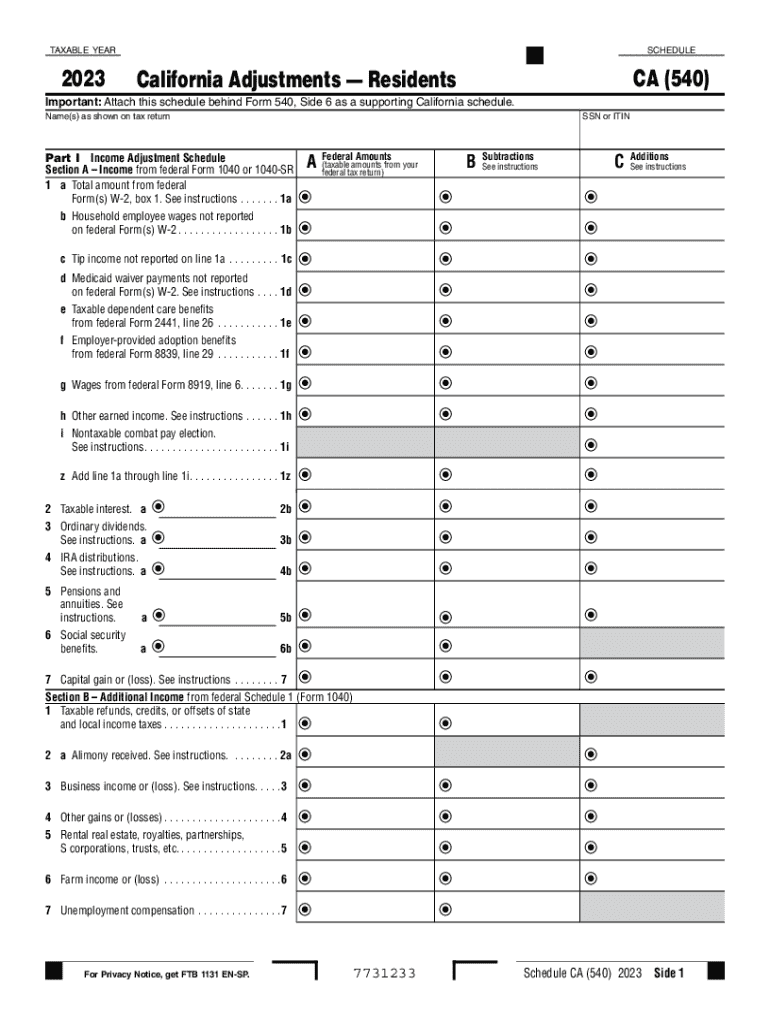

CA FTB Schedule CA (540) 2023 free printable template

Instructions and Help about CA FTB Schedule CA 540

How to edit CA FTB Schedule CA 540

How to fill out CA FTB Schedule CA 540

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about CA FTB Schedule CA 540

What should I do if I realize I've made a mistake on my CA FTB Schedule CA 540 after filing?

If you've made a mistake on your CA FTB Schedule CA 540, you can file an amended return to correct it. Use Form 540-X for amendments, ensuring all changes are clearly stated. Be prepared to provide explanation and any supporting documentation, especially if the error affects your tax liability.

How can I verify if my CA FTB Schedule CA 540 has been received and processed?

To verify the status of your CA FTB Schedule CA 540, you can use the 'Where's My Refund?' tool on the California FTB website. This tool provides updates on the processing status and any issues related to your filing. Make sure your details match exactly as submitted for accurate tracking.

What are common mistakes to avoid when filing the CA FTB Schedule CA 540?

Common mistakes when filing the CA FTB Schedule CA 540 include incorrect Social Security numbers, miscalculating your total income, and missing signatures. Ensure all arithmetic is double-checked and provide all required attachments to avoid unnecessary delays or rejections.

Is e-signature acceptable for submitting CA FTB Schedule CA 540?

Yes, e-signatures are permissible for submitting CA FTB Schedule CA 540 if filed electronically through authorized software or providers. However, it's essential to follow the specific guidelines of the e-filing platform you are using to ensure compliance with California's electronic filing requirements.

See what our users say