IRS W-4 2024 free printable template

Show details

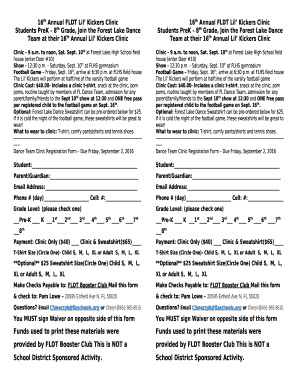

FormW4Department of the Treasury Internal Revenue ServiceStep 1: Enter Personal InformationEmployees Withholding CertificateOMB No. 15450074Complete Form W4 so that your employer can withhold the

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

Instructions and Help about IRS W-4

How to edit IRS W-4

To edit the IRS W-4, begin by downloading the most recent version of the form from the IRS website or utilizing a reliable tool like pdfFiller. Once you have the form, carefully make your changes, ensuring all information remains clear and accurate. Check for any specific fields that may require updates, including personal information, tax situation changes, or additional income sources.

How to fill out IRS W-4

01

Download the IRS W-4 form from the IRS website or pdfFiller.

02

Provide your personal information including your name, address, and Social Security number.

03

Indicate your filing status, choosing between single, married, or head of household.

04

Complete the multiple jobs or spouse section if applicable, to ensure accurate withholding.

05

Sign and date the form before submitting it to your employer.

About IRS W-4 2024 previous version

What is IRS W-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-4 2024 previous version

What is IRS W-4?

IRS W-4 is the Employee's Withholding Certificate used by U.S. employers to determine the correct amount of federal income tax to withhold from an employee's paycheck. This form is crucial for ensuring that employees meet their tax obligations throughout the year.

What is the purpose of this form?

The primary purpose of the IRS W-4 is to provide employers with information necessary to withhold the correct amount of federal income tax from employees' wages. The form allows individuals to indicate their tax circumstances, which can include factors such as dependent claims and additional income that might require adjustments to withholding rates.

Who needs the form?

All employees in the U.S. working for an employer who withholds federal taxes need to fill out the IRS W-4. This includes individuals starting new jobs, current employees who have experienced changes in their tax situation, such as marriage or adding dependents, or anyone seeking to adjust their tax withholding for other reasons.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-4 if you had no tax liability in the previous year and expect to have none in the current year. Individuals in such situations can choose to indicate this status directly on the form, thereby instructing their employer not to withhold federal income tax from their paychecks.

Components of the form

The IRS W-4 comprises several sections. The first section collects personal information, followed by the section where employees can claim their tax withholding allowances. Additional components allow individuals to declare multiple jobs or spouse income, as well as to indicate additional amounts to withhold per paycheck if desired.

What are the penalties for not issuing the form?

Failure to submit a W-4 form can result in the employer withholding taxes at the highest rate, leading to potential over-withholding and larger-than-necessary tax refunds at year-end. Inaccurate or missing information on the form could also lead to penalties from the IRS, as individuals might face a tax shortfall if the appropriate withholding isn’t established.

What information do you need when you file the form?

When filing the IRS W-4, you will need your personal identification details, such as your full name, address, Social Security number, and your filing status. Additionally, gather any information regarding other sources of income and deductions that may impact your taxable income, as these will influence your withholding calculations.

Is the form accompanied by other forms?

The IRS W-4 is primarily a standalone form submitted to your employer. However, if you are making adjustments based on specific scenarios, such as claiming additional deductions or income, you may need to reference or include other forms or schedules depending on your tax situation.

Where do I send the form?

After completing the IRS W-4, you send it directly to your employer, not to the IRS. Your employer will retain this document for their payroll records and base your tax withholding on the provided information. Ensure you keep a copy of the submitted form for your personal records.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to understand and user friendly for myself and the receiver of the document

Excellent company. Not only does the PDF Filler work great, but when I asked for the annual fee to be refunded after I neglected to cancel my subscription, it was done so immediately and graciously.

Great Customer Service & Turnaround Time

pdfFiller is a great tool and they have a great Customer centred approach in their services. I recommend them and thumbs up on the work that are doing really.

Excellent customer service

Extremely fast response. It didn't work out for me, but they were very friendly and helpful.

No special revew

No special rewvew

Statement of Impact

OK Enjoyed Will recommend to friends

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.