MN Year-End Reminders for Employees 2023-2025 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Year-End Reminders for Employees

Edit your MN Year-End Reminders for Employees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Year-End Reminders for Employees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN Year-End Reminders for Employees online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MN Year-End Reminders for Employees. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Year-End Reminders for Employees Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Year-End Reminders for Employees

How to fill out MN Year-End Reminders for Employees

01

Gather all necessary employee information and records for the year.

02

Access the MN Year-End Reminders document or template.

03

Begin by filling out employee details such as name, ID, and department.

04

Review and input year-to-date earnings and deductions for each employee.

05

Ensure to include any relevant tax adjustments or benefits applicable.

06

Double-check all figures for accuracy before submission.

07

Distribute the completed reminders to employees and provide an overview if needed.

Who needs MN Year-End Reminders for Employees?

01

All employers operating in Minnesota who have employees.

02

HR departments responsible for payroll management.

03

Finance teams involved in year-end reporting.

04

Employees wanting to understand their year-end earnings and deductions.

Fill

form

: Try Risk Free

People Also Ask about

Should I get a 1099 or W-2?

Payroll Taxes for W2 Vs 1099 Workers At tax time, as discussed earlier, you'll need to give employees a W-2 that shows the amount of these taxes that were withheld from their pay. For independent contractors, you'll need to issue a Form 1099-NEC to report what you paid if they received $600 or more during the year.

What forms do employers need to file at year end?

Employment Tax Forms: Form 940, Employer's Annual Federal Unemployment Tax Return. Form 941, Employer's Quarterly Federal Tax Return. Form 943, Employer's Annual Tax Return for Agricultural Employees. Form 944, Employer's Annual Federal Tax Return. Form 945, Annual Return of Withheld Federal Income Tax.

What do employers send at the end of the year?

Employers must complete, file electronically or by mail with the Social Security Administration (SSA), and furnish to their employees Form W-2, Wage and Tax StatementPDF showing the wages paid and taxes withheld for the year for each employee.

What do employers send at the end of the year for taxes?

At the end of the year, the employer must complete Form W-2, Wage and Tax Statement, to report wages, tips and other compensation paid to an employee. File Copy A of all paper and electronic Forms W-2 with Form W-3, Transmittal of Wage and Tax Statements, to the Social Security Administration (SSA).

What is a year end form?

What Are Year-End Forms? Year-end forms are the annual payroll tax reports that you must generate and distribute to anyone you've paid, such as employees, vendors, and contractors. You also need to provide the information in these forms to the relevant government agencies.

What does payroll mean in business?

Payroll is a business function or process that all companies must undertake in order to pay their employees. It involves the calculation of wages and taxes and the issuing of paychecks. Payroll processing may be handled in-house or, increasingly, outsourced to a third party.

What is the year-end payroll processing?

Year-end payroll processing includes calculating your business's payroll taxes, employee paycheck deductions, and employee earnings and reviewing payroll records. Year-end payroll processing is completed during the final financial quarter of the year and extends to the first quarter of the following year.

What does it mean to be paid by payroll?

Payroll is the process of paying a company's employees, which includes tracking hours worked, calculating employees' pay, and distributing payments via direct deposit to employee bank accounts or by check.

What is an example of payroll?

For example, an employee has an annual salary of $84000 and is being paid semi-monthly. Calculate the pay per salary for that particular person. $84,000 / 24 = $3500.

How do you run payroll at the end of the year?

How To Complete Year-End Payroll In 10 Steps Step 1: Verify All Employee & Company Information. Step 2: Verify Wages, Taxes, & Benefits. Step 3: Order Your W-2s. Step 4: Manage Paid-Time-Off. Step 5: Decide On Bonuses. Step 6: Update Your Compliance Posters. Step 7: Update Payroll Information.

What do employers give you at the end of the year?

A year-end bonus is a form of compensation that employers pay to their employees in addition to their regular earnings. This type of bonus is often tied to performance metrics. Bonuses can be made in cash as lump-sum payments or in other forms, such as stocks or paid time off.

What are year-end forms?

What Are Year-End Forms? Year-end forms are the annual payroll tax reports that you must generate and distribute to anyone you've paid, such as employees, vendors, and contractors. You also need to provide the information in these forms to the relevant government agencies.

What are the payroll changes for 2023?

For 2023, the Social Security tax wage base for employees will increase to $160,200. The Social Security tax rate for employees and employers remains unchanged at 6.2% on wages up to $160,200. Medicare tax will also apply to all wages and will be imposed at a rate of 1.45% for both employees and employers.

What is the 1099 form at the end of the year?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MN Year-End Reminders for Employees online?

With pdfFiller, you may easily complete and sign MN Year-End Reminders for Employees online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my MN Year-End Reminders for Employees in Gmail?

Create your eSignature using pdfFiller and then eSign your MN Year-End Reminders for Employees immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit MN Year-End Reminders for Employees on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute MN Year-End Reminders for Employees from anywhere with an internet connection. Take use of the app's mobile capabilities.

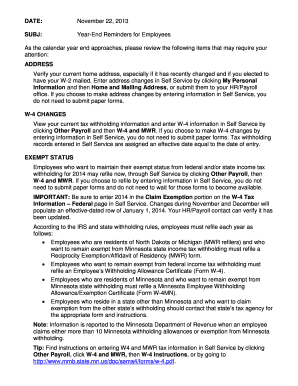

What is MN Year-End Reminders for Employees?

MN Year-End Reminders for Employees is a document provided by the Minnesota Department of Revenue that highlights important information and deadlines for employees regarding their income tax responsibilities at the end of the year.

Who is required to file MN Year-End Reminders for Employees?

Employees in Minnesota who earn income and are subject to state taxes need to be aware of the MN Year-End Reminders, although it is not a filing requirement but a guide to assist them with their tax responsibilities.

How to fill out MN Year-End Reminders for Employees?

MN Year-End Reminders for Employees does not require filling out forms. Instead, it provides guidance on tax obligations and deadlines for employees, ensuring they understand what is required for tax reporting.

What is the purpose of MN Year-End Reminders for Employees?

The purpose of MN Year-End Reminders for Employees is to inform them of important tax-related information, deadlines, and obligations to ensure compliance with state tax laws.

What information must be reported on MN Year-End Reminders for Employees?

The MN Year-End Reminders for Employees includes information on withholding taxes, reporting income, deadlines for form submissions, and other pertinent tax-related information that employees need to be aware of for accurate tax filing.

Fill out your MN Year-End Reminders for Employees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Year-End Reminders For Employees is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.