Get the free Budget and Fiscal Services Home

Show details

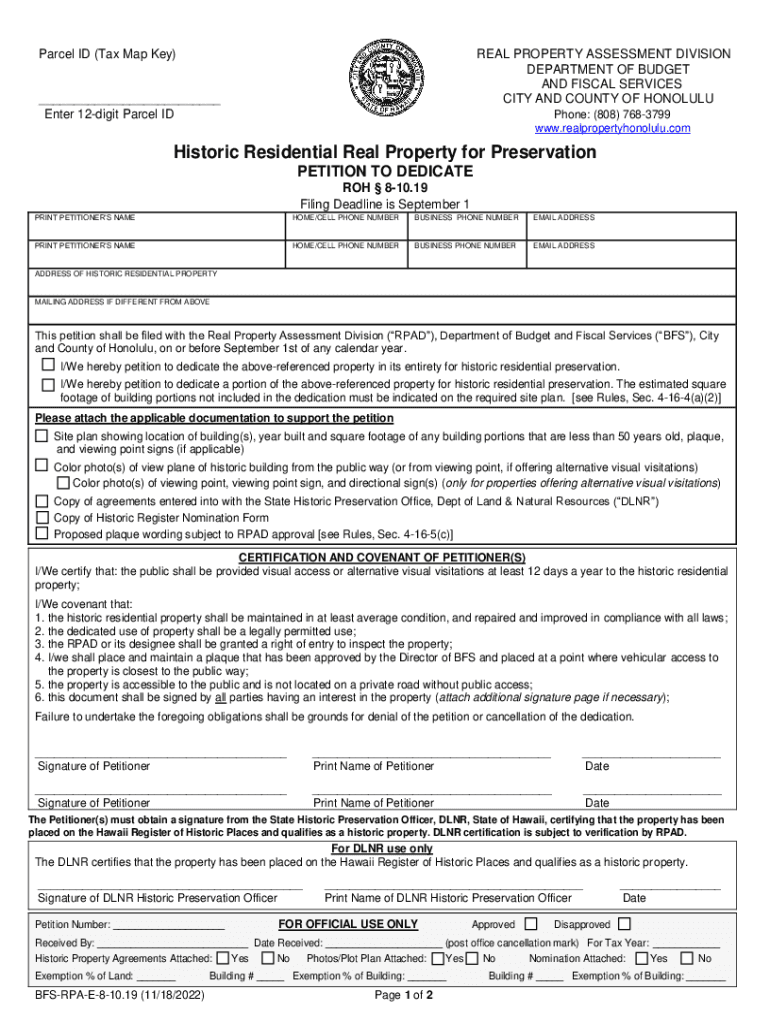

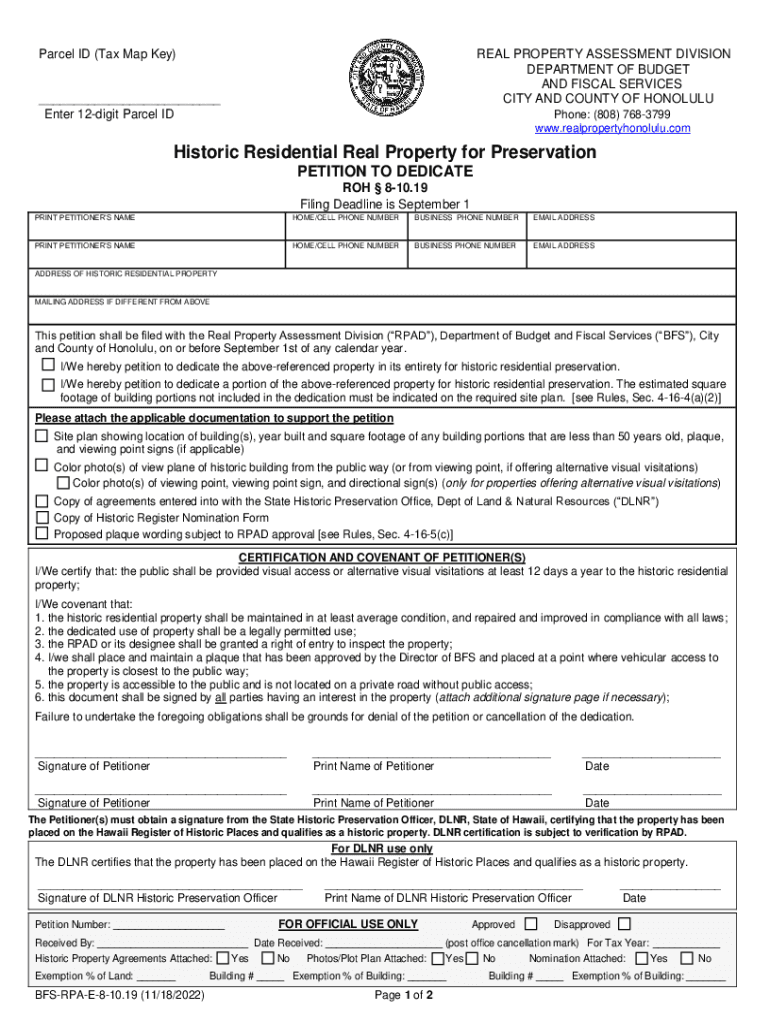

Parcel ID (Tax Map Key)REAL PROPERTY ASSESSMENT DIVISION

DEPARTMENT OF BUDGET

AND FISCAL SERVICES

CITY AND COUNTY OF HONOLULU___

Enter 12digit Parcel iPhone: (808) 7683799

www.realpropertyhonolulu.comHistoric

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budget and fiscal services

Edit your budget and fiscal services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budget and fiscal services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit budget and fiscal services online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit budget and fiscal services. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budget and fiscal services

How to fill out budget and fiscal services

01

To fill out a budget and fiscal services, follow these steps:

02

Start by gathering all relevant financial documents, such as income statements, expense reports, and bank statements.

03

Assess your current financial situation and set financial goals for the desired period.

04

Categorize your income and expenses into different budget categories, such as housing, transportation, groceries, entertainment, etc.

05

Allocate a specific amount to each category based on your financial goals and priorities.

06

Track your actual income and expenses regularly and update the budget as needed.

07

Review and analyze your budget periodically to identify areas where you can save money or make adjustments.

08

Make necessary adjustments to your spending habits to align with the budget.

09

Consider seeking professional advice or using budgeting software/tools to simplify the process and ensure accuracy.

10

Monitor your progress and make adjustments as necessary to achieve your financial goals.

11

Keep records of your budget and fiscal services for future reference and analysis.

Who needs budget and fiscal services?

01

Budget and fiscal services are beneficial for various individuals and entities, including:

02

- Individuals who want to manage their personal finances effectively and achieve financial goals.

03

- Small business owners who need to track income, expenses, and profitability.

04

- Non-profit organizations that require proper financial management and transparency.

05

- Government agencies and departments responsible for maintaining fiscal discipline and accountability.

06

- Educational institutions managing their budgets and funding allocations.

07

- Entrepreneurs and startups looking to secure funding or present financial information to stakeholders.

08

- Individuals or organizations that need to comply with tax regulations and reporting requirements.

09

- Financial institutions that require accurate financial data for decision-making and risk assessment.

10

- Anyone who wants to have better control over their finances and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my budget and fiscal services directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your budget and fiscal services and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete budget and fiscal services online?

pdfFiller has made it simple to fill out and eSign budget and fiscal services. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the budget and fiscal services in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your budget and fiscal services in seconds.

What is budget and fiscal services?

Budget and fiscal services refer to the management and oversight of financial resources, including the preparation, monitoring, and execution of budgets within an organization.

Who is required to file budget and fiscal services?

Organizations, agencies, and entities that receive government funding or are required to report their financial activities must file budget and fiscal services.

How to fill out budget and fiscal services?

To fill out budget and fiscal services, follow the guidelines provided by the fiscal authority, gather necessary financial data, complete the required forms accurately, and submit them by the deadline.

What is the purpose of budget and fiscal services?

The purpose of budget and fiscal services is to ensure effective financial planning, accountability, and transparency in the use of funds, helping organizations to achieve their financial goals.

What information must be reported on budget and fiscal services?

Information such as revenue estimates, expenditure plans, funding sources, and financial performance metrics must be reported on budget and fiscal services.

Fill out your budget and fiscal services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budget And Fiscal Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.