Get the free INDIAN INCOME TAX UPDATED RETURN ACKNOWLEDGEMENT

Show details

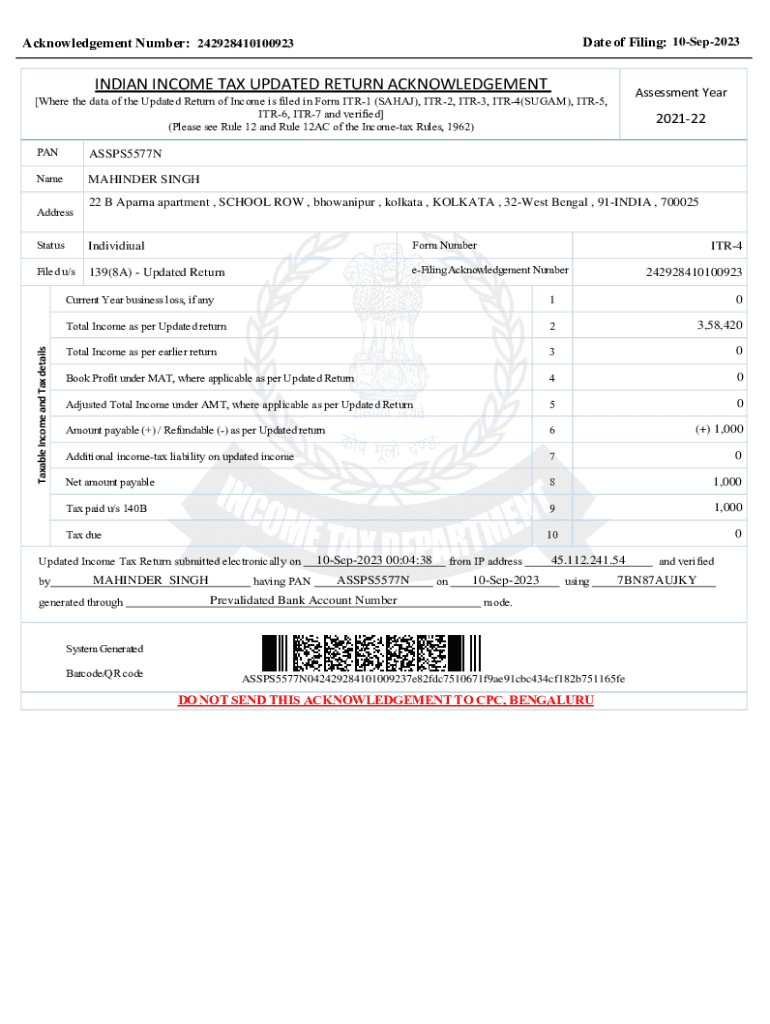

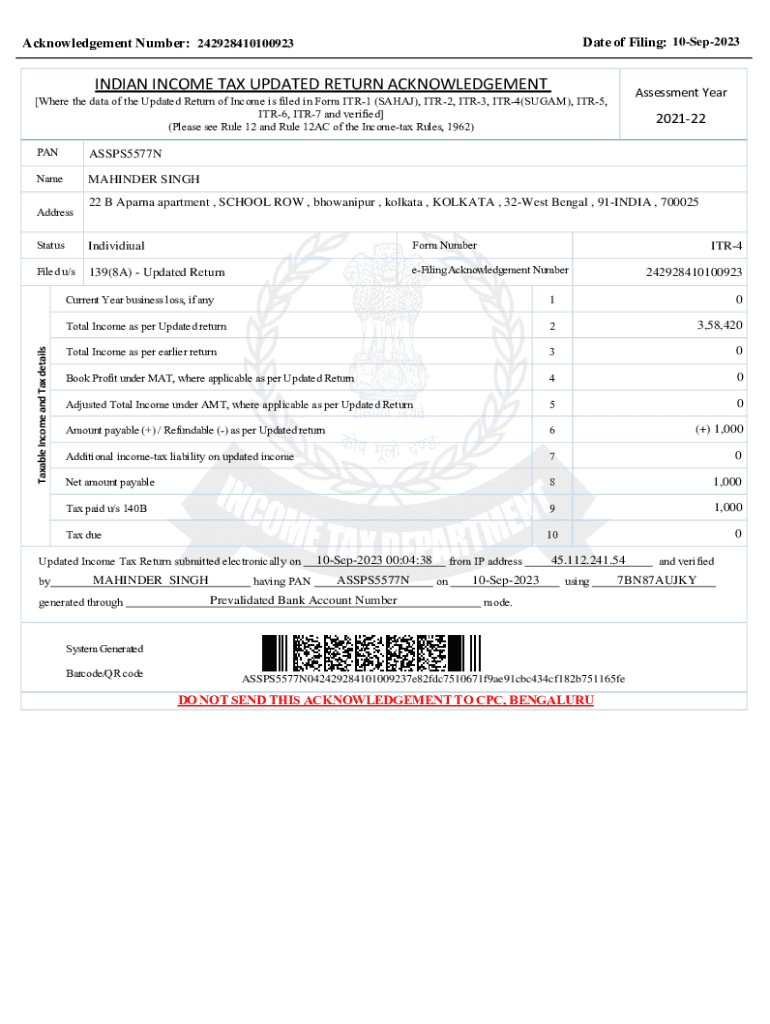

Date of Filing: 10Sep2023Acknowledgement Number: 242928410100923INDIAN INCOME TAX UPDATED RETURN ACKNOWLEDGEMENTAssessment Year[Where the data of the Updated Return of Income is filed in Form ITR1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian income tax updated

Edit your indian income tax updated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian income tax updated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indian income tax updated online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indian income tax updated. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian income tax updated

How to fill out indian income tax updated

01

To fill out Indian income tax updated, follow these steps:

1. Gather all necessary documents such as Form 16, Form 26AS, bank statements, etc.

2. Calculate your total income by adding all sources of income including salary, rent, capital gains, etc.

3. Identify the applicable income tax slab based on your total income.

4. Download the relevant income tax return form from the Income Tax Department's official website.

5. Fill out the form by providing accurate information such as personal details, income details, deductions, etc.

6. Double-check all the information provided in the form for any errors or omissions.

7. Calculate your tax liability and ensure proper utilization of deductions and exemptions.

8. Generate the XML file of the filled form using the income tax return filing software.

9. Log in to the Income Tax Department's e-Filing portal.

10. Upload the XML file and submit the income tax return.

11. Verify the filed return using Aadhaar OTP or Digital Signature Certificate (DSC).

12. Wait for the acknowledgement receipt to be generated.

02

Please note that it is advisable to consult a tax professional or chartered accountant for accurate and updated guidance specific to your financial situation.

Who needs indian income tax updated?

01

Indian taxpayers who earn income from various sources including salary, business/profession, capital gains, rental income, etc., need to file income tax returns annually to comply with the tax laws of the country. It is mandatory for individuals, Hindu Undivided Families (HUFs), and companies whose total income exceeds the specified threshold to file income tax returns. Additionally, individuals and entities who want to claim tax refunds, carry forward losses, or avail tax benefits such as deductions and exemptions also need to file income tax returns. It is important to note that income tax laws are subject to change, and it is always advisable to stay updated with the latest regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute indian income tax updated online?

Easy online indian income tax updated completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the indian income tax updated in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the indian income tax updated form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign indian income tax updated and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is indian income tax updated?

The Indian income tax updated refers to the current provisions, rules, and regulations related to income tax in India as stipulated by the Income Tax Department for the financial year and any changes made in the annual budget.

Who is required to file indian income tax updated?

Individuals, Hindu Undivided Families (HUFs), companies, and other entities whose income exceeds the taxable limit are required to file income tax returns. Specific exemptions may apply based on age, type of income, and other conditions.

How to fill out indian income tax updated?

To fill out the Indian income tax updated, taxpayers can use the online filing portal of the Income Tax Department, where they need to register and complete the required forms by providing details of income, deductions, and taxes paid.

What is the purpose of indian income tax updated?

The purpose of the Indian income tax updated is to generate revenue for the government, regulate the income of individuals and businesses, ensure a fair taxation system, and facilitate the welfare of the public through various governmental programs.

What information must be reported on indian income tax updated?

Taxpayers must report their total income, exemptions, deductions under different sections (like Section 80C), taxes paid, and any other relevant financial information, including details of bank accounts and assets.

Fill out your indian income tax updated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Income Tax Updated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.