Get the free Records and Audit

Show details

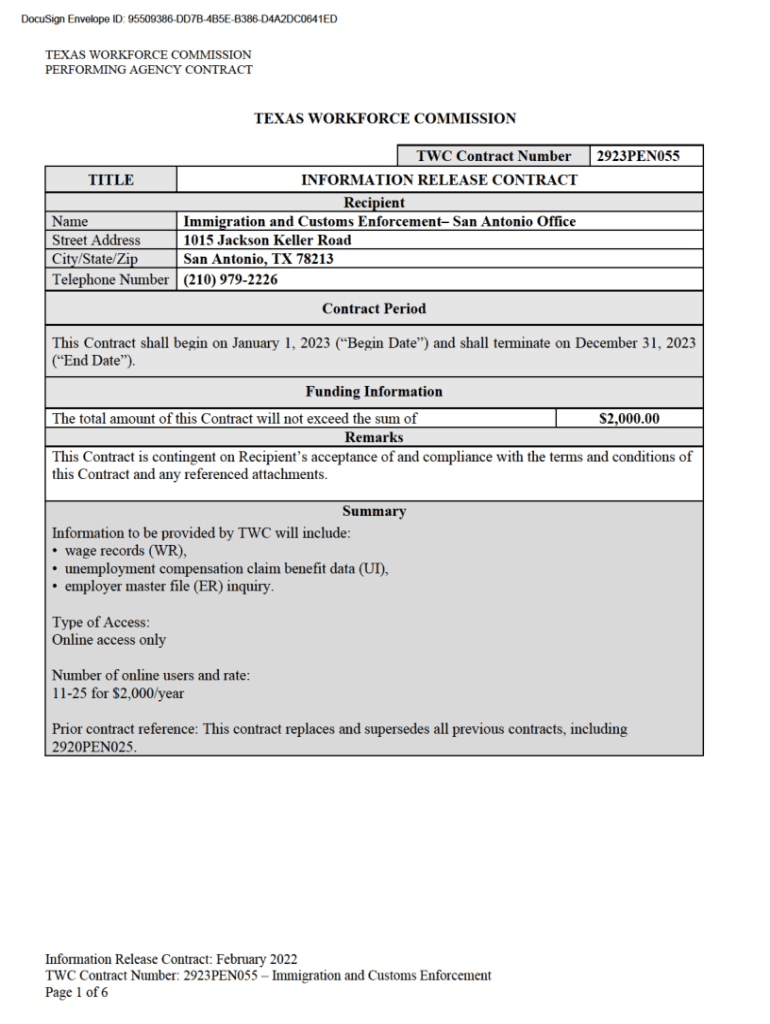

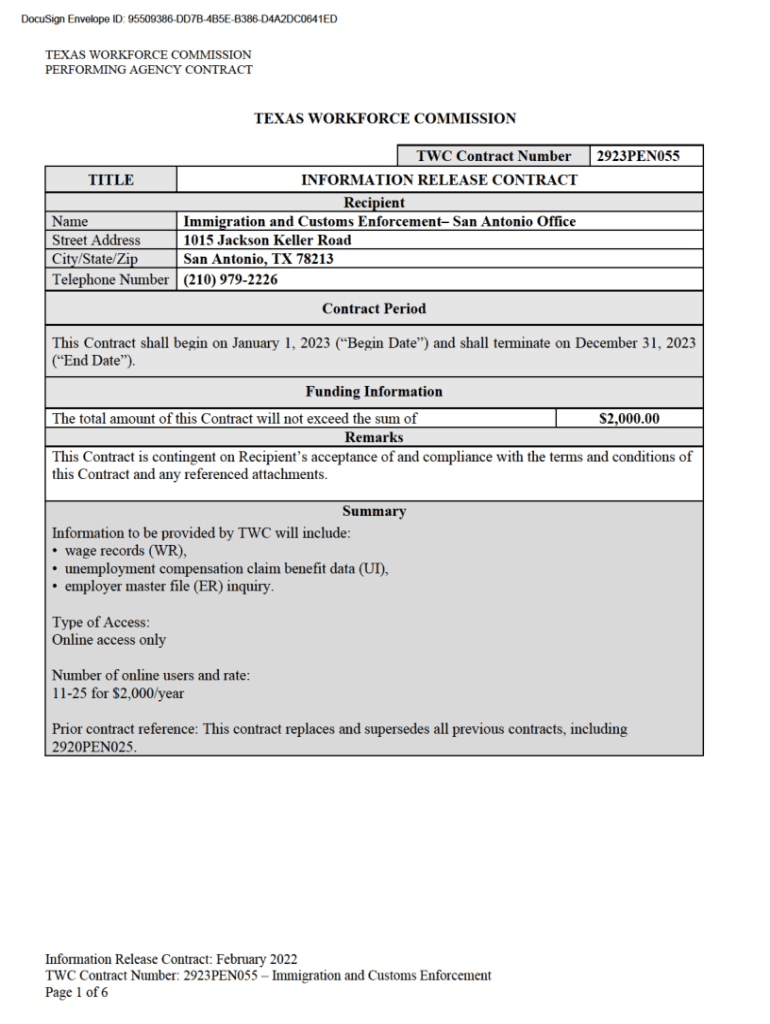

DocuSign Envelope ID: 95509386DD7B4B5EB386D4A2DC0641EDTEXAS WORKFORCE COMMISSION PERFORMING AGENCY CONTRACTTABLE OF CONTENTSGeneral Terms and Conditions Section 1 Purpose and Legal Authority Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign records and audit

Edit your records and audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your records and audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit records and audit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit records and audit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out records and audit

How to fill out records and audit

01

To fill out records and audit, follow these steps:

02

Start by gathering all the necessary documents and information that you will need to accurately fill out the records. This can include financial statements, invoices, receipts, and any other relevant documentation.

03

Determine the format and structure of the records. This can vary depending on the specific requirements and regulations of your industry or organization.

04

Begin by entering the necessary information into the records. This can include details such as dates, transaction amounts, descriptions, and any other relevant data.

05

Make sure to double-check your entries for accuracy and completeness. Any errors or omissions can impact the overall integrity of the records.

06

Once the records are filled out, it is important to conduct an audit. This involves a thorough review of the records to ensure their accuracy and compliance with applicable laws and regulations.

07

During the audit, compare the records to the original source documents to verify their authenticity and reliability.

08

Document any findings or discrepancies discovered during the audit process and take appropriate actions to rectify them.

09

Finally, ensure that the records and audit documentation are properly organized, stored, and maintained for future reference and potential audits.

Who needs records and audit?

01

Records and audit are needed by various individuals, organizations, and entities, including:

02

- Businesses of all sizes, to track their financial transactions, comply with regulatory requirements, and provide accurate financial reporting.

03

- Government agencies, to ensure compliance with tax laws, monitor financial activities, and detect any potential fraud or illegal activities.

04

- Investors and shareholders, who rely on accurate records and audit reports to make informed investment decisions and evaluate the financial health of a company.

05

- Non-profit organizations, to maintain transparency and accountability, demonstrate the proper use of funds, and adhere to funding requirements.

06

- Financial institutions, to assess the creditworthiness of individuals or businesses when making lending or investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find records and audit?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the records and audit in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute records and audit online?

Filling out and eSigning records and audit is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the records and audit in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your records and audit.

What is records and audit?

Records and audit refer to the systematic collection and examination of financial statements and supporting documents to ensure accuracy and compliance with relevant regulations.

Who is required to file records and audit?

Entities such as businesses, non-profits, and certain individuals may be required to file records and audit based on jurisdictional laws and the size of their operations.

How to fill out records and audit?

To fill out records and audit, collect all relevant financial data, complete the required forms accurately, and ensure all documentation supports the information reported.

What is the purpose of records and audit?

The purpose of records and audit is to verify the accuracy of financial reporting, ensure compliance with laws and regulations, and provide transparency for stakeholders.

What information must be reported on records and audit?

Information such as financial statements, transaction records, compliance documentation, and other relevant financial disclosures must be reported.

Fill out your records and audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Records And Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.