Get the free Transactions Between Related Persons and Partnerships

Show details

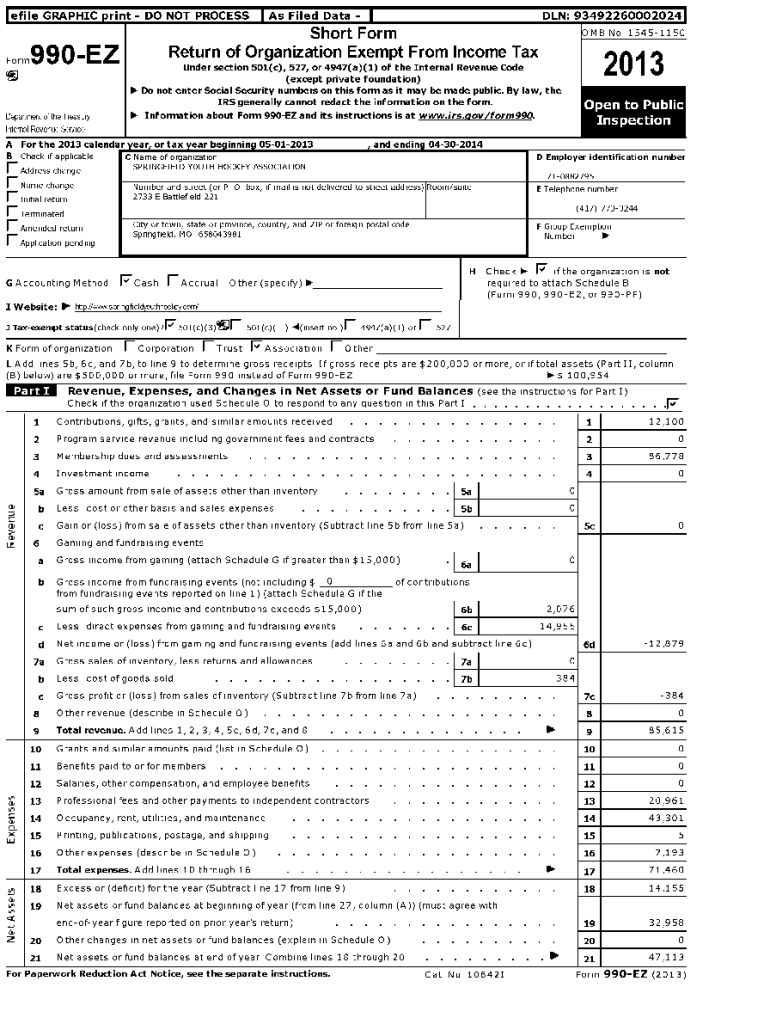

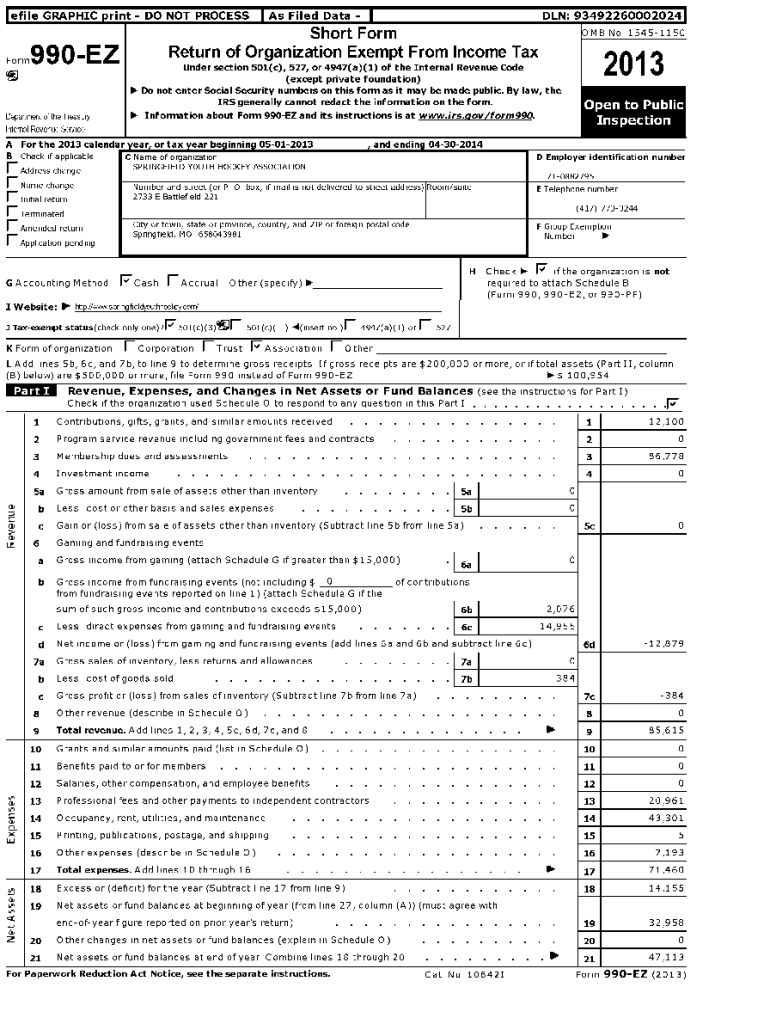

Le file GRAPHICFormp rint990.EZ19Department of the Treasury DO NOT Processes Filed Data DAN: 93492260002024Short Form

Return of Organization Exempt From Income Tax OMB No 1545115020 1 3Under section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transactions between related persons

Edit your transactions between related persons form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transactions between related persons form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transactions between related persons online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transactions between related persons. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transactions between related persons

How to fill out transactions between related persons

01

Identify the related persons involved in the transaction. Related persons can include family members, business partners, or entities controlled by the same individual or group.

02

Determine the purpose and nature of the transaction. This will help in understanding the specific requirements and regulations that apply.

03

Gather all necessary documentation and information related to the transaction. This may include financial statements, agreements, tax records, and any other relevant documents.

04

Determine the fair market value of the transaction. It is important to establish a fair and reasonable value for the goods, services, or assets being transferred.

05

Follow any applicable tax laws and regulations. Transactions between related persons may have specific tax implications and require compliance with relevant laws.

06

Document the transaction in writing. It is important to have a clear record of the transaction details, including the parties involved, the nature of the transaction, and any relevant terms and conditions.

07

Consider seeking professional advice. Depending on the complexity of the transaction and the applicable regulations, it may be beneficial to consult with a tax professional or legal advisor.

08

Review and record the transaction. After the transaction has taken place, it is important to review the documentation and ensure that all necessary records are maintained for future reference and compliance purposes.

Who needs transactions between related persons?

01

Transactions between related persons may be required for various reasons:

02

- Family members may need to transfer assets or provide financial support to each other.

03

- Business partners or entities under common control may enter into transactions for business purposes, such as joint ventures or asset transfers.

04

- Companies may need to engage in transactions with their subsidiaries or parent companies for operational or strategic reasons.

05

- Individuals or entities may engage in transactions between related persons for tax planning purposes or to comply with specific regulations.

06

Overall, anyone involved in a relationship where there is a need to transfer assets, provide financial support, or conduct business activities with related persons may require transactions between related persons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my transactions between related persons directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your transactions between related persons and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit transactions between related persons on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing transactions between related persons.

Can I edit transactions between related persons on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign transactions between related persons right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is transactions between related persons?

Transactions between related persons refer to financial dealings or exchanges that occur between individuals or entities that have a close relationship, such as family members, business partners, or affiliated companies. These transactions are often subject to special reporting requirements to ensure transparency and compliance with tax regulations.

Who is required to file transactions between related persons?

Individuals and entities involved in transactions with related parties, such as corporations, partnerships, or sole proprietors, are typically required to file disclosures related to these transactions to tax authorities, as part of their tax returns or separate reports.

How to fill out transactions between related persons?

To fill out transactions between related persons, one must accurately report the nature of the relationship, the details of the transaction, the amounts involved, and the terms of the transaction. This information is often included in specific forms or schedules designated by tax authorities.

What is the purpose of transactions between related persons?

The purpose of transactions between related persons is to facilitate the exchange of goods, services, or assets while ensuring that these transactions are conducted at arm's length and fairly reported for tax purposes. This helps to prevent tax avoidance and maintains the integrity of the tax system.

What information must be reported on transactions between related persons?

Information that must be reported includes the names and relationships of the parties involved, the nature of the transaction, the dates, the monetary values, and any terms or agreements related to the transaction. Specific reporting formats may vary by jurisdiction.

Fill out your transactions between related persons online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transactions Between Related Persons is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.