IRS 4562 2023 free printable template

Show details

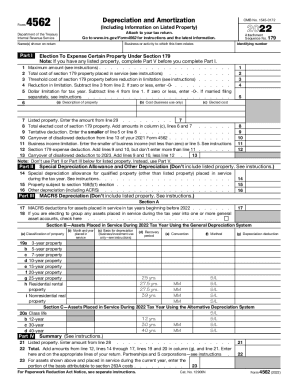

For Paperwork Reduction Act Notice see separate instructions. Cat. No. 12906N Form 4562 2023 Page 2 Part V entertainment recreation or amusement. 10 Carryover of disallowed deduction from line 13 of your 2022 Form 4562. 11 Business income limitation. Enter the smaller of business income not less than zero or line 5. Including Information on Listed Property Department of the Treasury Internal Revenue Service Attach to your tax return* Go to www*irs*gov/Form4562 for instructions and the latest...information* Form Depreciation and Amortization Name s shown on return Part I OMB No* 1545-0172 Identifying number Business or activity to which this form relates Election To Expense Certain Property Under Section 179 Note If you have any listed property complete Part V before you complete Part I. Maximum amount see instructions. Total cost of section 179 property placed in service see instructions. Threshold cost of section 179 property before reduction in limitation see instructions. Reduction...in limitation* Subtract line 3 from line 2. If zero or less enter -0-. Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less enter -0-. If separately see instructions. Attachment Sequence No* 179 a Description of property b Cost business use only. married. filing Special Depreciation Allowance and Other Depreciation Don t include listed property. See instructions. 14 Special depreciation allowance for qualified property other during the tax year. See instructions. 15...Property subject to section 168 f 1 election. 16 Other depreciation including ACRS. c Elected cost 7 Listed property. Enter the amount from line 29. 8 Total elected cost of section 179 property. Add amounts in column c lines 6 and 7 9 Tentative deduction* Enter the smaller of line 5 or line 8. See instructions 12 Section 179 expense deduction* Add lines 9 and 10 but don t enter more than line 11. Note Don t use Part II or Part III below for listed property. Instead use Part V. than listed...property placed in service. MACRS Depreciation Don t include listed property. See instructions. Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2023. 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts check here. Section B Assets Placed in Service During 2023 Tax Year Using the General Depreciation System a Classification of property 19a b c d e f g h i 20a b Month and year placed in...service c Basis for depreciation business/investment use only see instructions d Recovery period e Convention f Method 3-year property 25 yrs. S/L MM Residential rental property 39 yrs. Nonresidential real Class life 12-year 30-year 40 yrs. Summary See instructions. 22 Total* Add amounts from line 12 lines 14 through 17 lines 19 and 20 in column g and line 21. Enter here and on the appropriate lines of your return* Partnerships and S corporations see instructions. 23 For assets shown above and...placed in service during the current year enter the portion of the basis attributable to section 263A costs.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

Instructions and Help about IRS 4562

How to edit IRS 4562

To edit IRS 4562, first ensure you have the latest version of the form. You can find this form on the IRS website or through tax preparation services. Use pdfFiller to upload the form PDF, where tools allow you to add or modify text easily. Following completion, save the edited form securely.

How to fill out IRS 4562

To fill out IRS 4562, gather the necessary financial documentation related to your property and equipment. Start by entering your business information at the top, followed by sections detailing the depreciation methods you are using. Ensure that you accurately describe each asset and its cost. Review your entries carefully to minimize errors, as these can complicate your filing process.

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4562?

IRS 4562 is a tax form used by U.S. taxpayers to report depreciation and amortization of assets. This form identifies how much value an asset has lost over time, allowing taxpayers to claim deductions accordingly. It is essential for individuals and businesses that acquire property or equipment, as it helps them manage tax liability effectively.

What is the purpose of this form?

The purpose of IRS 4562 is to provide a means for taxpayers to report claims for depreciation and certain amortization. By using this form, taxpayers can illustrate the deduction that reflects the wear and tear on key assets, which decreases their taxable income. Proper use of IRS 4562 facilitates compliance with tax regulations and optimizes tax benefits.

Who needs the form?

Taxpayers who purchase or improve property used in a trade or business must file IRS 4562. This includes sole proprietors, partnerships, S corporations, and C corporations. Additionally, individuals claiming depreciation on personal property used for business purposes must also submit this form to properly account for depreciation expenses.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 4562 if you do not claim depreciation, if you use the property exclusively for personal use, or if you qualify for safe harbor under certain conditions. Moreover, if your total of the asset purchases falls below specific thresholds set by the IRS, you might not need to file this form.

Components of the form

IRS 4562 consists of several components, including lines for entering the business name, type of property, depreciation methods, and calculation of allowable deductions. Additionally, it requires detailed information about each asset, including its cost, purchase date, and any previous depreciation claimed. Understanding each component is crucial for accurate reporting.

What are the penalties for not issuing the form?

Failing to file IRS 4562 when required can result in substantial penalties. The IRS may impose a penalty of up to $50 for each form not filed, with a maximum penalty amount depending on your filing status and the duration of non-compliance. Additionally, taxpayers may lose out on potential tax deductions, significantly impacting their overall tax liability.

What information do you need when you file the form?

When filing IRS 4562, gather comprehensive information including the total cost of the property, the date it was placed in service, and any prior depreciation taken. You will also need to specify the depreciation method being utilized, such as straight-line or declining balance, and provide any applicable bonus depreciation amounts. Accurate data collection is essential to ensure proper deductions.

Is the form accompanied by other forms?

IRS 4562 may be accompanied by other forms depending on your specific tax situation. Commonly, this includes Form 4797 for reporting the sale of business property or Form 8829 for home office expenses. Check the IRS guidelines or consult a tax professional to determine if additional forms are necessary for your filing.

Where do I send the form?

The filing location for IRS 4562 depends on your business structure and the location of your primary filing. Generally, individuals and businesses must submit the form along with their tax return. For specific mailing addresses, refer to the IRS instructions accompanying the form, or consult the IRS website to ensure correct submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It was just fine - a few learning curve quirks, but relatively easy.

It has been just what I have needed. Love it!

See what our users say