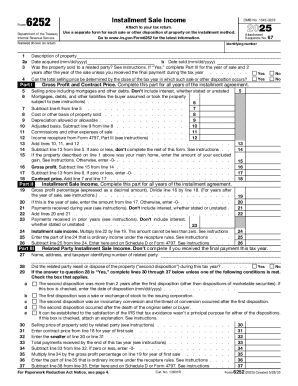

IRS 6252 2023 free printable template

Show details

Don t report interest received carrying charges received original issue discount or unstated interest on Form 6252. If you used Form 4797 only to figure the recapture on line 25 or 36 of Form 6252 enter N/A on lines 31 and 32 of Form 4797. Don t file Form 6252 for sales that don t result in a gain even if you will receive a payment in a tax year after the year of sale. Any excess must be reported in future years on Form 6252 up to the taxable part of has been reported. Paperwork Reduction Act...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 6252

Edit your IRS 6252 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 6252 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 6252 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 6252. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 6252 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 6252

How to fill out IRS 6252

01

Begin by downloading IRS Form 6252 from the official IRS website.

02

Provide your name and taxpayer identification number (TIN) at the top of the form.

03

In Part I, indicate the sale date of the property and the selling price.

04

Enter the costs of the sale, such as commissions and other expenses, to calculate the adjusted sales price.

05

In Part II, report the adjusted basis of the property you sold, including your purchase price and any improvements made.

06

Calculate your gain or loss by subtracting the adjusted basis from the adjusted sales price.

07

Fill out Part III, which determines the amount of gain that is eligible for installment reporting.

08

Complete the remaining sections, including any applicable elections or details about the installment sale.

09

Review all information for accuracy before submitting the form with your tax return.

Who needs IRS 6252?

01

Any taxpayer who sells property using an installment sale method needs IRS Form 6252.

02

Individuals reporting a gain from a sale where they will receive payments over time should complete this form.

03

Taxpayers who have sold certain types of property, including real estate or businesses, on an installment basis are required to use Form 6252.

Fill

form

: Try Risk Free

People Also Ask about

What is IRS form 6252 used for?

Use Form 6252 to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

What is IRS form 6252 used for?

Use this form to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

What is the purpose of an installment sale?

An installment sale is a form of revenue recognition where revenue and expenses are recognized at the time of cash exchange. Installment sales require the buyer to make regular payments—i.e. installments. This method is useful for taxpayers looking to defer capital gains to future years.

Is form 6252 required?

Form 6252 is meant to help you separate the money you earned in a tax year into gains, interest, and returns on capital. This will allow you to correctly report your income on your annual tax return. You are required to file Form 6252 for every year where you receive an installment sale payment.

Do you have to file form 6252 every year?

Further, you may have to file Form 6252 every year until the property is fully paid for—even in years when you don't receive a payment.

WHO reports sale of real estate to IRS?

Who files the Form 1099 for a real estate sale? ing to the IRS, the person who must file the Form 1099-S reporting the sale is the person responsible for closing the transaction.

How to fill out 6252?

When you're filling out Form 6252, you need to be sure that you're including the right information, such as: A description of the product, how you acquired the product, and the date you made the sale. What price you sold the product for. Any debts or mortgages that were assumed by the buyer. The cost of the property.

Who must file 6252?

Form 6252 is used to report income from the sale of real or personal property coming from an installment sale. This form is filed by anyone who has realized a gain on the property using the installment method. New rules allow taxpayers to defer part or all of the capital gain into a Qualified Opportunity Fund.

Do I need form 6252?

Use this form to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

Who qualifies for an installment sale?

Installment sales require two factors: You agree to sell an asset to a buyer with payments made over time. The first payment must be received in any subsequent year after the tax year in which the sale took place. You report this as an installment sale on IRS Form 6252.

What qualifies as an installment sale?

An installment sale is a sale of property where you receive at least one payment after the tax year of the sale.

Do I need to file form 6252?

Who Can File Form 6252: Installment Sale Income? Filers may need to use this form any time they realize a gain on property in the installment method. Taxpayers do not have to file Form 6252 if the sale of the property does not result in a gain for them, even if their payments are received in a subsequent tax year.

Who must file form 6252?

Form 6252 is used to report income from the sale of real or personal property coming from an installment sale. This form is filed by anyone who has realized a gain on the property using the installment method. New rules allow taxpayers to defer part or all of the capital gain into a Qualified Opportunity Fund.

What is form 6252 for?

Use this form to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

What is reported on form 6252?

Use this form to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

Is form 8824 required every year?

If during the current tax year you transferred property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. Also file Form 8824 for the 2 years following the year of a related party exchange.

How do I fill out form 6252?

When you're filling out Form 6252, you need to be sure that you're including the right information, such as: A description of the product, how you acquired the product, and the date you made the sale. What price you sold the product for. Any debts or mortgages that were assumed by the buyer. The cost of the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 6252 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IRS 6252, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit IRS 6252 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your IRS 6252, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit IRS 6252 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IRS 6252, you can start right away.

What is IRS 6252?

IRS 6252 is a form used to report income from the sale of property when the seller receives at least one payment in a year after the year of sale, often involving installment sales.

Who is required to file IRS 6252?

Taxpayers who sell property and receive payment in installments must file IRS 6252 to report the income from those sales.

How to fill out IRS 6252?

To fill out IRS 6252, gather details of the sale, including the sale price, basis, amount received, and installment payments expected in future years. Complete the form's sections according to provided instructions.

What is the purpose of IRS 6252?

The purpose of IRS 6252 is to calculate and report the taxable income from installment sales, spreading the tax liability over the years in which payments are received.

What information must be reported on IRS 6252?

IRS 6252 requires reporting the sale price, your adjusted basis in the property, the amount of each payment received, and the gross profit from the sale among other details.

Fill out your IRS 6252 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 6252 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.