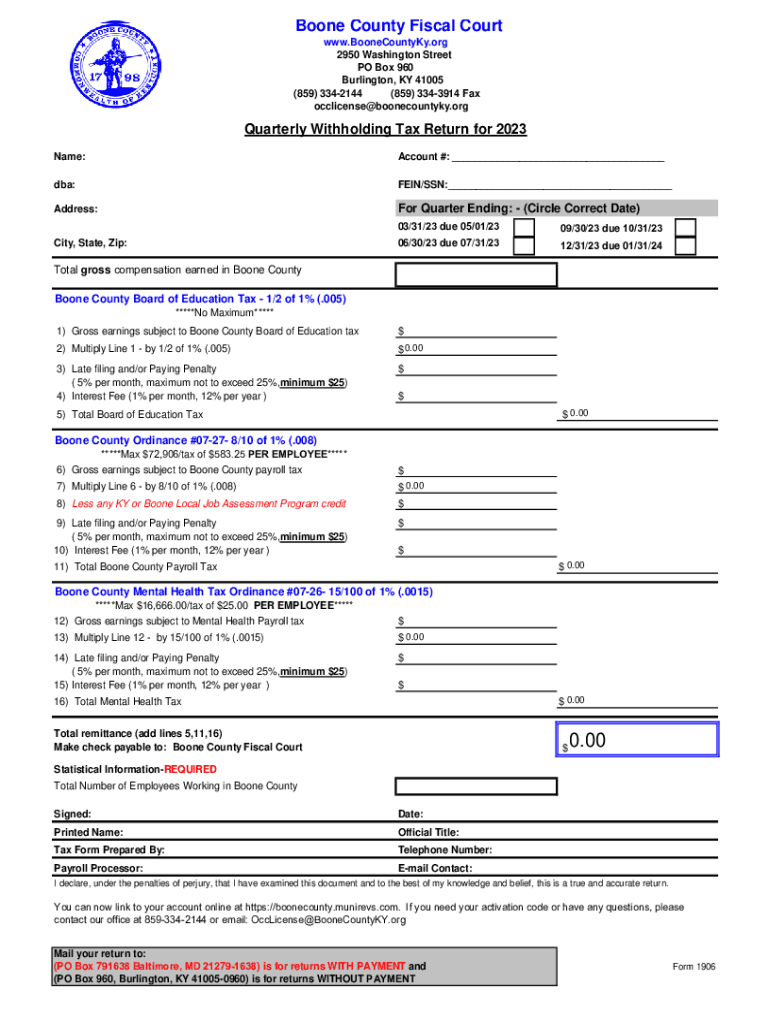

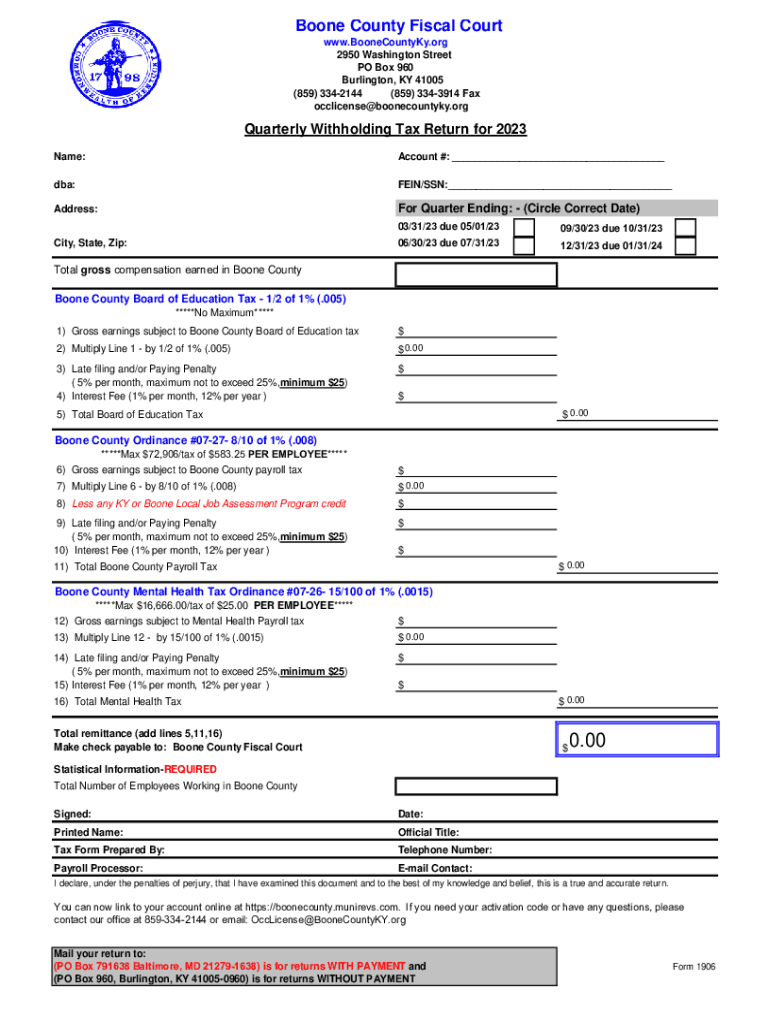

KY 1906 - Boone County 2023 free printable template

Get, Create, Make and Sign form 1906

Editing how to ky form withholding tax online

Uncompromising security for your PDF editing and eSignature needs

KY 1906 - Boone County Form Versions

How to fill out ky quarterly return form

How to fill out KY 1906 - Boone County

Who needs KY 1906 - Boone County?

Video instructions and help with filling out and completing ky return

Instructions and Help about ky return tax

There were two distinct kinds of people it's a shame at Bro bee farms in a dare Villa today that was the old family house outsiders who came in to help clean up I was going to play golf today I felt like this was a lot more important and insiders who were here it's shocking unreal when it all came crashing down her son gave us a call saying there's a tornado heading your way we looked our all the windows we couldn't see it we said where is it coming from Ashley Barth and Brenda Keller almost died yesterday this is our house that we were in the storm was literally on top of them as the farms' owner Lee RO be hustled them into the bathroom of a nearby farm house he could hear it coming, and he said hold on girls it's about to hit five maybe ten minutes went by that wall you could see the bathtub with the blood on it that's where we were yeah right there four of them crammed in a bathroom as the surrounding house disappeared I just felt a big bang we were sitting right there between the toilet and bathtub you can see it she still can't believe it where they all hid how she walked away why the tornado picked this one spot amid all this open farmland everyone safe all of our workers are safe so we this stuff can be fixed an admirable perspective perhaps from someone who was inside a tornado now looking out yep that life is still going to go on's right

People Also Ask about kentucky quarterly tax

What is an occupational tax in Kentucky?

What is property tax in Boone County KY?

What is an employee occupation tax?

What is the income tax in Boone County Kentucky?

What is the tax rate for Boone County KY?

Does Boone County KY have income tax?

Who pays occupational taxes in KY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete how to ky return online?

How do I make edits in ky return 2023 form without leaving Chrome?

How do I complete ky return 2023 form on an iOS device?

What is KY 1906 - Boone County?

Who is required to file KY 1906 - Boone County?

How to fill out KY 1906 - Boone County?

What is the purpose of KY 1906 - Boone County?

What information must be reported on KY 1906 - Boone County?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.