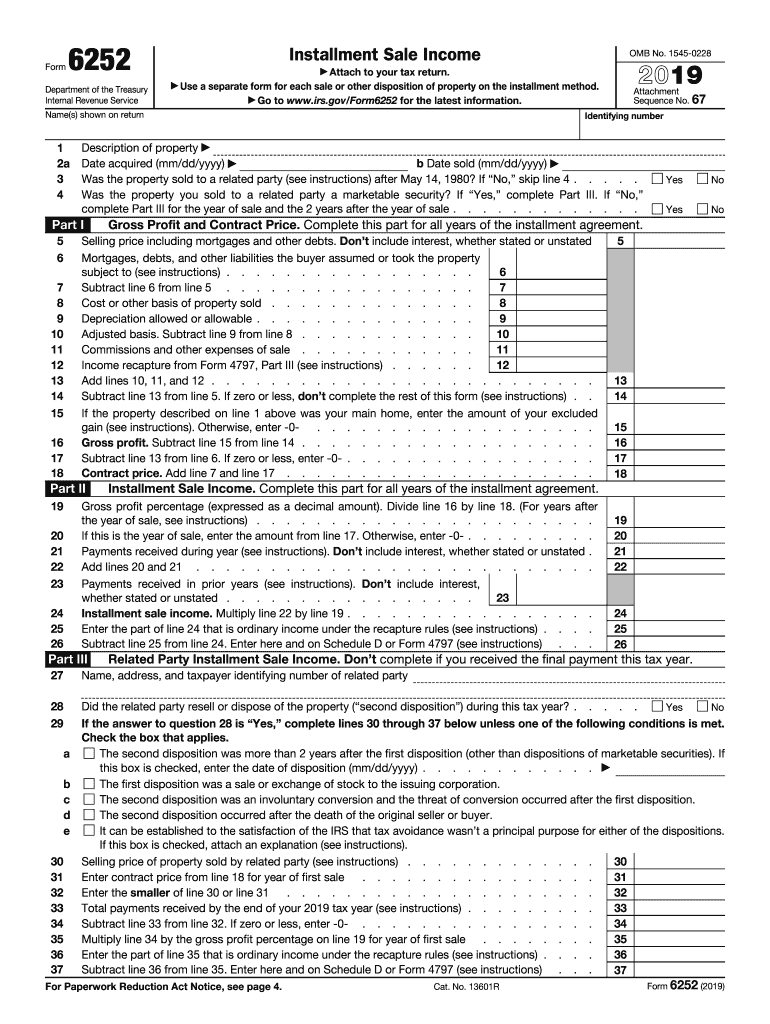

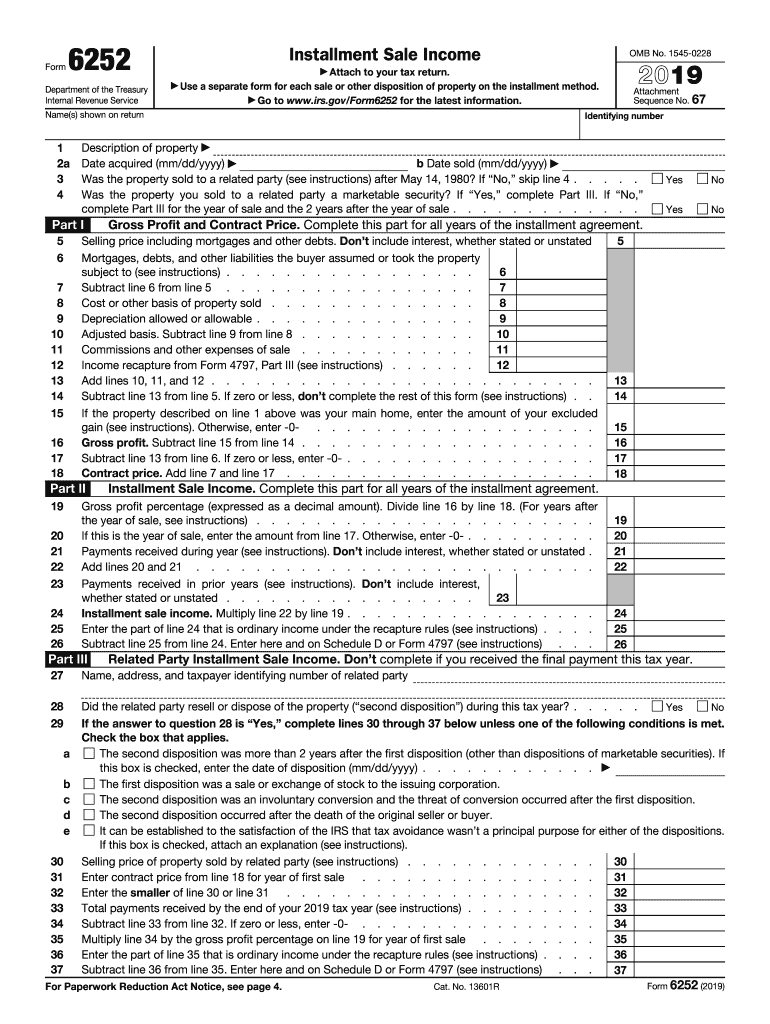

IRS 6252 2019 free printable template

Get, Create, Make and Sign IRS 6252

How to edit IRS 6252 online

Uncompromising security for your PDF editing and eSignature needs

IRS 6252 Form Versions

How to fill out IRS 6252

How to fill out IRS 6252

Who needs IRS 6252?

Instructions and Help about IRS 6252

Music good afternoon everyone and welcome to todays class on installment sales I see a few names in todays class attendees that I do not recognize if you are new to us welcome and if youre returning to us thank you for coming back our class on installment sales is one hour long do stay tuned for two passwords that Ill be giving you during todays class you need those so that you can take the password test to show that you participated in todays class and were just going to bounce over now to page three of the manual where I begin with a course introduction and when you sell an asset at a gain or a profit the game is usually taxable in the year of the sale however if the proceeds from the sale are paid overtime in installments the gain in the taxes owed are generally reported in years where payments from the sale are actually received an installment sale is a sale of property where you receive at least one payment after the tax year of the sale the installment sale rules though do not apply to the following the regular sale of inventory stock or securities traded on an established securities market or the sale of property at a loss and todays course is going to discuss the rules for calculating gains and reporting income under the installment method lets take a look now at the general rules if a sale qualifies as an installment sale the gain must be reported under the installment method unless you elect not to use the installment method or the property sold does not qualify for the installment method figuring your installment income will each payment on an installment sale usually consists of the following three parts interest income return of your adjusted basis in the sale and gain on the sale and these three figures are really important in how each is treated is very different interest income will of course be ordinary income and typically you would report that on Schedule B and then carry it over to line 8 of your tax return the return of your adjusted basis on the sale is not taxable at all you dont ring clued that part in your income and then the gain on the sale is the profit or capital gain and its going to receive in most cases capital gain treatment that would carry over to line 13 of the tax return and be reported as capital gain income now for each year that you receive a payment on the sale of your property you must include the interest part in your income as well as the part that is your gain on the sale but you do not include an income the part that is the return of your basis in the property so lets talk a little bit about interest here you must report interest as ordinary income and interest is generally not included in a down payment however you normally would treat a part of each later payment as interest even if it is not called interest in your agreement with the buyer return of basis and gain on the sale the rest of each payment is treated as if it were made of two parts so every payment is really comprised of three parts but...

People Also Ask about

Do you have to file form 6252 every year?

Do I need to file form 6252?

Who needs to file form 6252?

Who must file form 6252?

What is IRS form 6252 used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 6252 for eSignature?

How do I fill out the IRS 6252 form on my smartphone?

How do I edit IRS 6252 on an Android device?

What is IRS 6252?

Who is required to file IRS 6252?

How to fill out IRS 6252?

What is the purpose of IRS 6252?

What information must be reported on IRS 6252?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.