Get the free Top 20+ Matching Gift Companies: Leaders in Corporate ...

Show details

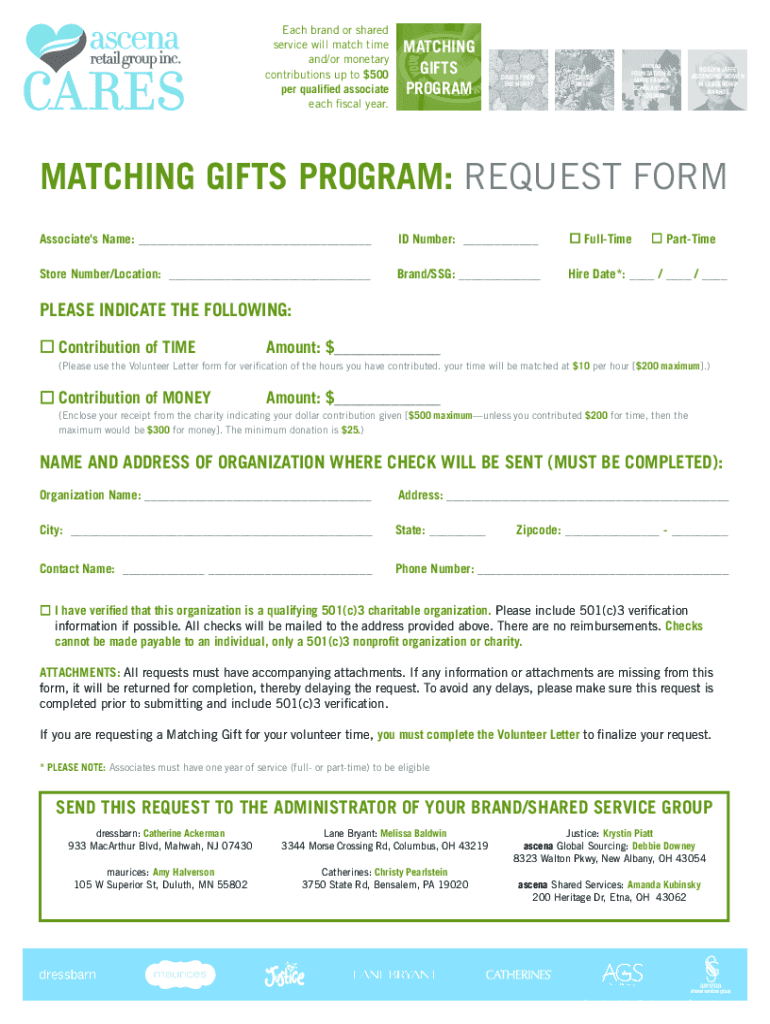

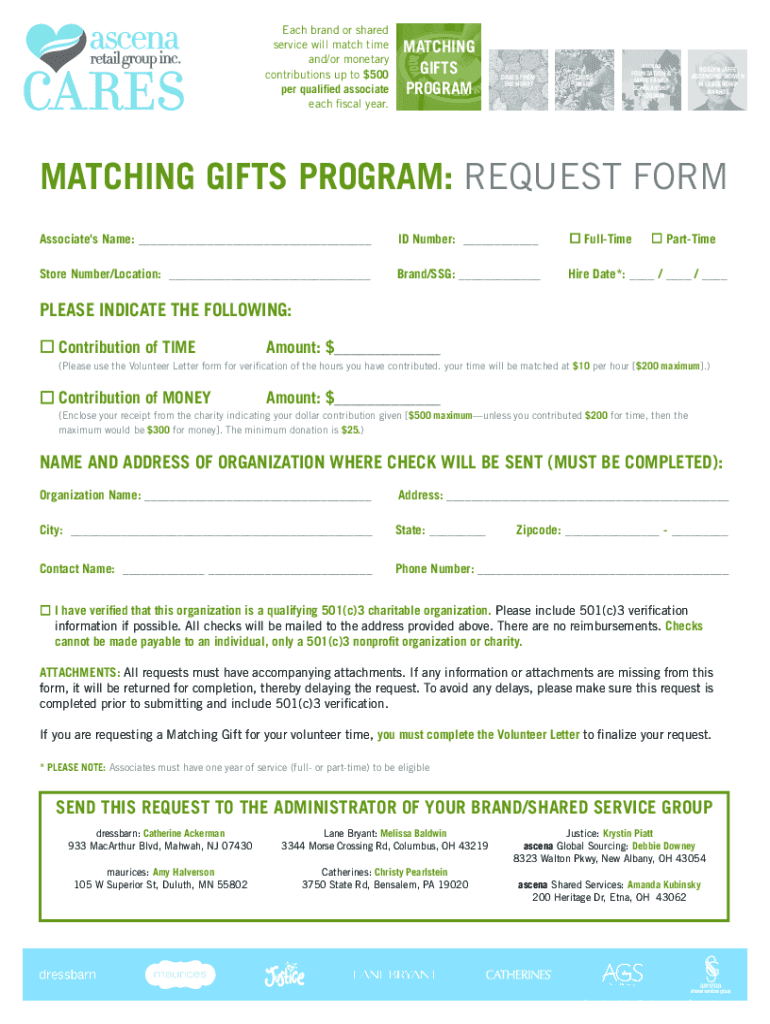

Each brand or shared

service will match time

and/or monetary

contributions up to $500

per qualified associate

each fiscal year. MATCHING

GIFTS

PROGRAMMED FROM

THE HEARTCRISIS

RELIEFascena

FOUNDATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign top 20 matching gift

Edit your top 20 matching gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your top 20 matching gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit top 20 matching gift online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit top 20 matching gift. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out top 20 matching gift

How to fill out top 20 matching gift

01

Step 1: Start by gathering all the necessary information, such as the donor's name, contact details, and donation amount.

02

Step 2: Determine the eligibility criteria for the top 20 matching gift. This can include factors like the donor's employment status, company policies, and specific program guidelines.

03

Step 3: Check if the donor's employer offers a matching gift program. This information can usually be found on the company's website or by contacting their HR department.

04

Step 4: Once eligibility is confirmed, fill out the top 20 matching gift form provided by the employer. Ensure that all required fields are completed accurately.

05

Step 5: Attach any necessary supporting documentation, such as the original donation receipt or proof of the donor's contribution.

06

Step 6: Double-check all the information provided in the form and attachments to avoid any errors or discrepancies.

07

Step 7: Submit the filled out top 20 matching gift form to the designated department or contact at the donor's employer.

08

Step 8: Keep track of the submission date and follow up with the employer if no confirmation is received within a reasonable timeframe.

09

Step 9: Once the matching gift is approved, make sure to acknowledge and thank both the donor and their employer for their generosity.

10

Step 10: Properly document the matching gift process for future reference or auditing purposes.

Who needs top 20 matching gift?

01

Non-profit organizations and charitable institutions can benefit from top 20 matching gifts. It is a fundraising strategy where donors' contributions are matched by their employers, effectively doubling the donated amount. This incentive motivates individuals to give more and boosts the overall fundraising efforts of the organization. By offering top 20 matching gifts, non-profits can attract and encourage donors to contribute, ultimately supporting their mission and projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit top 20 matching gift from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your top 20 matching gift into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my top 20 matching gift in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your top 20 matching gift and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete top 20 matching gift on an Android device?

Use the pdfFiller app for Android to finish your top 20 matching gift. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is top 20 matching gift?

The top 20 matching gift typically refers to a program where companies match the donations made by their employees to nonprofit organizations, which can amplify the impact of individual contributions.

Who is required to file top 20 matching gift?

Individuals who participate in their employer's matching gift program and nonprofit organizations that receive these donations are generally required to file the top 20 matching gift.

How to fill out top 20 matching gift?

To fill out the top 20 matching gift, you typically need to provide your personal information, details of the donation made, your employer's information, and any required documentation to verify the donation.

What is the purpose of top 20 matching gift?

The purpose of the top 20 matching gift is to encourage employee donations to charitable organizations by providing a matching contribution from the employer, thereby increasing overall funding for nonprofits.

What information must be reported on top 20 matching gift?

The information that must be reported typically includes the donor's name, the amount of the donation, the recipient organization, and the employer's matching contribution details.

Fill out your top 20 matching gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Top 20 Matching Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.