NY DoF VTC-9541 - New York City 2023-2026 free printable template

Show details

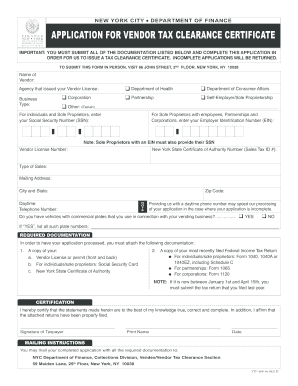

APPLICATION FOR VENDOR TAX CLEARANCE CERTIFICATE

IMPORTANT: You must include all of the documentation listed below in order for us to issue a certificate indicating that you have no

docketed tax warrants.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DoF VTC-9541 - New York

Edit your NY DoF VTC-9541 - New York form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DoF VTC-9541 - New York form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DoF VTC-9541 - New York online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DoF VTC-9541 - New York. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DoF VTC-9541 - New York City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DoF VTC-9541 - New York

How to fill out NY DoF VTC-9541 - New York City

01

Download the NY DoF VTC-9541 form from the official New York City Department of Finance website.

02

Begin by filling out the top section with your name, address, and contact information.

03

Provide the property information in the designated fields, including the tax block and lot number.

04

Indicate the type of exemption you are applying for by checking the appropriate box.

05

Complete the income and household information as required, ensuring accuracy.

06

Attach any required documentation, such as proof of income or age.

07

Review the form for any errors or missing information.

08

Sign and date the form at the bottom.

09

Submit the completed form by mail or in person to the appropriate Department of Finance office.

Who needs NY DoF VTC-9541 - New York City?

01

Individuals who are applying for property tax exemption in New York City may need to complete NY DoF VTC-9541.

02

Homeowners aged 62 and older, or those with disability status, may need this form to qualify for specific exemptions.

03

Residents seeking to provide proof of income for a tax exemption also require this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax clearance letter from the IRS?

What Is a Tax Clearance Certificate? A tax clearance certificate is a document issued by a state government agency, usually the Department of Revenue. It certifies that a business or individual has met their tax obligations as of a certain date.

How long does it take to get an IRS tax clearance certificate?

After filing Form 706, it normally takes anywhere from 6 to 8 weeks for the form to be processed and entered into the IRS database. ing to the IRS, it takes 4 to 6 months to obtain the clearance letter if the return is accepted without any errors or special circumstances.

How do I get a tax clearance letter from New York?

You can get a New York Tax Compliance Certificate by contacting the New York Department of Taxation and Finance.

How to avoid NYC city tax?

For example, you can avoid NYC income taxes if you live in New Jersey and commute to work in the city. And you can reach Manhattan in as little as thirty minutes from cities like Hoboken, Jersey City, or the many suburban towns in NJ.

What is NYC tax clearance?

DOF certifies that certain types of street vendors are current with their New York City business taxes when they apply for licenses. This is called a tax clearance. If you are a street vendor and need a tax clearance certificate, you must request one by filling out an Application for Vendor Tax Clearance Certificate.

How do I get a tax clearance certificate from the IRS?

Obtain a permit by filing the applicable Form 2063, U.S. Departing Alien Income Tax Statement or Form 1040-C, U.S. Departing Alien Income Tax Return with your local IRS office (by appointment only) before you leave the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DoF VTC-9541 - New York for eSignature?

NY DoF VTC-9541 - New York is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in NY DoF VTC-9541 - New York without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NY DoF VTC-9541 - New York, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out NY DoF VTC-9541 - New York using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY DoF VTC-9541 - New York and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NY DoF VTC-9541 - New York City?

NY DoF VTC-9541 is a document required by the New York City Department of Finance for reporting certain financial information by property owners and landlords.

Who is required to file NY DoF VTC-9541 - New York City?

Property owners and landlords of residential and commercial properties in New York City are required to file NY DoF VTC-9541.

How to fill out NY DoF VTC-9541 - New York City?

To fill out NY DoF VTC-9541, gather necessary property and financial information, complete the form accurately, and submit it to the Department of Finance by the specified deadline.

What is the purpose of NY DoF VTC-9541 - New York City?

The purpose of NY DoF VTC-9541 is to ensure compliance with local regulations regarding property taxation and to provide accurate information for the assessment of property taxes.

What information must be reported on NY DoF VTC-9541 - New York City?

The information that must be reported includes property details, ownership information, rental income, expenses, and any applicable tax-related data.

Fill out your NY DoF VTC-9541 - New York online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DoF VTC-9541 - New York is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.