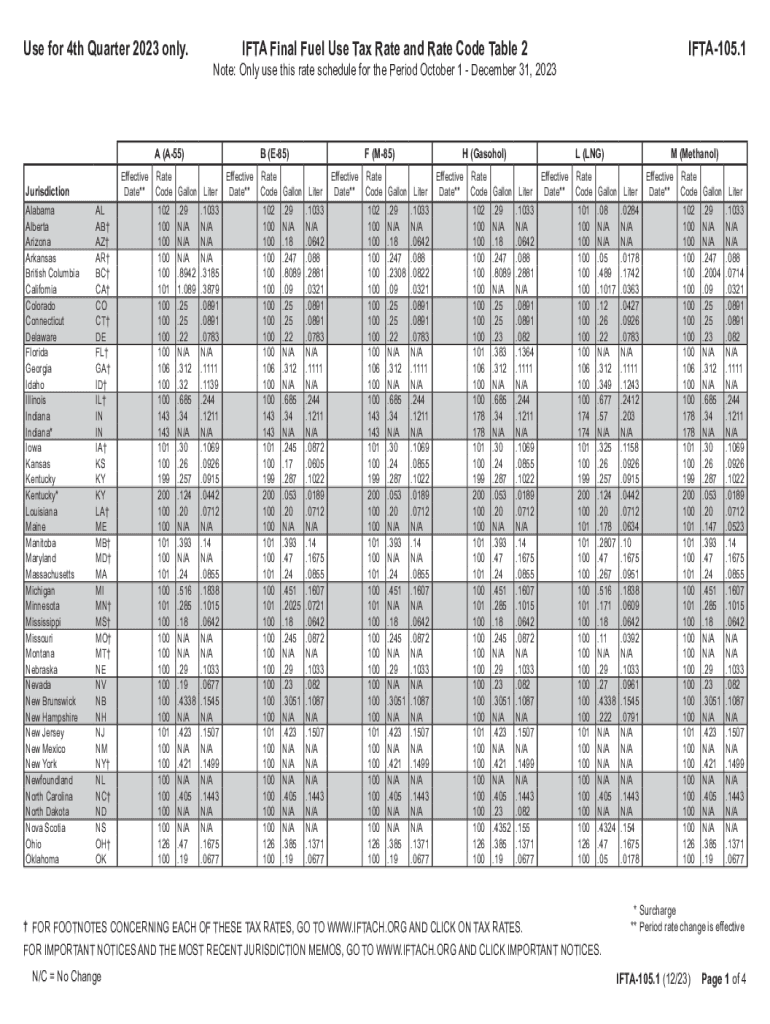

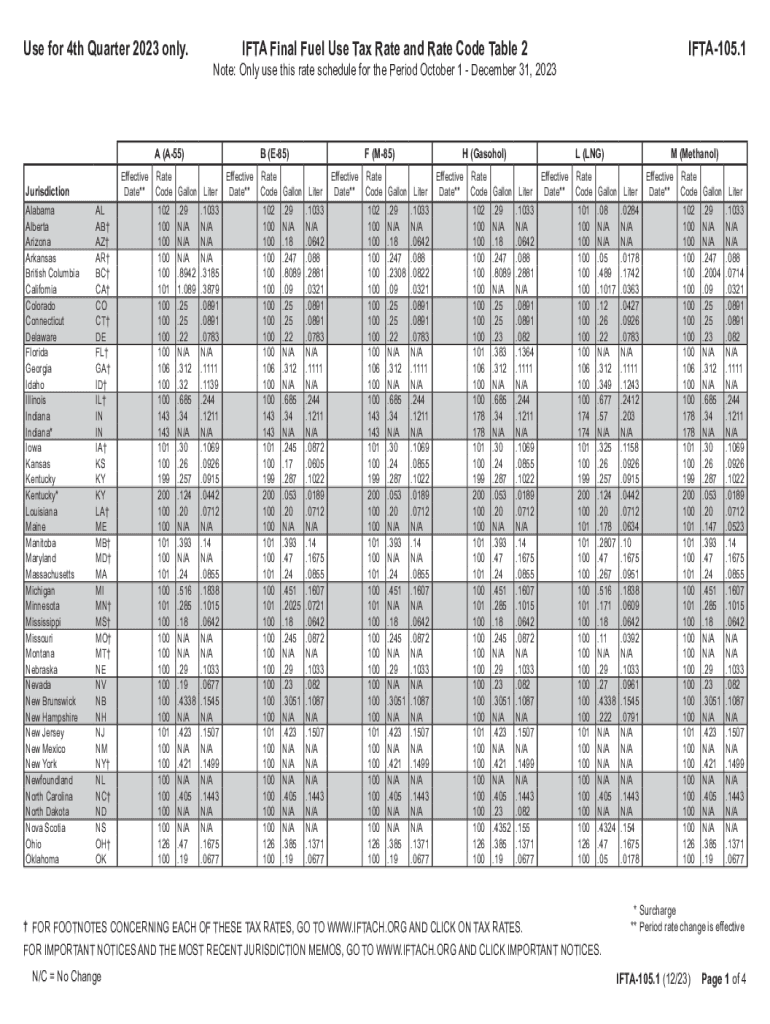

NY DTF IFTA-105.1 2023 free printable template

Get, Create, Make and Sign NY DTF IFTA-1051

Editing NY DTF IFTA-1051 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF IFTA-105.1 Form Versions

How to fill out NY DTF IFTA-1051

How to fill out NY DTF IFTA-105.1

Who needs NY DTF IFTA-105.1?

Instructions and Help about NY DTF IFTA-1051

It's a big deal this guy's a big deal man yeah man Charlie Murphy's here ladies and gentlemen Chile oh man what's up brother I'm good to man you've been man you look at a million tree oh you look at a million bucks today Charlie probably like a million bucks I got a new TV show coming on talking to the mic bro oh yeah they're going to pop out boom tell us about black Jesus right now on hear about this man show is coming on to name we shot it back in February it's uh produced and directed by Eddie written by Aaron Cruder who did the boondocks that's how I met him you know I was on the show Eddie third yeah, yeah so when he and a guy who named Mike Wattenberg who was a direct up in Canada I did a film with him called I'm moving day those two guys hooked up they came up with this I did, and then they gave me the role of Vic black Jesus is satire first of all yeah some people getting mad about if it's like don't it's not I mean it's not a documentary no scene is the true story no saying is just religious freaks must be some specific I'm Michael calm freak even got no names not like them, I know Sam they don't get it you know they will get it when they see the show you know the show is just funny I mean it's already huge you said I'm the trail on your Facebook my Facebook 90 million hits on my trailer on my Facebook wow that was just one of the sites that it was up on, so you know I can see there's a tremendous interest is a lot of people you know going back forth talking about it, and tonight it's on at 11 o'clock, and I can't wait and that's Adult Swim that's another thing you know we're coming we're not coming on for an afternoon coming on late at night with groceries for grown folks man no Sam can you when you get a chance can you ask Aaron Cruder if you remember Who I am oh we because not know you no no we were close no definitely now forgot you where's your clothes didn't just go together yeah we went to college together at the rain we work to the radio station okay all right and back in now he has more money yeah and this change he's chained dig air exchange well I don't well I don't know if he's changed because I haven't talked to him since he blew up never I never saw him again never saw him again I'm not saying he dissed me we weren't like best friends ever by him, and I was each other the radio station he's real cool um he's a cool dude yeah man how rich is he let's talk about how rich is actually done't home I didn't get into how rich he was you didn't count his money now account people's well I wonder man I've been around people with money I'm so yes I have yeah yeah I don't know I don't know how much money is this guy I don't count people's money that is of no significance what we tell him I say hello I would definitely tell him Tom tell her I swear hello you know I'm sure he's my solution and best wishes yeah because I'm telling you man he puts a put something together we were doing this I was like you know what managed you just got a...

People Also Ask about

What is the Kentucky surcharge for IFTA?

Is there an app to calculate IFTA miles?

How is IFTA tax-paid gallons calculated?

How do I pay my IFTA in NY?

How to apply for IFTA in CT?

How do I manually calculate IFTA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF IFTA-1051 for eSignature?

How do I edit NY DTF IFTA-1051 in Chrome?

How can I edit NY DTF IFTA-1051 on a smartphone?

What is NY DTF IFTA-105.1?

Who is required to file NY DTF IFTA-105.1?

How to fill out NY DTF IFTA-105.1?

What is the purpose of NY DTF IFTA-105.1?

What information must be reported on NY DTF IFTA-105.1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.