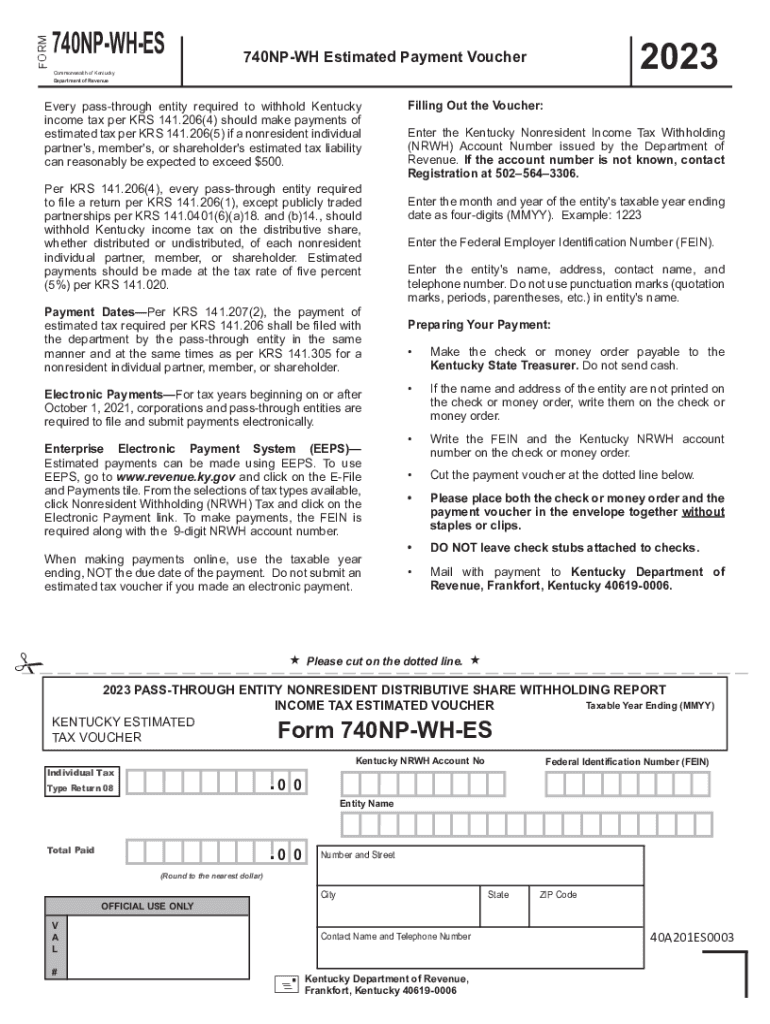

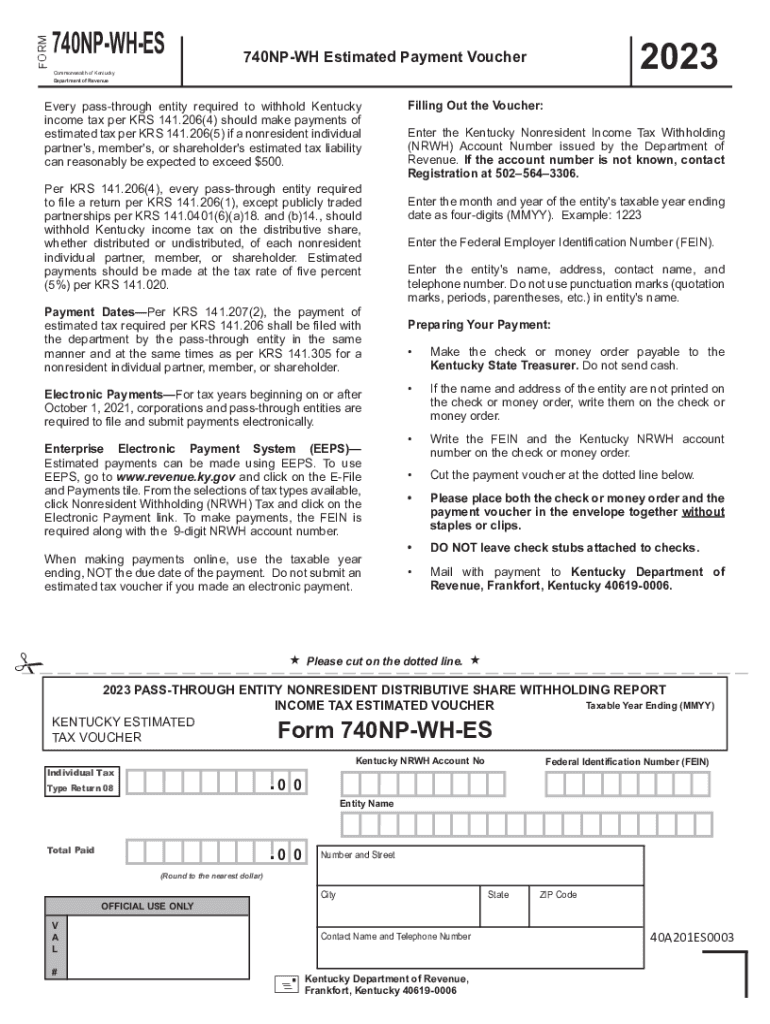

KY DoR 740NP-WH-ES 2023 free printable template

Get, Create, Make and Sign kentucky composite return form

How to edit kentucky withholding voucher fill online

Uncompromising security for your PDF editing and eSignature needs

KY DoR 740NP-WH-ES Form Versions

How to fill out kentucky pass through withholding form

How to fill out KY DoR 740NP-WH-ES

Who needs KY DoR 740NP-WH-ES?

Video instructions and help with filling out and completing kentucky 740np wh es

Instructions and Help about ky nonresident voucher blank

Scheduling the NRC P recirculation pump in this video we will show you how to set the recirculation pump schedule on the NRC P from the home screen press the clock button flashing a CT should appear press again to see the current program times that are set press the clock button once more to back out to the flashing a CT screen toggle left and right to see the available options the set option is used to customize the recirculation schedule the clear option is used to factory reset to the default schedule of 500 am to 8 am and 500 pm to 11 pm lets go back to the set option and push the dial to begin scheduling and program the system to operate only when needed you will see a flashing clock and zero box along with the default time blocks of 500 am to 800 am using the dial you can scroll through the 24-hour timescale in 30-minute increments for this example we will select 400 am through 1100 am if you wish to deselect a time block scroll to the time block and press the dial to select it once you have selected your desired time frames press and hold the dial for two seconds to return to the CT mode now press the clock button to return to the home screen where you can see your newly set times highlighted this concludes the programming of the recirculation schedule if you have any additional questions regarding the NRC P unit or any other nor its products please contact us at eight six seven six seven four eight nine or visit support nor its comm

People Also Ask about kentucky withholding voucher download

What does I want to claim exemption from Kentucky withholding mean?

Do I have to file a Kentucky nonresident tax return?

How much Ky state tax should be withheld?

Who must file KY state tax return?

Does Kentucky require you to file a tax return?

What is the non resident withholding tax in Kentucky?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ky nonresident share return?

How do I edit kentucky nonresident share voucher straight from my smartphone?

Can I edit kentucky share withholding download on an Android device?

What is KY DoR 740NP-WH-ES?

Who is required to file KY DoR 740NP-WH-ES?

How to fill out KY DoR 740NP-WH-ES?

What is the purpose of KY DoR 740NP-WH-ES?

What information must be reported on KY DoR 740NP-WH-ES?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.