Get the free Sales Tax Holiday Frequently Asked Questions

Show details

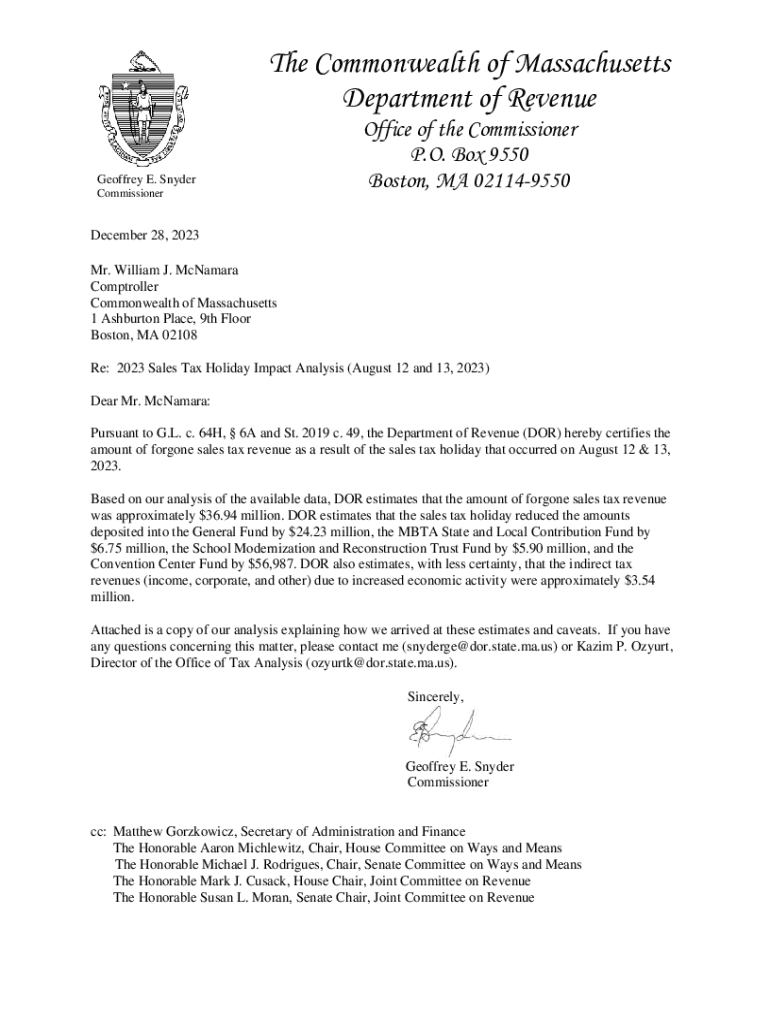

The Commonwealth of Massachusetts

Department of Revenue

Geoffrey E. Snyder

CommissionerOffice of the Commissioner

P.O. Box 9550

Boston, MA 021149550December 28, 2023

Mr. William J. McNamara

Comptroller

Commonwealth

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales tax holiday frequently

Edit your sales tax holiday frequently form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax holiday frequently form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales tax holiday frequently online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sales tax holiday frequently. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax holiday frequently

How to fill out sales tax holiday frequently

01

Research the dates of the sales tax holiday in your state or region.

02

Make a list of the items that are eligible for the sales tax exemption.

03

Prepare your shopping list and prioritize the items you need.

04

Check if there are any purchase limits or restrictions on certain items.

05

Plan your budget and determine how much you can afford to spend.

06

Research the participating stores and their sales promotions.

07

Visit the stores early during the sales tax holiday to avoid crowds.

08

Double-check the prices and compare them to regular prices to ensure you're getting a good deal.

09

Keep all your receipts and documentation for proof of purchase.

10

Enjoy your savings and take advantage of the sales tax holiday!

Who needs sales tax holiday frequently?

01

Individuals who want to save money on their purchases.

02

Families on a tight budget who are looking for ways to stretch their dollars.

03

Students who need to buy back-to-school supplies and clothing.

04

Small business owners who want to save on business-related purchases.

05

Anyone who wants to take advantage of discounted prices and sales promotions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sales tax holiday frequently to be eSigned by others?

When your sales tax holiday frequently is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute sales tax holiday frequently online?

Completing and signing sales tax holiday frequently online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the sales tax holiday frequently form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign sales tax holiday frequently and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is sales tax holiday frequently?

A sales tax holiday frequently refers to designated periods where certain products can be purchased without the imposition of sales tax, typically to promote economic activity.

Who is required to file sales tax holiday frequently?

Retailers who participate in the sales tax holiday are typically required to file to report their sales during these tax-free periods.

How to fill out sales tax holiday frequently?

To fill out the sales tax holiday report, retailers usually must document their exempt sales, providing details such as transaction amounts and applicable items.

What is the purpose of sales tax holiday frequently?

The purpose of the sales tax holiday is to provide financial relief to consumers and stimulate spending on designated items.

What information must be reported on sales tax holiday frequently?

Retailers must report total sales amounts, the types of items sold that qualify for the holiday, and the duration of the sales.

Fill out your sales tax holiday frequently online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Tax Holiday Frequently is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.