Get the free Wage / Hr:

Show details

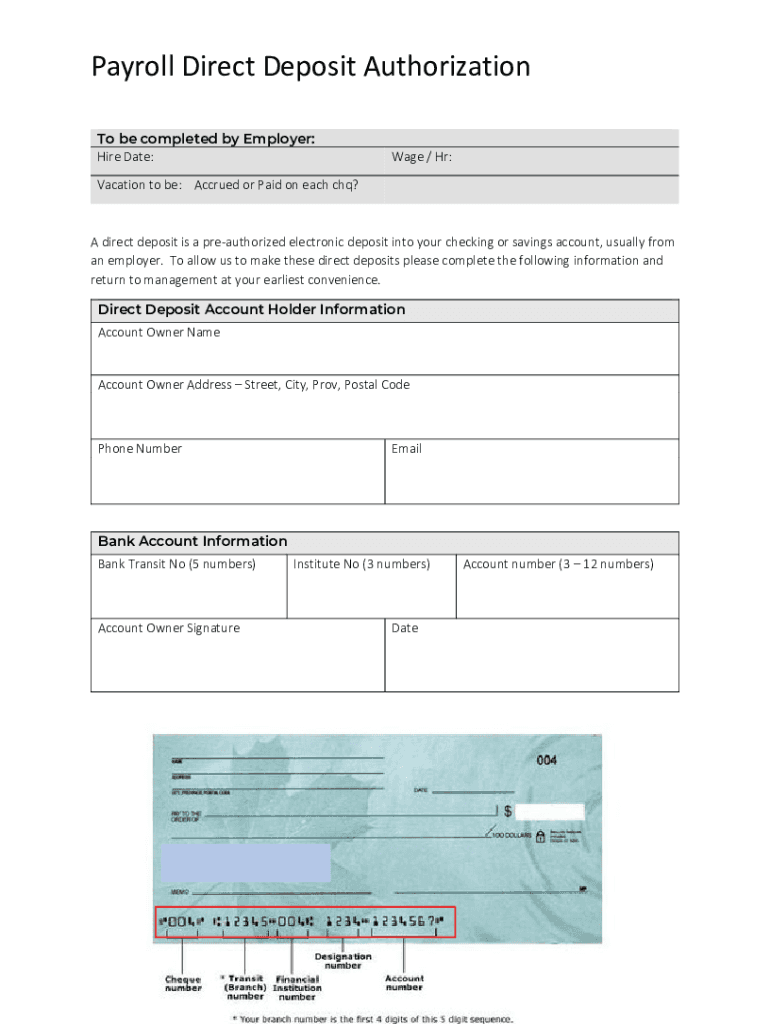

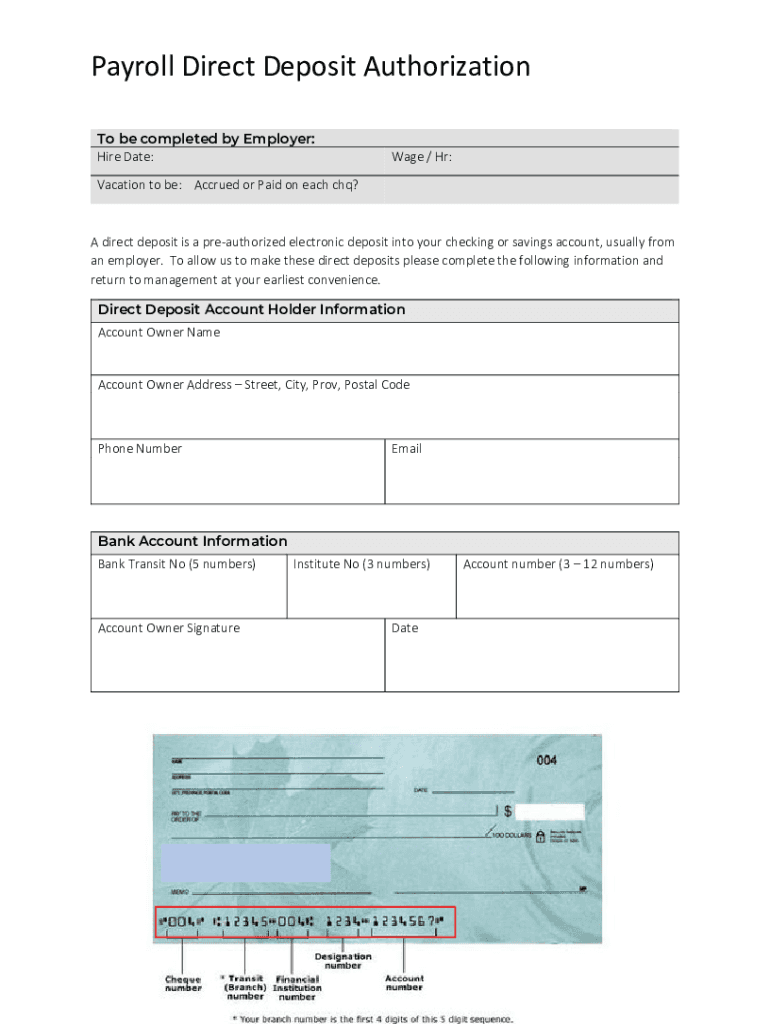

Payroll Direct Deposit Authorization

To be completed by Employer:

Hire Date:Wage / Hr:Vacation to be: Accrued or Paid on each CHQ? A direct deposit is a preauthorized electronic deposit into your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage hr

Edit your wage hr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage hr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wage hr online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage hr. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage hr

How to fill out wage hr

01

To fill out wage hr, follow these steps:

02

Start by gathering all the necessary information, such as employee details, work hours, and wage rates.

03

Make sure you have a clear understanding of the pay period and any specific rules or regulations related to wage hr in your jurisdiction.

04

Determine the appropriate wage hr form or template to use. You can find standard forms online or consult with your HR department for guidance.

05

Begin by entering the employee's personal information, including their full name, address, employee ID, and tax information.

06

Next, record the hours worked by the employee during the specified pay period. This may include regular hours, overtime hours, and any other relevant categories.

07

Calculate the employee's gross wages by multiplying the hours worked by the applicable wage rates.

08

Deduct any applicable taxes, social security contributions, or other withholdings from the gross wages to determine the net wages.

09

Include any additional information or deductions that are specific to your organization, such as benefits, bonuses, or reimbursements.

10

Review the wage hr form for accuracy and completeness. Make sure all calculations are correct and all necessary information is included.

11

Obtain the necessary signatures from the employee and any relevant supervisors or managers before finalizing the wage hr form.

12

Keep a copy of the completed wage hr form for your records and distribute the appropriate copies to the employee and relevant parties as required.

13

Note: It is important to stay updated with any changes in wage hr regulations to ensure compliance.

Who needs wage hr?

01

Wage hr is essential for various individuals and organizations, including:

02

- Employers: Employers need wage hr to accurately calculate and document employee wages, hours worked, and related payroll information for legal and administrative purposes.

03

- Human Resources (HR) Departments: HR departments use wage hr to maintain a record of employee compensation, ensure compliance with labor laws, and facilitate payroll processing.

04

- Employees: Employees may need wage hr to monitor their own hours worked, verify the accuracy of their pay, and address any discrepancies or concerns.

05

- Tax Authorities: Tax authorities rely on wage hr documentation to verify income, employment status, and tax withholdings during audits or tax filing processes.

06

- Government Agencies: Government agencies may require wage hr information to enforce labor laws, monitor employment practices, and ensure fair treatment of workers.

07

- Auditors and Accountants: Auditors and accountants often rely on wage hr records to assess business financials, conduct audits, and ensure accurate reporting of employee compensation.

08

- Legal Professionals: Legal professionals may use wage hr records as evidence in labor disputes, workplace discrimination cases, or other legal matters.

09

- Researchers and Analysts: Researchers and analysts may utilize wage hr data for studying employment trends, analyzing wage gaps, or conducting economic research.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wage hr?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the wage hr. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in wage hr without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit wage hr and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the wage hr in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your wage hr right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is wage hr?

Wage HR refers to a report or form that employers use to report wage and hour information to government agencies, typically for compliance with labor laws and tax regulations.

Who is required to file wage hr?

Employers who pay wages to employees and are subject to federal and state wage laws are generally required to file wage HR.

How to fill out wage hr?

To fill out wage HR, employers must provide details about employee wages, hours worked, and any deductions. It's important to complete each section accurately and submit it to the appropriate agency.

What is the purpose of wage hr?

The purpose of wage HR is to ensure compliance with labor laws, facilitate the proper calculation of taxes, and provide transparency regarding employee compensation.

What information must be reported on wage hr?

Information required on wage HR typically includes employee names, social security numbers, wages paid, hours worked, and any deductions or withholdings.

Fill out your wage hr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Hr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.