Get the free Preparing for Your Estate Planning Consultation

Show details

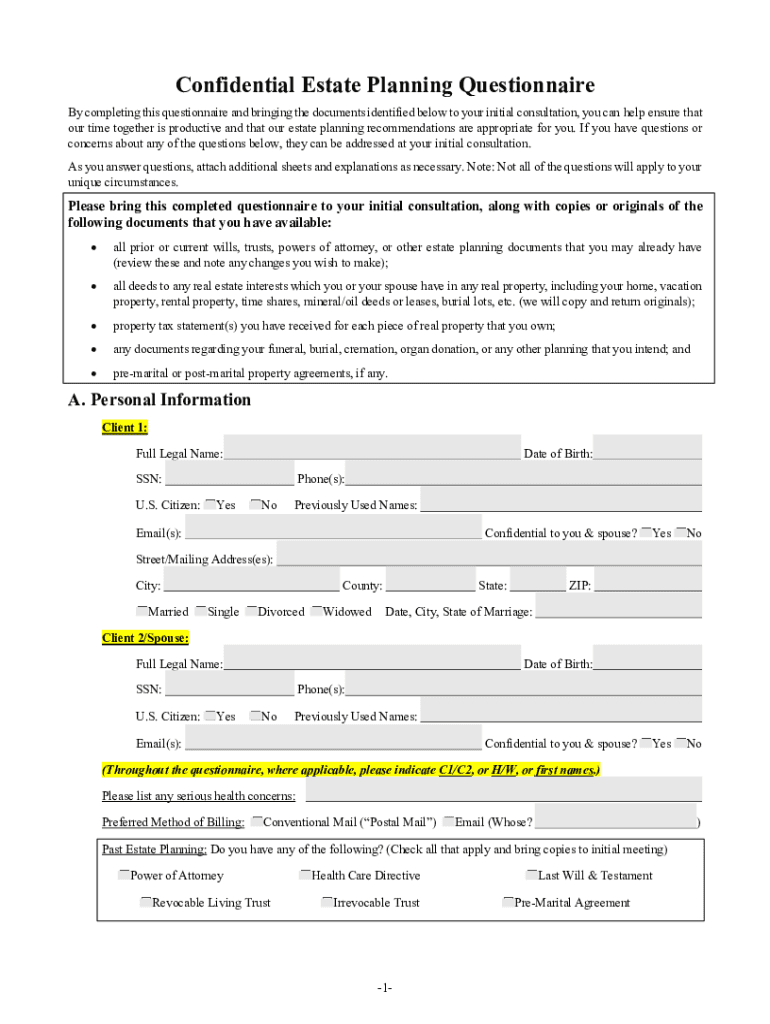

Confidential Estate Planning Questionnaire By completing this questionnaire and bringing the documents identified below to your initial consultation, you can help ensure that our time together is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preparing for your estate

Edit your preparing for your estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preparing for your estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit preparing for your estate online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit preparing for your estate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out preparing for your estate

How to fill out preparing for your estate

01

Determine your assets: Start by making a list of all your assets, including real estate, bank accounts, retirement accounts, investments, and valuable possessions.

02

Identify beneficiaries: Decide who you want to inherit your assets after your death. This can include family members, friends, or charitable organizations.

03

Appoint an executor: Choose someone you trust to carry out your estate plan, handle your affairs, and distribute your assets according to your wishes.

04

Create a will: Draft a legally valid will that clearly outlines how you want your assets distributed. It is recommended to consult with an attorney to ensure your will meets all legal requirements.

05

Consider a trust: Depending on your circumstances, establishing a trust might be beneficial in avoiding probate, minimizing estate taxes, and protecting your assets.

06

Update beneficiary designations: Review and update the beneficiaries listed on your financial accounts, insurance policies, and retirement plans to align with your estate plan.

07

Plan for incapacity: Prepare documents like a durable power of attorney and a healthcare proxy that appoint someone to make financial and medical decisions on your behalf if you become incapacitated.

08

Consult with professionals: Seek guidance from an estate planning attorney, financial planner, and tax advisor to ensure your estate plan is comprehensive and aligned with your goals.

09

Review and update periodically: Regularly review your estate plan to ensure it remains up-to-date and reflects any changes in your assets, beneficiaries, or personal circumstances.

Who needs preparing for your estate?

01

Everyone, regardless of their wealth or age, can benefit from preparing for their estate.

02

It is especially important for individuals with significant assets, dependents, or specific wishes on how their assets should be distributed after their death.

03

Estate planning ensures that your assets are protected, your loved ones are taken care of, and your final wishes are respected.

04

Even young adults and those with few assets should have basic estate planning documents in place to designate beneficiaries and appoint decision-makers in case of incapacity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit preparing for your estate from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your preparing for your estate into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send preparing for your estate for eSignature?

Once you are ready to share your preparing for your estate, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my preparing for your estate in Gmail?

Create your eSignature using pdfFiller and then eSign your preparing for your estate immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is preparing for your estate?

Preparing for your estate involves organizing your financial and legal affairs to ensure a smooth transition of your assets and responsibilities after your death.

Who is required to file preparing for your estate?

The executor or administrator of the estate is required to file the estate preparation documents, typically required by law or the specific circumstances of the estate.

How to fill out preparing for your estate?

Filling out the estate preparation documents typically requires collecting relevant information about assets, liabilities, beneficiaries, and personal identification. It's generally advisable to consult with a legal professional to ensure accuracy.

What is the purpose of preparing for your estate?

The purpose is to ensure that your assets are distributed according to your wishes, to minimize tax implications, and to ease the process for your loved ones during a difficult time.

What information must be reported on preparing for your estate?

You must report information regarding all assets, liabilities, debts, beneficiaries, and any specific bequests or gifts in your estate documents.

Fill out your preparing for your estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preparing For Your Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.