IRS 1041 - Schedule K-1 2023 free printable template

Show details

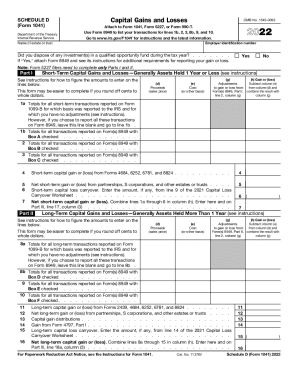

6611172023Schedule K1

(Form 1041)

Department of the Treasury

Internal Revenue Service

beginningFor calendar year 2023, or tax year//ending//Beneficiarys Share of Income, Deductions,

Credits, etc.

See

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

To edit IRS 1041 - Schedule K-1, utilize tools that allow for text modifications on PDF documents. This can be done through platforms like pdfFiller, which offers specific features for form completion, enabling users to fill out necessary fields accurately. After making the necessary edits, ensure that the changes are saved and that you review the form for any errors before submission.

How to fill out IRS 1041 - Schedule K-1

Filling out IRS 1041 - Schedule K-1 requires careful attention to detail. Follow these steps:

01

Gather pertinent information related to the estate or trust.

02

Identify the beneficiaries involved and collect their details.

03

Complete each section of the form accurately, providing information on income, deductions, and credits.

04

Review the completed form for accuracy and make necessary edits.

Consider consulting a tax professional if uncertainties arise during the completion of the form to avoid errors.

About IRS 1041 - Schedule K-1 2023 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041 - Schedule K-1 2023 previous version

What is IRS 1041 - Schedule K-1?

IRS 1041 - Schedule K-1 is a tax form utilized to report income, deductions, and credits from estates and trusts to beneficiaries. This form is essential for beneficiaries to accurately report their share of income on their personal tax returns. Each beneficiary will receive their own Schedule K-1, detailing their individual tax responsibilities resulting from the estate or trust.

What is the purpose of this form?

The primary purpose of IRS 1041 - Schedule K-1 is to provide beneficiaries with the necessary information to report income received from estates or trusts. It outlines the amounts distributed to each beneficiary, ensuring that the IRS can track income distribution and verify that beneficiaries report the correct amount on their returns.

Who needs the form?

Beneficiaries of estates or trusts must receive IRS 1041 - Schedule K-1 to ensure compliance with tax reporting requirements. If you received distributions from an estate or trust during the tax year, you may expect to receive this form from the estate or trust’s fiduciary, such as an executor or trustee.

When am I exempt from filling out this form?

You may be exempt from IRS 1041 - Schedule K-1 if you did not receive any distributions from the estate or trust during the tax year. Additionally, if you are a person or organization that does not report income from estates or trusts via IRS Form 1040, you generally won't require this form.

Components of the form

IRS 1041 - Schedule K-1 includes various components that provide detailed information regarding distributions. Key sections include the beneficiary's identification information, the estate or trust's name and tax identification number, and specific amounts regarding income, deductions, and credits allocated to the beneficiary. Each section must be filled out comprehensively to avoid inaccuracies.

What are the penalties for not issuing the form?

Failure to issue IRS 1041 - Schedule K-1 can result in penalties for the fiduciary responsible for managing the estate or trust. The IRS may impose fines for non-compliance, which can vary based on the severity of the oversight. Additionally, beneficiaries may face problems in accurately reporting their income, leading to potential tax liabilities.

What information do you need when you file the form?

When filing IRS 1041 - Schedule K-1, gather all relevant information related to the estate or trust, including:

01

The fiduciary's name and tax identification number.

02

Details about the beneficiary, including name, address, and tax identification number.

03

Income items distributed, such as dividends, interest, and capital gains.

04

Deductions and credits applicable to the beneficiary.

Accurate information is crucial for proper tax reporting and compliance.

Is the form accompanied by other forms?

IRS 1041 - Schedule K-1 may be submitted alongside other tax-related forms, including IRS Form 1041 (U.S. Income Tax Return for Estates and Trusts). While processing the K-1 form, review whether additional documents are required to substantiate reported amounts or clarifications needed for tax filings.

Where do I send the form?

IRS 1041 - Schedule K-1 does not need to be submitted directly to the IRS by the beneficiary. Instead, beneficiaries should retain the form and include it with their personal tax returns when filing IRS Form 1040. However, the fiduciary must send a copy of the K-1 to the IRS along with Form 1041 by the designated due date.

See what our users say