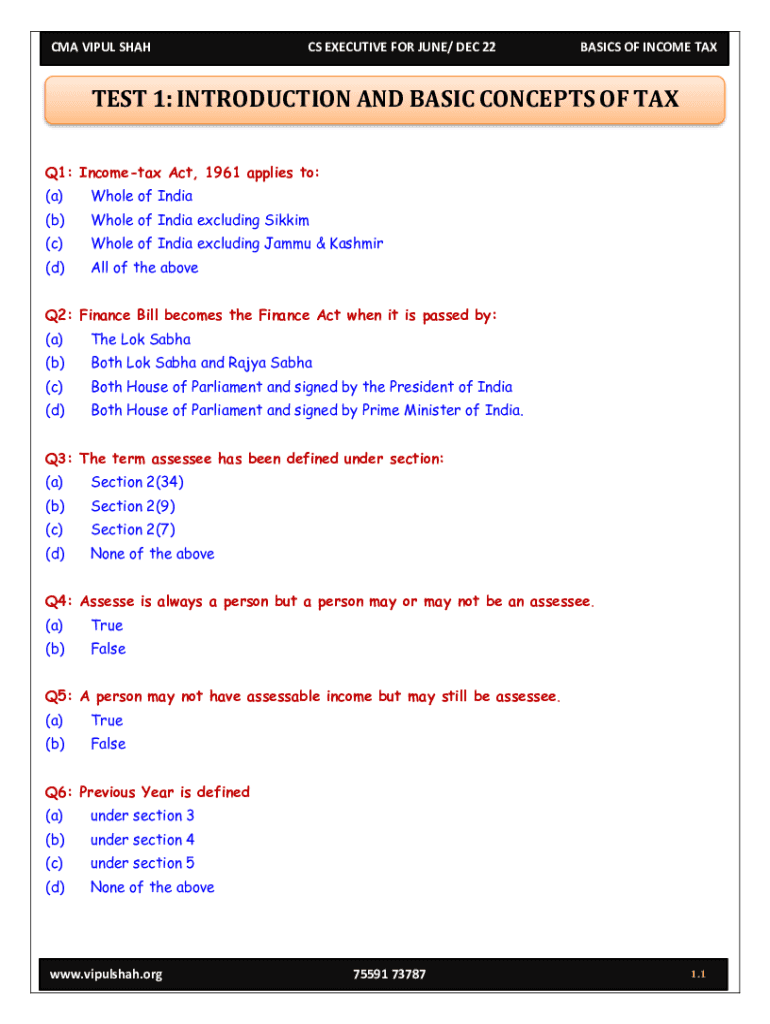

CMA VI PUL SHAHS EXECUTIVE FOR JUNE/ DEC 22CMA VI PUL SHAH CS EXECUTIVE TEST PAPER 1 INTRODUCTION TO INCOME BASICS OF INCOME TAUTEST 1: INTRODUCTION AND BASIC CONCEPTS OF TAX

Q1: Income tax Act, 1961

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ca intermediate direct tax

Edit your ca intermediate direct tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca intermediate direct tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca intermediate direct tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ca intermediate direct tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca intermediate direct tax

How to fill out ca intermediate direct tax

01

To fill out CA Intermediate Direct Tax, follow these steps:

02

Start by gathering all the necessary documents, such as income statements, investment details, and tax forms.

03

Carefully read and understand the instructions provided in the tax form.

04

Begin by filling out your personal details, such as name, address, and PAN (Permanent Account Number).

05

Proceed to report your income from various sources, including salary, business, capital gains, and other taxable incomes.

06

Provide details of deductions and exemptions you are eligible for, such as investments in tax-saving schemes, medical insurance premiums, and donations.

07

Calculate tax payable or refundable based on your income and deductions.

08

Complete any additional sections required in the form, such as reporting foreign assets or incomes, if applicable.

09

Double-check all the information provided and ensure its accuracy.

10

Sign and date the form before submission.

11

Submit the completed form either online or in person to the appropriate tax authority.

12

Retain a copy of the filled-out form and any supporting documents for future reference.

13

Please note that the above steps are only a general guideline. It is recommended to consult a tax professional or refer to the specific instructions provided with the CA Intermediate Direct Tax form for accurate filing.

Who needs ca intermediate direct tax?

01

CA Intermediate Direct Tax is required by individuals or entities who fall under the following categories:

02

- Individuals or Hindu Undivided Family (HUF) earning income through various sources.

03

- Businesses, partnerships, or Limited Liability Partnerships (LLPs) with taxable income.

04

- Professionals, such as doctors, lawyers, architects, etc., who earn income through their profession.

05

- Companies, whether private or public, that generate taxable profits.

06

- Any other entity or individual as mandated by the tax laws of the respective country or jurisdiction.

07

It is advisable to consult a tax advisor or refer to the specific regulations governing the taxation requirements to determine if CA Intermediate Direct Tax is applicable to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ca intermediate direct tax directly from Gmail?

ca intermediate direct tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get ca intermediate direct tax?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ca intermediate direct tax and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the ca intermediate direct tax form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign ca intermediate direct tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is ca intermediate direct tax?

CA Intermediate Direct Tax refers to the tax laws and regulations that candidates studying for the CA Intermediate course must understand and comply with, which generally includes the principles of taxation applicable in India.

Who is required to file ca intermediate direct tax?

Students enrolled in the CA Intermediate course are required to file CA Intermediate Direct Tax as part of their examination requirements and practical training.

How to fill out ca intermediate direct tax?

To fill out CA Intermediate Direct Tax, students must complete the relevant forms provided by the Institute of Chartered Accountants of India (ICAI), ensuring to accurately report all applicable income, deductions, and tax liabilities.

What is the purpose of ca intermediate direct tax?

The purpose of CA Intermediate Direct Tax is to equip students with the necessary knowledge and skills to understand and apply tax laws, preparing them for professional practice in taxation.

What information must be reported on ca intermediate direct tax?

Information that must be reported includes personal details, income details from various sources, deductions claimed, tax calculations, and any applicable exemptions.

Fill out your ca intermediate direct tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Intermediate Direct Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.