Get the free FLOURISH FINANCIAL PLANNING - Investment Adviser Firm

Show details

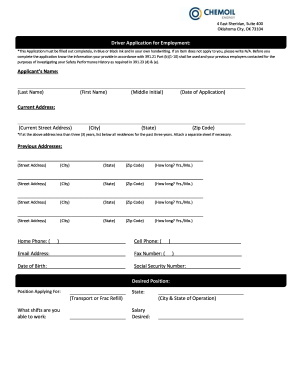

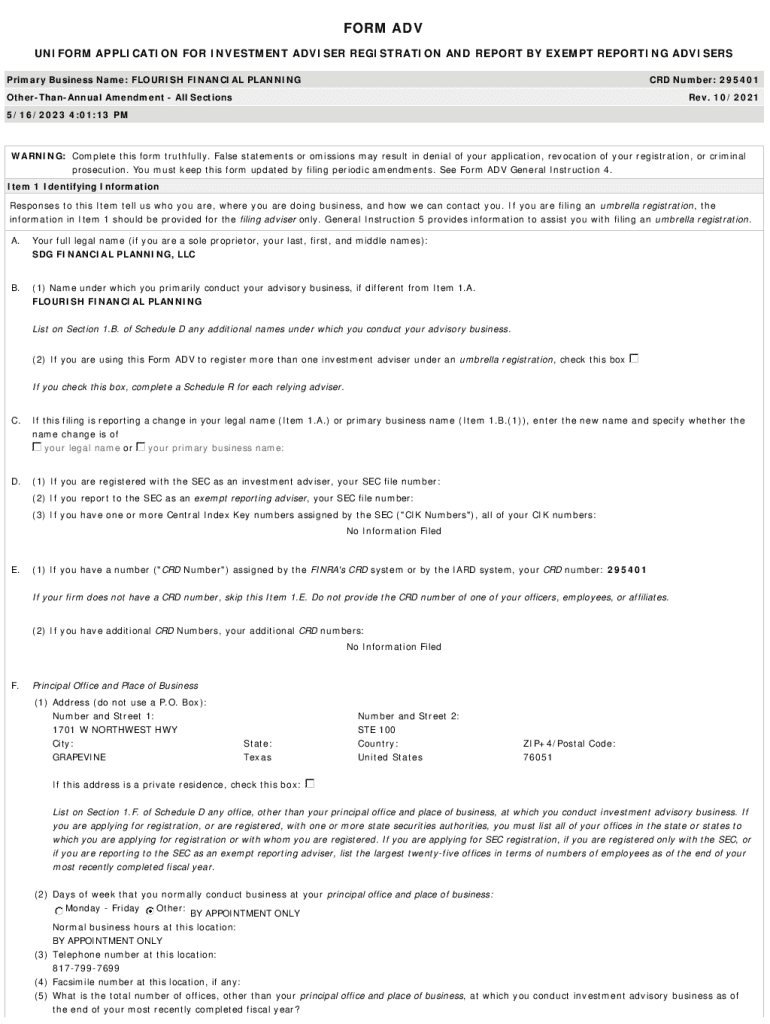

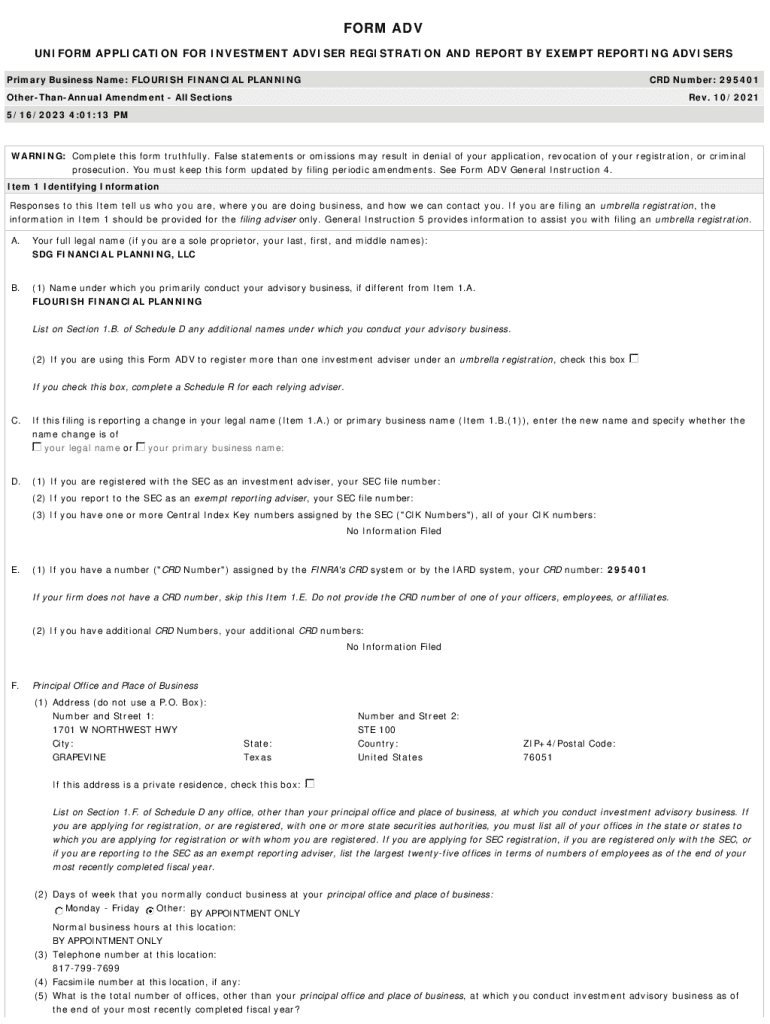

FORM ADV

UNIFORM APPLICATION FOR INVESTMENT ADVISER REGISTRATION AND REPORT BY EXEMPT REPORTING ADVISERS

Primary Business Name: FLOURISH FINANCIAL PLANNING CRD Number: 295401OtherThanAnnual Amendment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flourish financial planning

Edit your flourish financial planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flourish financial planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flourish financial planning online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit flourish financial planning. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flourish financial planning

How to fill out flourish financial planning

01

To fill out Flourish Financial Planning, follow these steps:

02

Start by gathering all of your financial information, including your income, expenses, debts, assets, and investments.

03

Take the time to thoroughly understand your financial goals and objectives. Consider what you want to achieve in the short term and long term.

04

Next, analyze your current financial situation. Assess your income and expenses, savings and investments, and any outstanding debts.

05

Use the gathered information to create a budget. Allocate your income towards different categories such as housing, transportation, food, savings, and entertainment.

06

Consider your insurance needs and assess if you have adequate coverage for health, life, property, or any other insurance types.

07

Evaluate your investment strategy. Determine your risk tolerance and investment goals. Decide if you need to make any adjustments to your portfolio.

08

Review your debt management strategies. Decide if you need to prioritize paying off certain debts or if you should refinance any loans.

09

Assess your tax planning strategies. Determine if there are any tax advantages or deductions that you can take advantage of.

10

Evaluate your retirement planning. Determine if you're on track to meet your retirement goals and if you need to adjust your savings or investment approach.

11

Finally, revisit and update your Flourish Financial Planning regularly to ensure it remains aligned with your financial goals and objectives.

Who needs flourish financial planning?

01

Flourish Financial Planning is beneficial for anyone who wants to take control of their financial situation and plan for a secure future.

02

It is particularly useful for individuals or families who want to:

03

- Establish a budget and effectively manage their income and expenses

04

- Set and achieve financial goals, such as saving for retirement or a down payment on a house

05

- Reduce or eliminate debt

06

- Optimize investment strategies and understand their risk tolerance

07

- Plan for major life events, such as buying a home, starting a family, or sending children to college

08

- Ensure they have adequate insurance coverage

09

- Minimize tax liabilities

10

- Prepare for retirement and determine how much they need to save

11

- Have a comprehensive and organized financial plan that can be regularly reviewed and adjusted as needed

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flourish financial planning directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your flourish financial planning and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the flourish financial planning in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your flourish financial planning and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit flourish financial planning on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as flourish financial planning. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is flourish financial planning?

Flourish financial planning is a strategic approach to managing an individual's or an organization's financial resources to enhance their overall financial health and achieve specific goals.

Who is required to file flourish financial planning?

Individuals, businesses, or organizations that aim to have a structured financial plan, manage investments, or comply with specific regulatory requirements may be required to file flourish financial planning.

How to fill out flourish financial planning?

To fill out flourish financial planning, one must gather all relevant financial data, outline objectives, create a budget, analyze current investments, and then develop a detailed plan that outlines future financial actions and goals.

What is the purpose of flourish financial planning?

The purpose of flourish financial planning is to provide a comprehensive roadmap for managing finances, ensuring that individuals and organizations can meet their financial objectives, make informed decisions, and secure their financial future.

What information must be reported on flourish financial planning?

Information that must be reported includes personal or organizational income, expenses, assets, liabilities, investment holdings, and specific financial goals or objectives.

Fill out your flourish financial planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flourish Financial Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.