Get the free extraordinary - Revenue and Disaster Management

Show details

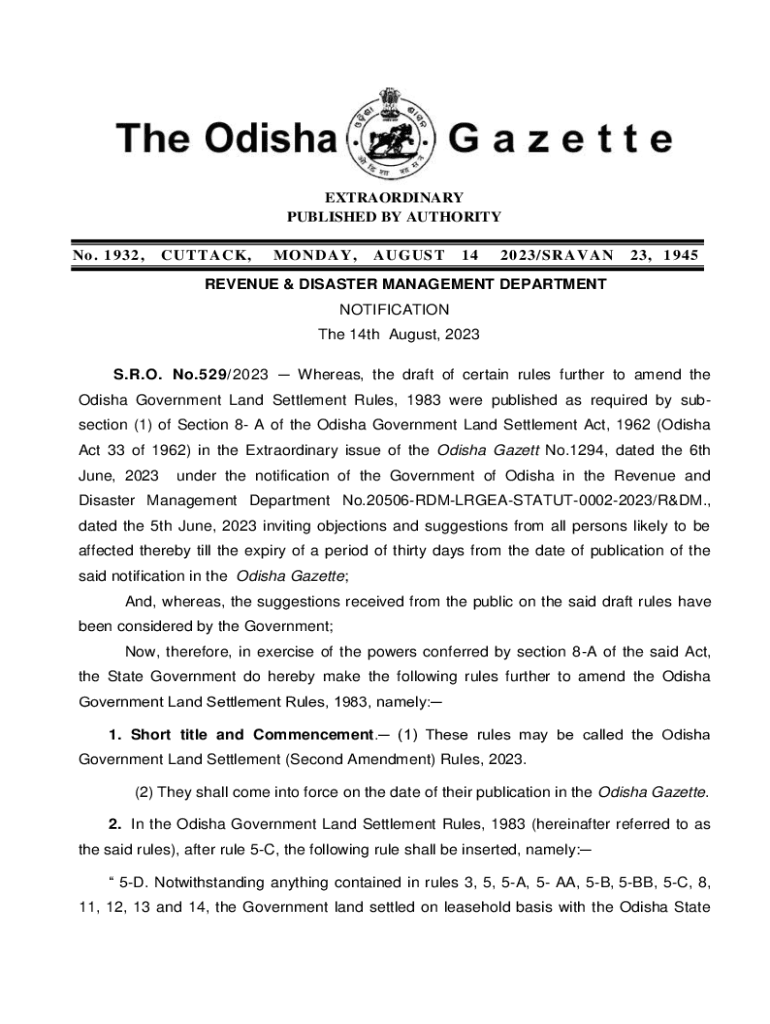

EXTRAORDINARY PUBLISHED BY AUTHORITY No. 1932,CUTTACK,MONDAY,AUGUST142023/SRAVAN23, 1945REVENUE & DISASTER MANAGEMENT DEPARTMENT NOTIFICATION The 14th August, 2023 S.R.O. No.529/2023 Whereas, the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extraordinary - revenue and

Edit your extraordinary - revenue and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extraordinary - revenue and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit extraordinary - revenue and online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit extraordinary - revenue and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extraordinary - revenue and

How to fill out extraordinary - revenue and

01

To fill out extraordinary revenue, follow these steps:

02

Gather all the necessary documents and information related to the revenue you want to report.

03

Identify the source of the extraordinary revenue and determine whether it is a one-time or recurring event.

04

Determine the appropriate accounting treatment for the revenue based on your company's accounting policies and relevant accounting standards.

05

Record the extraordinary revenue in the appropriate financial statement accounts, ensuring proper classification and disclosure.

06

Provide supporting documentation and explanations for the extraordinary revenue in the footnotes accompanying the financial statements.

07

Review and reconcile the extraordinary revenue figures with other financial reports, ensuring accuracy and consistency.

08

Seek professional advice or consultation if you are uncertain about any aspect of recording extraordinary revenue.

09

Submit the completed financial statements, including the extraordinary revenue, to the relevant authorities or stakeholders as required.

Who needs extraordinary - revenue and?

01

Extraordinary revenue is typically relevant to businesses and organizations that have experienced or are expecting an influx of significant and non-recurring revenue.

02

Some examples of entities that might need to report extraordinary revenue include:

03

- Companies that received a one-time large insurance settlement due to a major event or disaster.

04

- Non-profit organizations that received a substantial donation or grant for a specific project.

05

- Professional service firms that won a lucrative contract or engagement unrelated to their usual business operations.

06

- Governments or municipalities that received unexpected windfalls from a natural resource discovery or legal settlement.

07

Overall, anyone who needs to accurately reflect and disclose significant, non-recurring revenue in their financial reporting should consider the appropriate treatment of extraordinary revenue.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send extraordinary - revenue and to be eSigned by others?

When you're ready to share your extraordinary - revenue and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit extraordinary - revenue and on an iOS device?

Create, edit, and share extraordinary - revenue and from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete extraordinary - revenue and on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your extraordinary - revenue and. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is extraordinary - revenue and?

Extraordinary revenue refers to non-recurring income or gains that a business might realize outside of its usual operations, often from events such as asset sales or litigation settlements.

Who is required to file extraordinary - revenue and?

Entities that realize extraordinary revenue and are subject to tax reporting requirements are required to file extraordinary revenue reports, including corporations, partnerships, and individuals depending on their jurisdiction.

How to fill out extraordinary - revenue and?

To fill out the extraordinary revenue form, gather all relevant financial information regarding the extraordinary income, complete the designated fields accurately, and provide supporting documentation as required by tax authorities.

What is the purpose of extraordinary - revenue and?

The purpose of extraordinary revenue reporting is to ensure transparency in financial reporting and compliance with tax laws, while also allowing tax authorities to assess tax liabilities accurately.

What information must be reported on extraordinary - revenue and?

The report must include the amount of extraordinary revenue, the source of the revenue, the date it was realized, and any associated expenses or deductions relevant to the extraordinary income.

Fill out your extraordinary - revenue and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extraordinary - Revenue And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.