Get the free Corporation, LLC, and Pass-Through Tax Frequently Asked ...

Show details

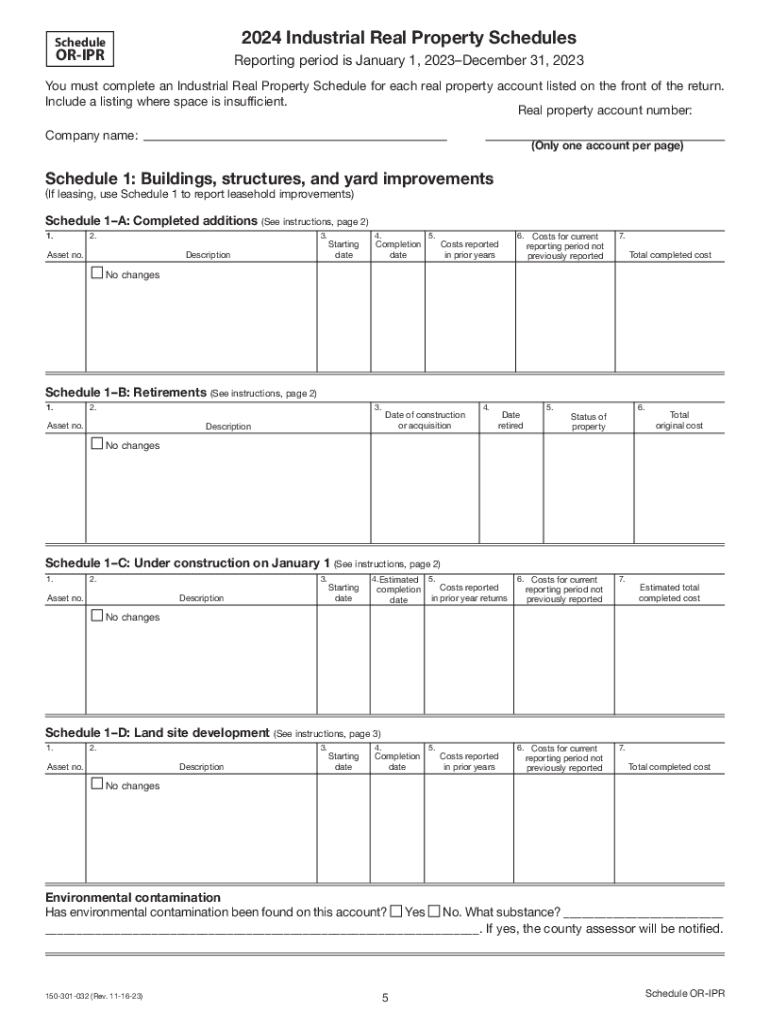

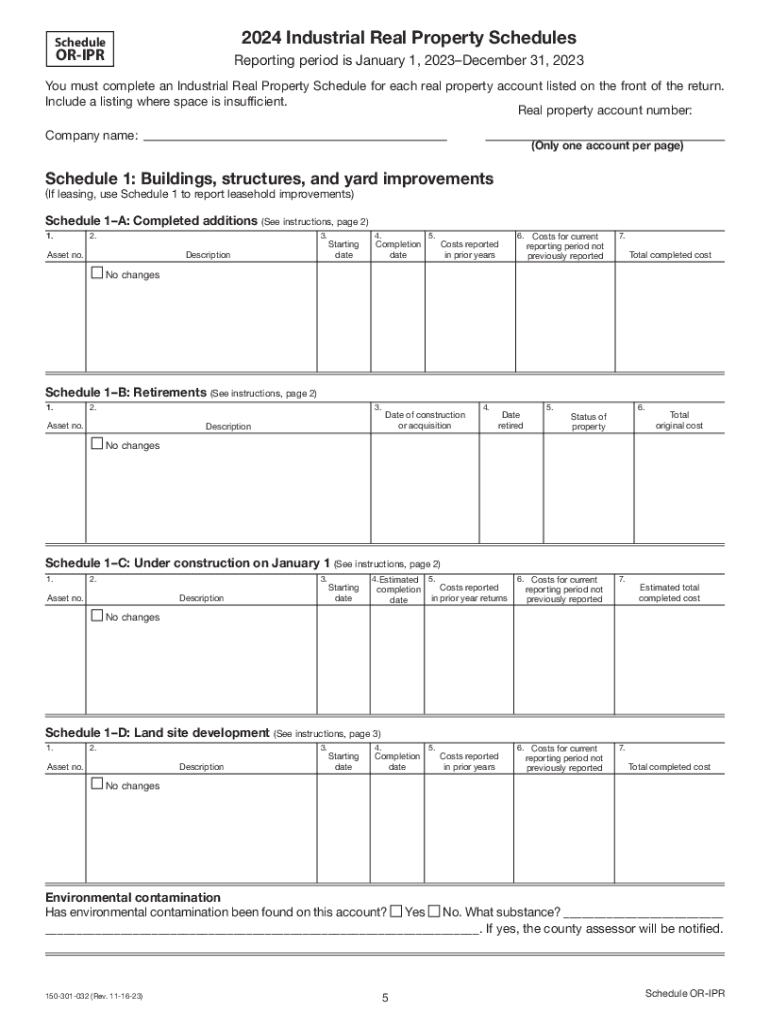

Each Industrial Property Return is

complete only when there is a taxpayer

declaration listing the companies name,

address, and account numbers along with

a completed schedule for each account.

To

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporation llc and pass-through

Edit your corporation llc and pass-through form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporation llc and pass-through form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporation llc and pass-through online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporation llc and pass-through. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporation llc and pass-through

How to fill out corporation llc and pass-through

01

To fill out a corporation LLC and pass-through, follow these steps:

02

Determine the type of pass-through entity you want to form, such as an LLC, partnership, or S corporation.

03

Choose a unique name for your entity and make sure it is available in your jurisdiction.

04

Prepare and file the necessary formation documents, such as articles of organization for an LLC or partnership agreement for a partnership.

05

Obtain any required licenses or permits for your specific industry or location.

06

Apply for an EIN (Employer Identification Number) from the IRS.

07

Determine the tax treatment for your pass-through entity, whether it will be taxed as a sole proprietorship, partnership, or S corporation.

08

Establish a record-keeping system to keep track of financial transactions and documents.

09

Comply with any ongoing filing and reporting requirements, such as annual reports or tax returns.

10

Consult with a legal or tax professional for guidance and assistance throughout the process.

Who needs corporation llc and pass-through?

01

Corporation LLC and pass-through entities are typically needed by:

02

- Small businesses that want flexibility in terms of management and taxation.

03

- Entrepreneurs who want to protect their personal assets by separating them from the liabilities of the business.

04

- Freelancers or independent contractors who want to establish a formal business entity.

05

- Business owners who want to take advantage of pass-through taxation, where the business income is not taxed at the entity level but instead reported on the owner's individual tax return.

06

- Individuals or groups looking to start a joint venture or collaborate on a business venture.

07

- Professionals such as doctors, lawyers, and accountants who want to form a professional limited liability company (PLLC) to shield themselves from personal liability while maintaining their professional status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my corporation llc and pass-through directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your corporation llc and pass-through and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit corporation llc and pass-through on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as corporation llc and pass-through. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out corporation llc and pass-through on an Android device?

Use the pdfFiller mobile app to complete your corporation llc and pass-through on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is corporation llc and pass-through?

A corporation LLC is a limited liability company that provides its owners with limited liability protection while allowing flexible management and tax benefits. A pass-through entity is a business structure where the income is passed directly to the owners and taxed on their personal tax returns, avoiding double taxation.

Who is required to file corporation llc and pass-through?

Any business entity structured as an LLC or a corporation that has chosen pass-through taxation is required to file appropriate forms with the IRS and possibly state agencies. This typically includes LLCs formed by single or multiple members and S Corporations.

How to fill out corporation llc and pass-through?

Filling out forms for corporation LLC and pass-through typically requires providing business information such as the entity's name, EIN, income, deductions, and individual owner information. Specific forms include IRS Form 1065 for partnerships or Form 1120S for S Corporations.

What is the purpose of corporation llc and pass-through?

The purpose of a corporation LLC and pass-through taxation is to provide liability protection for owners while allowing profits and losses to be reported on their individual tax returns, simplifying taxation and avoiding double taxation.

What information must be reported on corporation llc and pass-through?

Information typically required to be reported includes business income, expenses, all members' or shareholders' names, addresses, Social Security numbers or EINs, and percentage of ownership or interest in the business.

Fill out your corporation llc and pass-through online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Llc And Pass-Through is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.