Get the free Independent contractor vs. employee, what does it matter?

Show details

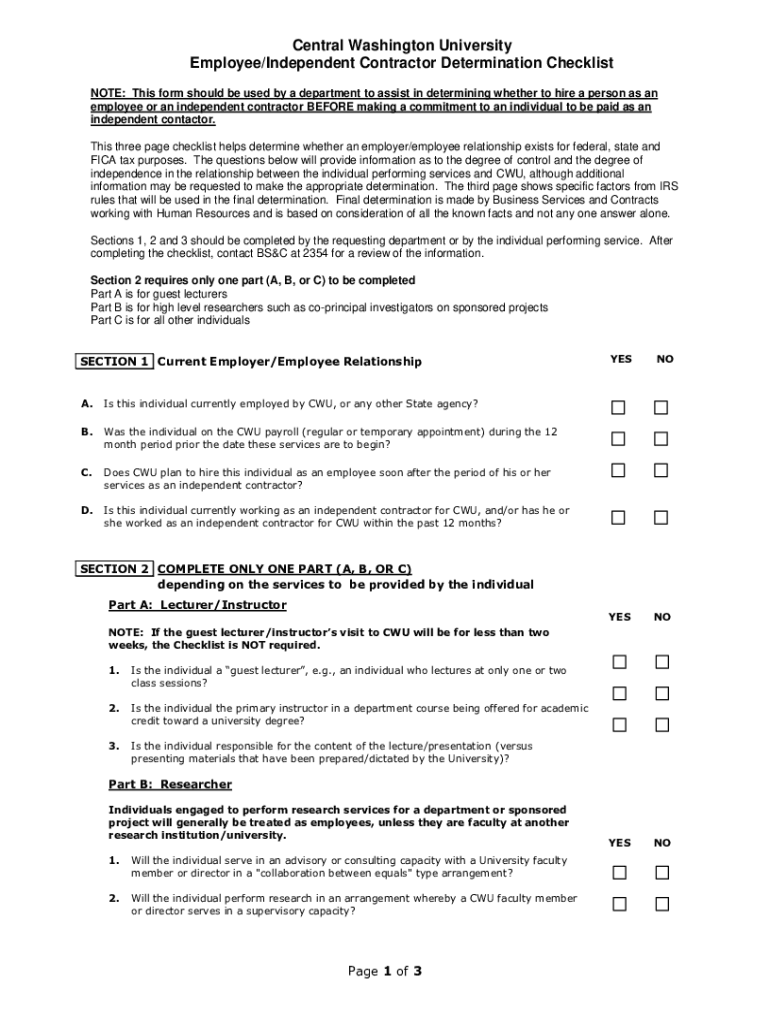

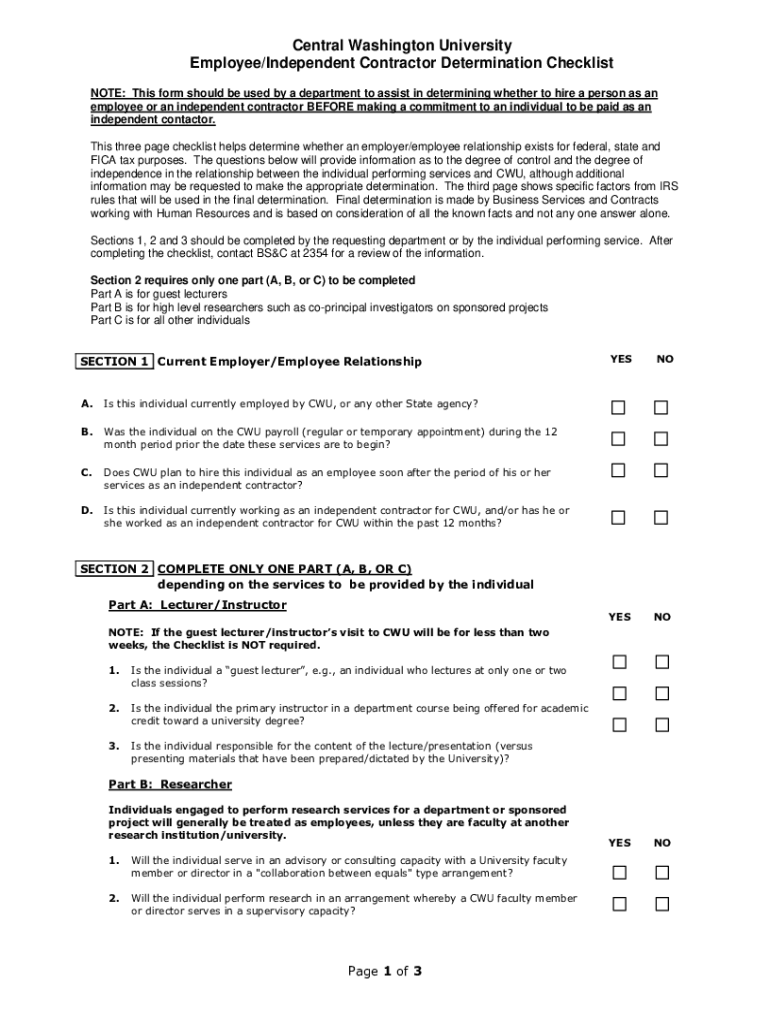

Central Washington University

Employee/Independent Contractor Determination Checklist

NOTE: This form should be used by a department to assist in determining whether to hire a person as an

employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor vs employee

Edit your independent contractor vs employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor vs employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractor vs employee online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit independent contractor vs employee. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor vs employee

How to fill out independent contractor vs employee

01

Understand the differences between an independent contractor and an employee. Independent contractors are self-employed individuals who work for themselves and provide services to clients or companies on a project basis. Employees, on the other hand, work directly for a company and are typically subject to the company's control and direction.

02

Determine the nature of the work relationship. Independent contractors are usually hired for specialized or temporary work that is outside the regular business activities of a company. Employees, on the other hand, are hired to perform ongoing roles within the company's regular business operations.

03

Familiarize yourself with the legal requirements. Independent contractors are responsible for paying their own taxes, obtaining their own insurance, and are not eligible for employee benefits. Employees, on the other hand, have taxes withheld from their paychecks, receive benefits, and may have other legal protections and entitlements.

04

Use the appropriate forms and contracts. When hiring an independent contractor, a company should use a written contract that outlines the scope of work, payment terms, and duration of the project. For hiring an employee, a company typically requires completion of employment forms such as a job application, tax withholding forms, and any applicable employment agreements.

05

Consult with legal and tax professionals. It is advisable to seek advice from legal and tax professionals to ensure compliance with relevant laws and regulations when classifying workers as independent contractors or employees.

Who needs independent contractor vs employee?

01

Companies or individuals who have short-term or specialized projects that require specific expertise may need independent contractors.

02

Companies looking to reduce costs and avoid the administrative responsibilities associated with hiring employees may prefer to hire independent contractors.

03

However, companies requiring workers for ongoing roles, or those who want more control over the work performed, may opt to hire employees instead of independent contractors.

04

Some professions, such as construction, consulting, and freelance writing, often rely heavily on independent contractors for their flexibility and specialized skills.

05

Ultimately, the decision between hiring an independent contractor or an employee depends on the specific needs and circumstances of the company or individual hiring.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find independent contractor vs employee?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific independent contractor vs employee and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit independent contractor vs employee on an iOS device?

Create, modify, and share independent contractor vs employee using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete independent contractor vs employee on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your independent contractor vs employee, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is independent contractor vs employee?

An independent contractor is a self-employed individual who provides services to clients under a contractual agreement, while an employee is a person who works for an employer under a contract of employment, receiving wages or salary and benefits.

Who is required to file independent contractor vs employee?

Employers are required to file information about both independent contractors and employees for tax reporting purposes. Independent contractors typically must fill out Form 1099, while employees are documented using Form W-2.

How to fill out independent contractor vs employee?

To fill out the necessary forms, independent contractors should complete Form 1099 detailing their earnings, while employers must fill out Form W-2 for employees, which includes their wages and tax withholdings. Proper documentation of hours worked and payments is essential for both.

What is the purpose of independent contractor vs employee?

The purpose of distinguishing between independent contractors and employees is to clarify tax obligations, labor rights, and benefits. It helps in ensuring compliance with labor laws and tax regulations.

What information must be reported on independent contractor vs employee?

For independent contractors, Form 1099 typically requires reported income earned during the year. For employees, Form W-2 must include total wages paid, federal and state taxes withheld, and other deductions.

Fill out your independent contractor vs employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Vs Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.