Get the free Revenue and Audit

Show details

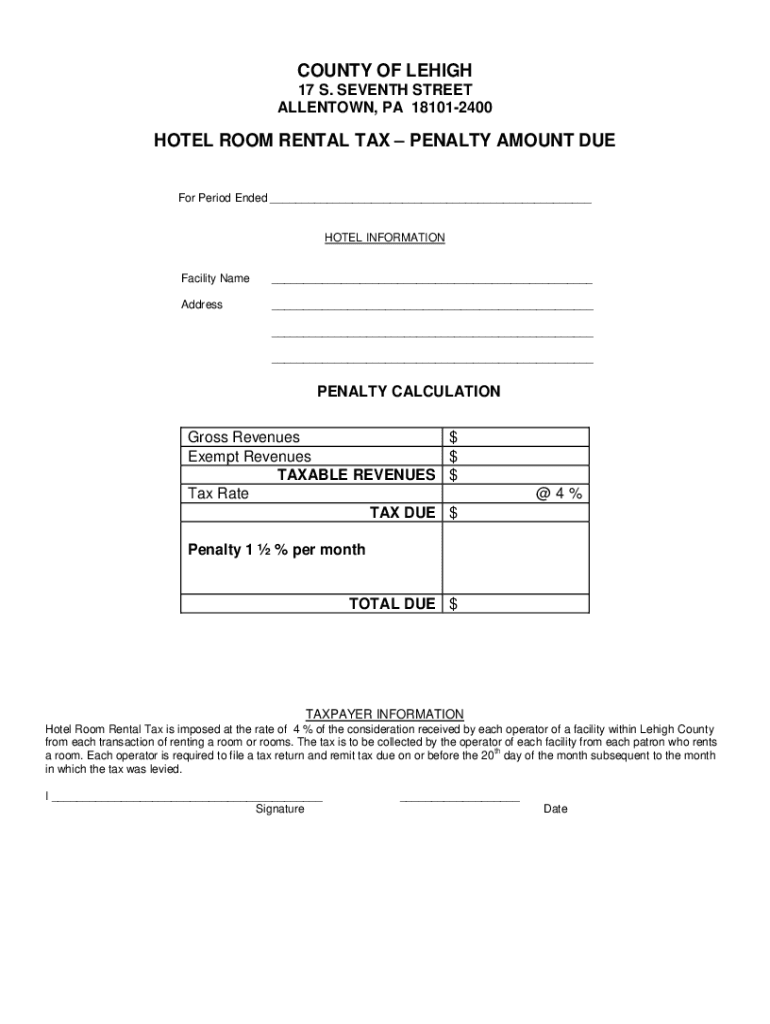

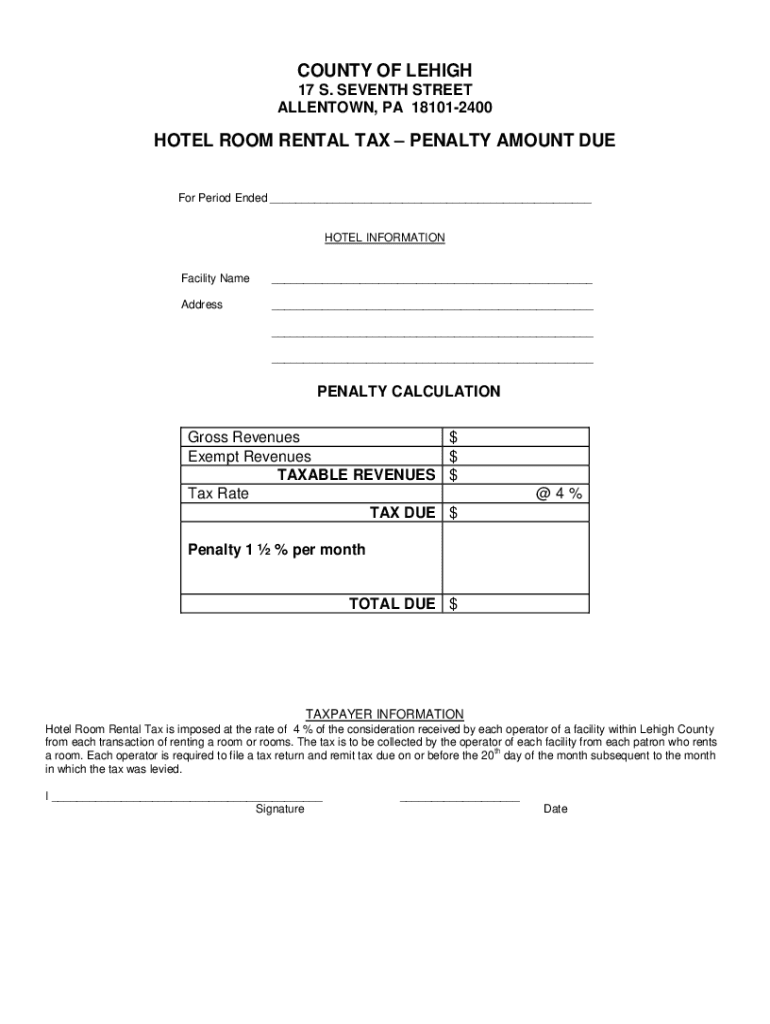

COUNTY OF LEIGH

17 S. SEVENTH STREET

ALLENTOWN, PA 181012400HOTEL ROOM RENTAL TAX PENALTY AMOUNT DUE

For Period Ended ___HOTEL INFORMATIONFacility Name___Address___

___

___PENALTY CALCULATION

Gross

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue and audit

Edit your revenue and audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue and audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue and audit online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revenue and audit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue and audit

How to fill out revenue and audit

01

To fill out revenue and audit, follow these steps:

02

Gather all relevant financial documents such as income statements, balance sheets, and cash flow statements.

03

Review the financial documents thoroughly to understand the company's revenue sources and expenses.

04

Calculate the total revenue by adding up all the income streams, including sales, services rendered, and other income sources.

05

Subtract any sales returns or allowances from the total revenue to arrive at the net revenue.

06

Analyze the revenue trends over a specific period to identify any fluctuations or anomalies.

07

Prepare an audit plan that outlines the procedures and methods to be used in the audit process.

08

Conduct a thorough examination of the company's financial records, verifying the accuracy and completeness of the revenue figures.

09

Review internal controls and processes to ensure compliance with accounting standards and regulations.

10

Document any findings or discrepancies discovered during the audit process.

11

Prepare the revenue and audit report, including a summary of the findings, recommendations for improvement, and any necessary financial adjustments.

12

Communicate the audit results to relevant stakeholders, such as management, shareholders, or regulatory bodies.

13

Follow up on any action plans or corrective measures identified during the audit to ensure implementation.

Who needs revenue and audit?

01

Revenue and audit are necessary for various entities, including:

02

- Companies: Businesses need revenue and audit to accurately track their financial performance, identify areas of improvement, and comply with accounting and regulatory requirements.

03

- Investors: Investors rely on revenue and audit reports to assess the financial health and viability of companies before making investment decisions.

04

- Lenders: Financial institutions and lenders require revenue and audit information to evaluate the creditworthiness and repayment capacity of borrowers.

05

- Regulatory Bodies: Government agencies and regulatory bodies use revenue and audit reports to ensure compliance with financial regulations and to detect any fraudulent activities.

06

- Stakeholders: Any stakeholders, including owners, shareholders, and employees, may have an interest in revenue and audit to monitor the financial stability and transparency of an organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify revenue and audit without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including revenue and audit, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the revenue and audit electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your revenue and audit in seconds.

How do I fill out revenue and audit using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign revenue and audit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is revenue and audit?

Revenue refers to the income generated from normal business operations, while an audit is an examination of records and procedures to verify a company's financial statements and compliance with regulations.

Who is required to file revenue and audit?

Generally, businesses and organizations that exceed a certain revenue threshold or are subject to financial regulations must file revenue and audit reports.

How to fill out revenue and audit?

To fill out revenue and audit forms, one typically needs to collect financial statements, detailed records of income, expenses, and ensure compliance with relevant guidelines or accounting standards.

What is the purpose of revenue and audit?

The purpose of revenue and audit is to ensure transparency and accuracy in financial reporting, to assess the financial health of an organization, and to comply with legal requirements.

What information must be reported on revenue and audit?

Typically, information such as total revenue, expenses, profit or loss, assets and liabilities, and any relevant notes regarding financial procedures must be reported.

Fill out your revenue and audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue And Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.