Get the free International Fuel Tax Agreement (IFTA) Licence Fees and ...

Show details

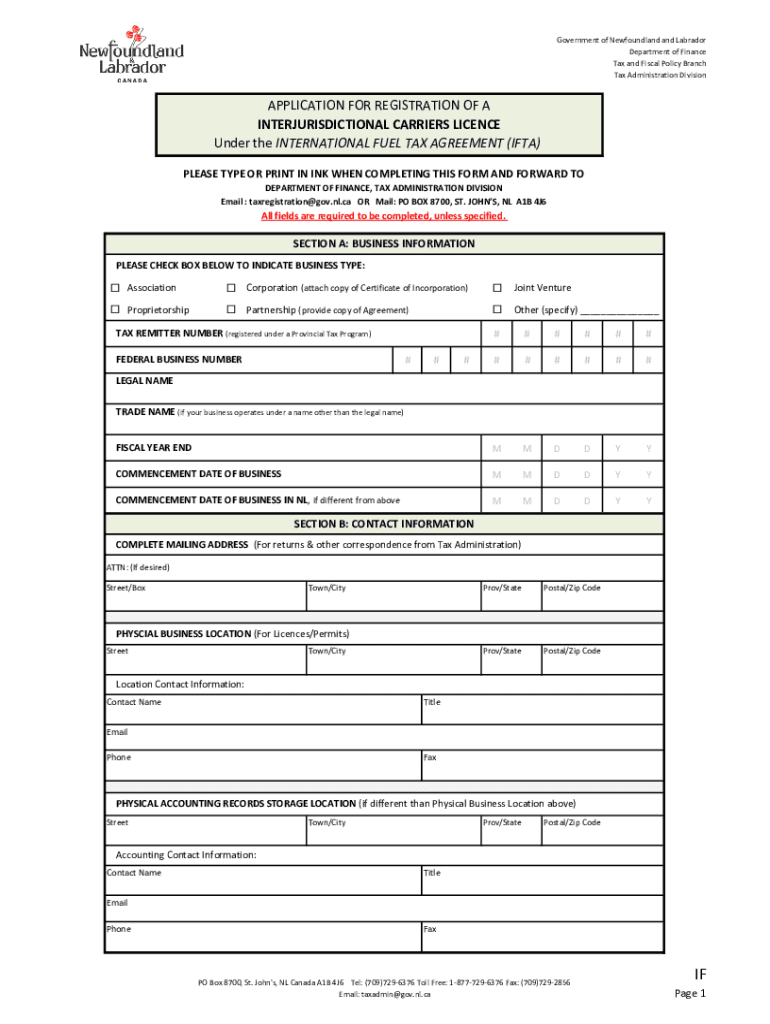

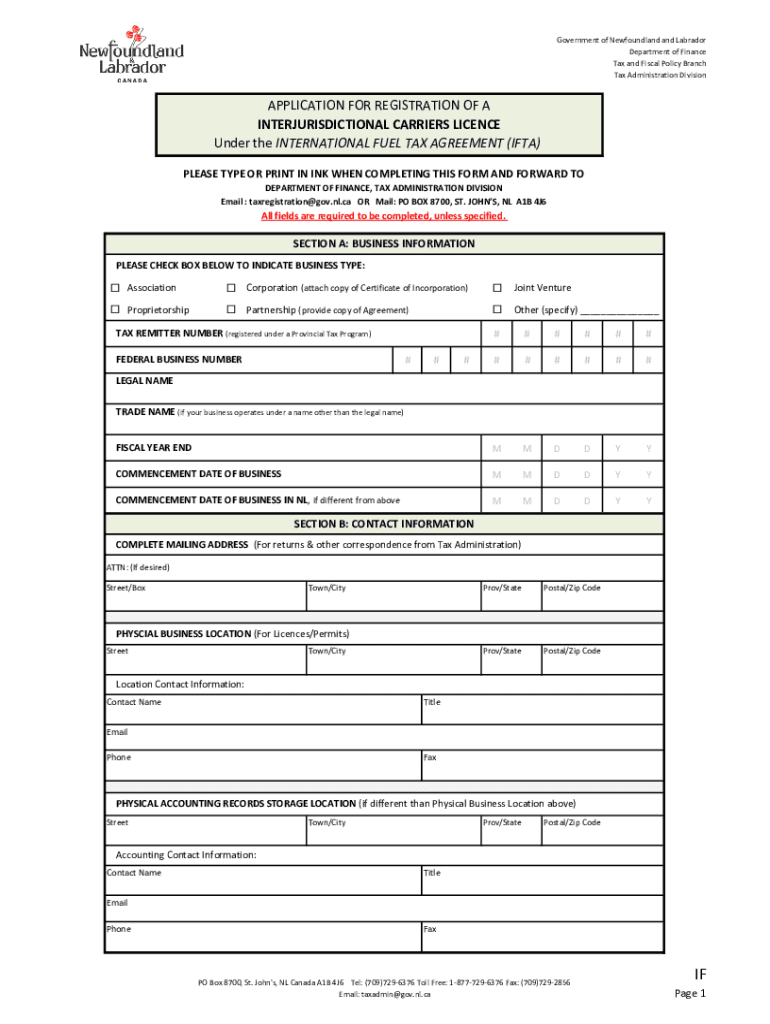

Government of Newfoundland and Labrador

Department of Finance

Tax and Fiscal Policy Branch

Tax Administration Divisionalization FOR REGISTRATION OF A

INTERJURISDICTIONALCARRIERSLICENCE

Under the INTERNATIONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international fuel tax agreement online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international fuel tax agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international fuel tax agreement

How to fill out international fuel tax agreement

01

To fill out an international fuel tax agreement, follow these steps:

02

Obtain the necessary forms: Start by getting the International Fuel Tax Agreement (IFTA) Application and the IFTA Quarterly Fuel Tax Schedule from your state's department of revenue.

03

Fill in your company information: Provide your company's legal name, address, USDOT number, FEIN, and contact information.

04

Indicate your base jurisdiction: Specify the jurisdiction where your qualified motor vehicles are based.

05

Report vehicle information: List all the vehicles qualified for IFTA and their corresponding information, including license plate number, vehicle type, and gross vehicle weight.

06

Log mileage and fuel usage: Keep a detailed record of the distance traveled and fuel consumed for each IFTA-qualified vehicle within each jurisdiction.

07

Calculate fuel tax liability: Use the mileage and fuel consumption data to determine the amount of fuel tax owed for each jurisdiction.

08

Submit quarterly fuel tax report: Prepare and submit your IFTA Quarterly Fuel Tax Schedule to your base jurisdiction's department of revenue along with the required payment.

09

Maintain records: It is important to keep all supporting documents, including fuel receipts, mileage records, and IFTA licenses, for at least four years, as they may be subject to audit by the tax authorities.

10

Renew your IFTA license: Make sure to renew your IFTA license annually to continue operating in IFTA jurisdictions.

11

Note: The above steps provide a general guideline, but it's advisable to consult your state's specific instructions and regulations for accurate and up-to-date information.

Who needs international fuel tax agreement?

01

Anyone who operates qualified motor vehicles for transporting goods across multiple jurisdictions needs an international fuel tax agreement (IFTA).

02

This includes trucking companies, fleet owners, and independent owner-operators who engage in the interstate transportation of taxable fuel.

03

IFTA simplifies fuel tax reporting by allowing carriers to pay taxes to their base jurisdiction, which then distributes the funds to the other jurisdictions where the vehicles traveled.

04

Without IFTA, carriers would be required to obtain fuel permits and file separate tax returns in each jurisdiction, resulting in significant administrative burdens and potential penalties for non-compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify international fuel tax agreement without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including international fuel tax agreement, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the international fuel tax agreement in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your international fuel tax agreement in seconds.

How do I fill out the international fuel tax agreement form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign international fuel tax agreement and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is international fuel tax agreement?

The International Fuel Tax Agreement (IFTA) is an agreement between U.S. states and Canadian provinces to simplify the reporting of fuel use taxes by interstate motor carriers.

Who is required to file international fuel tax agreement?

Motor carriers who operate qualified vehicles in multiple jurisdictions are required to file the IFTA.

How to fill out international fuel tax agreement?

To fill out the IFTA, you must provide details of your fuel purchases and miles traveled in each member jurisdiction on the IFTA quarterly tax return forms.

What is the purpose of international fuel tax agreement?

The purpose of the IFTA is to streamline the fuel tax reporting process for interstate motor carriers and ensure that taxes are fairly distributed to the jurisdictions where the fuel is consumed.

What information must be reported on international fuel tax agreement?

The IFTA requires reporting of fuel purchases, miles traveled in each jurisdiction, and the total miles driven during the reporting period.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.