OR DoR OR-W-4 2024 free printable template

Show details

Clear this page2024 Form ORW4

Page 1 of 1, 150101402

(Rev. 081823, very. 01)Office use only19612401010000Oregon Department of Revenue Oregon Withholding Statement and Exemption CertificateFirst nameInitial

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oregon revenue or form online

Edit your oregon revenue or form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon revenue orw4 template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dor orw4 withholding create online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit or w4 form printable. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR DoR OR-W-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oregon w 4 form blank

How to fill out OR DoR OR-W-4

01

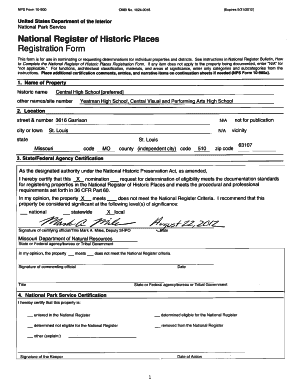

Obtain a copy of the Oregon DoR OR-W-4 form.

02

Provide your full name, Social Security number, and address in the designated fields.

03

Indicate your filing status (Single, Married, etc.) by marking the correct box.

04

Complete the number of allowances you are claiming or indicate if you want additional withholding.

05

Review the instructions for any special situations that may apply to you.

06

Sign and date the form at the bottom before submitting it to your employer.

Who needs OR DoR OR-W-4?

01

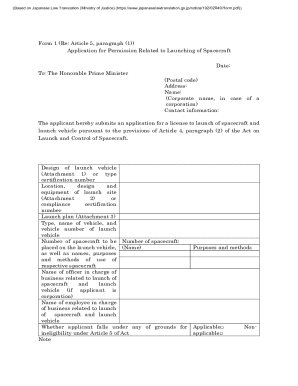

Employees working in Oregon who wish to adjust their state tax withholding.

02

Individuals starting a new job in Oregon.

03

Those who have had a change in their tax situation and need to submit a new withholding form.

04

Self-employed individuals in Oregon choosing to make estimated tax payments.

Fill

2024 or w 4 form

: Try Risk Free

People Also Ask about oregon dor form make

Can I still claim 0 on my w4 in 2022?

Should I claim 1 or 0 on my W-4 Form? You can no longer claim allowances like 1 or 0 on your W-4 since the IRS redesigned the form. However, you can claim an exemption from withholding if you owed no income tax last year and don't expect to owe anything in the current year.

Is w4 required in Texas?

All new employees for your business must complete a federal Form W-4. You can download blank W-4s from the IRS. You should keep the completed forms on file at your business and update them as necessary.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Is it better to claim 0 on taxes?

When you claim 0 on your taxes, you have the largest amount withheld from your paycheck for federal taxes. If your goal is to receive a larger tax refund, then it will be your best option to claim 0. Typically, those who opt for 0 want a lump sum to use as they wish, like: Pay bills.

Is it better to file 0 or 1?

In the event you claim 0 federal withholding allowances instead of 1 on your W 4 tax form, you'll receive less money every paycheck, though your tax bill will likely be reduced at the end of the year.

Does everyone have a W-4 form?

The W-4 tells the employer how much to withhold from the employee. The W-2, however, tells the IRS what the employee earned in the previous year. Small business owners and large businesses are required to submit Form W-2 . Every employee must file a W-4.

How to fill out w4 form 2022?

How to Complete the New Form W-4 Step 1: Provide your information. Provide your name, address, filing status, and SSN. Step 2: Indicate multiple jobs or a working spouse. Step 3: Add dependents. Step 4: Add other adjustments. Step 5: Sign and date Form W-4.

Can I find my tax forms online?

Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

How do I fill out a W-4 form?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Is the W-4 Mandatory?

A1: Employers are no longer required to routinely submit Forms W-4 to the IRS. However, in certain circumstances, the IRS may direct you to submit copies of Forms W-4 for certain employees in order to ensure that the employees have adequate withholding.

Is Oregon W-4 required?

Generally, no. However, if the IRS grants the employee an exemption, DOR will honor the exemption. To receive an exemption, the employee must file federal Form 8233 with you. If any portion of the employ- ee's wages are not exempt, use the employee's Form OR-W-4 elections to withhold on those non-exempt wages.

Are you required to fill out a W-4?

The W-4 tells the employer how much to withhold from the employee. The W-2, however, tells the IRS what the employee earned in the previous year. Small business owners and large businesses are required to submit Form W-2 . Every employee must file a W-4.

What states do not have a w4?

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.

Who is exempt from the W-4?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

How much should I claim on my w4 2022?

The 2022 standard deduction is $25,900 for married taxpayers filing jointly; $12,950 for single and married filing separately taxpayers; $19,400 for those filing as head of household.

Who is exempt from withholding W-4?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oregon revenue or form print to be eSigned by others?

When you're ready to share your oregon w 4 withholding printable, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my or form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your or w 4 form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit oregon w 4 withholding form online straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing or or pdf right away.

What is OR DoR OR-W-4?

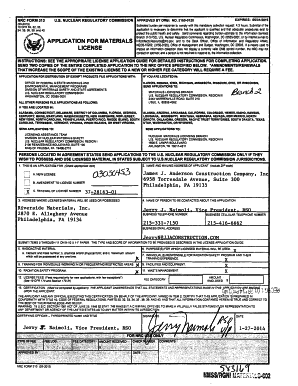

OR DoR OR-W-4 is a form used in Oregon for withholding tax purposes. It is specifically designed for employees to indicate their Oregon state income tax withholding allowances.

Who is required to file OR DoR OR-W-4?

Employees who are working in Oregon and wish to have state income tax withheld from their paychecks are required to file the OR DoR OR-W-4 form.

How to fill out OR DoR OR-W-4?

To fill out the OR DoR OR-W-4, you need to provide your personal information, including your name, Social Security number, and address, as well as the number of allowances you are claiming and any additional amount you wish to withhold.

What is the purpose of OR DoR OR-W-4?

The purpose of OR DoR OR-W-4 is to help employers determine the correct amount of state income tax to withhold from employees' wages, ensuring compliance with Oregon tax law.

What information must be reported on OR DoR OR-W-4?

The information that must be reported on OR DoR OR-W-4 includes the employee's name, Social Security number, address, marital status, number of withholding allowances claimed, and any additional withholding amount requested.

Fill out your 2024 or form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Or w4 Form is not the form you're looking for?Search for another form here.

Keywords relevant to or w 4 form printable

Related to oregon revenue or w form template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.