IRS 14039 2023 free printable template

Show details

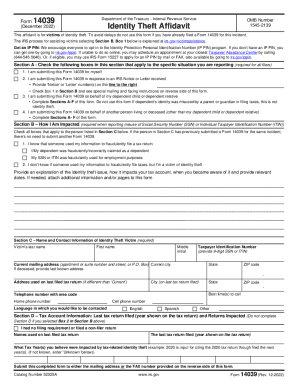

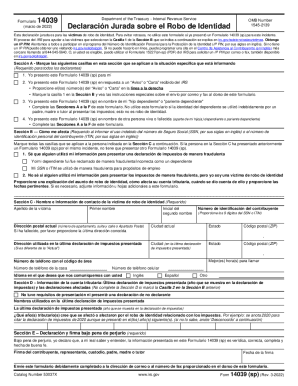

If the person in Section C has previously submitted a Form 14039 for the same incident there s no need to submit another Form 14039. To avoid delays do not use this form if you have already filed a Form 14039 for this incident. Form 14039 can also be completed online at https //apps. Help us avoid delays Do not use this form if you have already filed a Form 14039 for this incident. Form 14039 Department of the Treasury - Internal Revenue Service OMB Number 1545-2139 Identity Theft Affidavit...September 2023 This affidavit is for victims of identity theft. If not known enter Unknown below Submit this completed form to either the mailing address or the FAX number provided on the reverse side of this form. Catalog Number 52525A www.irs.gov Form 14039 Rev. 9-2023 Section E Penalty of Perjury Statement and Signature required Under penalty of perjury I declare that to the best of my knowledge and belief the information entered on this Form 14039 is true correct complete and made in good...faith. Signature of taxpayer or representative conservator parent or guardian Date signed Section F Representative Conservator Parent or Guardian Information required if completing Form 14039 on someone else s behalf Check only ONE of the following five boxes next to the reason you are submitting this form 1. I am submitting this Form 14039 for myself Provide Notice or Letter number s on the line to the right Check box 1 in Section B and see special mailing and faxing instructions on reverse...side of this form. Complete Sections A-F of this form. Do not use this form If dependent s identity was misused by a parent or guardian in filing taxes this is not identity theft. For all others FAX this form toll-free to 855-807-5720 to file your tax return electronically because the SSN/ITIN of you your spouse or dependent was misused attach this Form 14039 to the back of your paper tax return and submit to the IRS location where you normally file your tax return. All others should mail this...form to Internal Revenue Service Fresno CA 93888-0025 Privacy Act and Paperwork Reduction Notice Our legal authority to request the information is 26 U.S.C. irs. gov/app/digital-mailroom/dmaf/f14039/. The IRS process for assisting victims selecting Section B Box 1 below is explained at irs. gov/victimassistance. Get an IP PIN We encourage everyone to opt-in to the Identity Protection Personal Identification Number IP PIN program* If you don t have an IP PIN you can get one by going to irs....gov/ippin* If unable to do so online you may schedule an appointment at your closest Taxpayer Assistance Center by calling 844-545-5640. Or if eligible you may use IRS Form 15227 to apply for an IP PIN by mail or FAX also available by going to irs. gov/ippin* Section A - Check the following boxes in this section that apply to the specific situation you are reporting required for all filers 1. Section B How I Am Impacted required when reporting misuse of Social Security Number SSN or Individual...Taxpayer Identification Number ITIN Check all boxes that apply to the person listed in Section C below.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 14039

How to edit IRS 14039

How to fill out IRS 14039

Instructions and Help about IRS 14039

How to edit IRS 14039

Editing IRS 14039 is essential for ensuring that all information is accurate before submission. To make edits to the IRS 14039 form, you can utilize pdfFiller’s editing tools, which allow you to adjust text, add information, or correct any mistakes. Ensure that all changes reflect your accurate identification and tax information, as inaccuracies can lead to delays or issues with the IRS.

How to fill out IRS 14039

Filling out IRS 14039 involves a systematic approach. First, gather relevant personal information such as your name, address, and Social Security number (SSN). Then, follow these steps:

01

Begin by entering your personal identification details in the designated sections.

02

Provide a clear explanation of why you suspect identity theft, if applicable.

03

Review all entries for accuracy before saving or submitting the form.

Properly completing IRS 14039 is crucial for addressing tax-related identity theft effectively.

About IRS 14 previous version

What is IRS 14039?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 14 previous version

What is IRS 14039?

IRS 14039, also known as the Identity Theft Affidavit, is a form used to report instances of identity theft related to tax issues. This form empowers individuals to inform the IRS of unauthorized use of their personal information for tax-related purposes. It is primarily designed to help victims of identity theft resolve discrepancies in their tax records and prevent fraudulent activity.

What is the purpose of this form?

The purpose of IRS 14039 is to formally notify the IRS that an individual's tax identification has been compromised. By submitting this form, taxpayers can initiate a protective process that safeguards their account while the IRS investigates the claims of identity theft. This affidavit is critical for stopping unauthorized access to tax filings and potential refunds.

Who needs the form?

Individuals who suspect that their personal information has been misused for tax purposes should file IRS 14039. Common scenarios include unexpected notifications from the IRS, such as receiving notices about unfiled returns or discrepancies that one did not initiate. Taxpayers who discover evidence of identity theft are encouraged to file this affidavit immediately to mitigate potential damage.

When am I exempt from filling out this form?

Taxpayers may be exempt from filing IRS 14039 if they are not experiencing identity theft issues. Additionally, if someone else has filed a return with your information but you were not a victim of identity theft—meaning you did not initiate the action—you may not need to complete this form. If there's uncertainty, consulting a tax professional is advisable.

Components of the form

The components of IRS 14039 include your personal identification details and sections specifically addressing the nature of identity theft. You’ll need to provide detailed explanations about the identity theft experience, including evidence if available. This information directly aids the IRS in understanding and acting on your claims.

What are the penalties for not issuing the form?

Failure to file IRS 14039 when identity theft is suspected can lead to continued unauthorized access to your tax information, resulting in potential financial loss and complications with the IRS. Not reporting identity theft may also hinder your ability to receive assistance or resolution from the IRS in a timely manner.

What information do you need when you file the form?

When filing IRS 14039, you need personal details such as your full name, address, Social Security number, and any relevant supporting documentation indicating identity theft. Including details about any suspicious mail received from the IRS or discrepancies in your tax records strengthens your case and aids in a quicker resolution.

Is the form accompanied by other forms?

IRS 14039 can sometimes be submitted alongside other documentation if additional evidence of identity theft is available. However, it primarily serves as a standalone affidavit focused on reporting the theft itself. Reviewing any IRS correspondence may guide whether supplementary documentation is necessary.

Where do I send the form?

After completing IRS 14039, send the form to the address specified in the instructions, which typically directs you to the IRS processing center assigned to handle claims regarding identity theft. Double-check the mailing address to ensure timely and correct handling of your form.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

New to this skill. Still figuring out how to use to our advantage.

lank spots and missing bottom of the page, when commanded to print

See what our users say