Get the free Roth IRA Conversion Rules

Show details

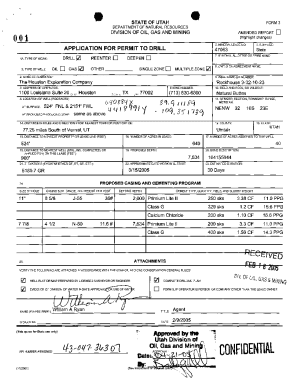

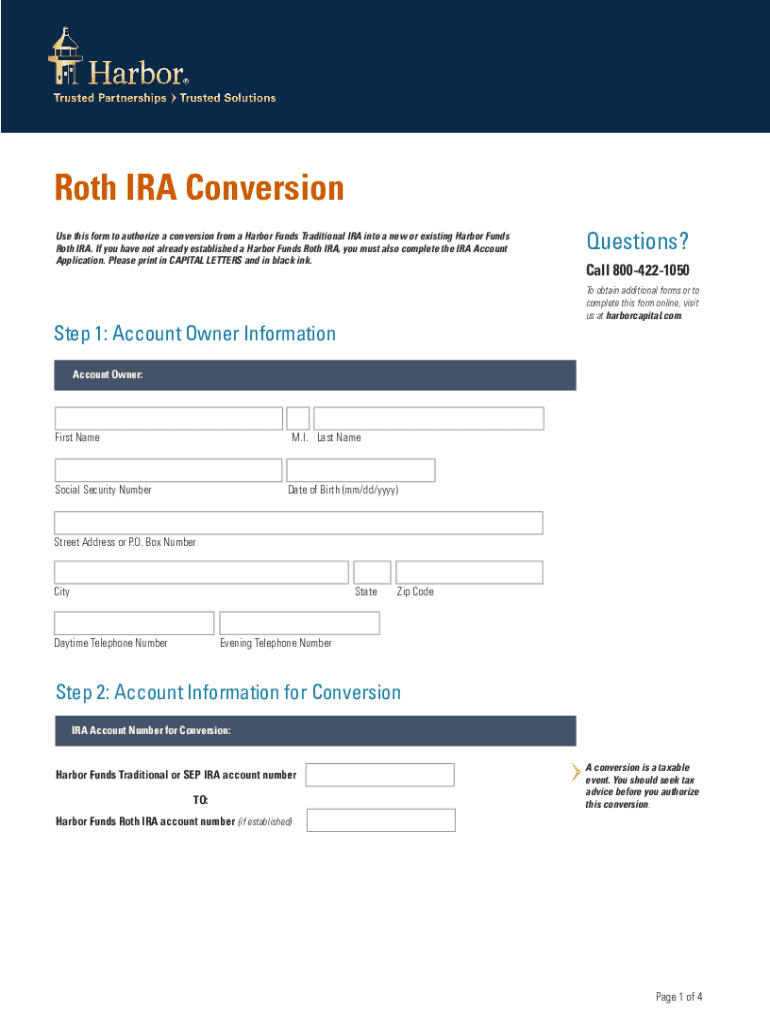

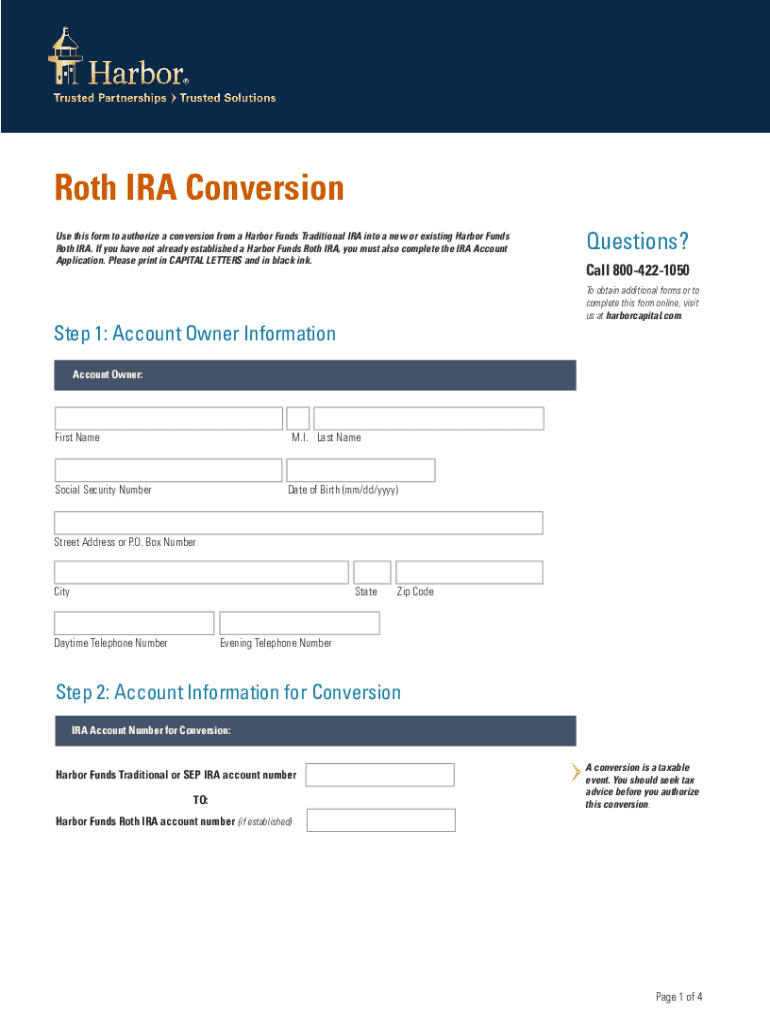

Roth IRA ConversionResetUse this form to authorize a conversion from a Harbor Funds Traditional IRA into a new or existing Harbor Funds

Roth IRA. If you have not already established a Harbor Funds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira conversion rules

Edit your roth ira conversion rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira conversion rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira conversion rules online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit roth ira conversion rules. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira conversion rules

How to fill out roth ira conversion rules

01

To fill out the Roth IRA conversion rules, follow these steps:

02

Determine your eligibility: Make sure you meet the income limits for a Roth IRA conversion. In 2021, individuals with modified adjusted gross incomes (MAGIs) over $140,000 and married couples filing jointly with MAGIs over $208,000 are generally not eligible.

03

Open a Roth IRA account: If you don't have a Roth IRA account already, you'll need to open one with a qualified financial institution of your choice.

04

Complete the conversion paperwork: Contact your financial institution to request the necessary conversion forms. They will guide you through the process and help you fill out the required paperwork, which typically includes a conversion authorization form.

05

Determine the conversion amount: Decide how much you want to convert from your traditional IRA or employer-sponsored retirement plan to a Roth IRA. Keep in mind that the converted amount will be subject to income taxes in the year of conversion.

06

Choose the conversion method: There are two main methods of conversion: a direct conversion or an indirect conversion. A direct conversion involves transferring funds directly from your traditional IRA to your Roth IRA. An indirect conversion, also known as a rollover, requires distributing the funds from your traditional IRA to yourself and then depositing them into your Roth IRA within 60 days.

07

Pay the applicable taxes: Remember that the amount you convert will be considered taxable income in the year of conversion. Consult a tax professional to estimate your tax liability and prepare for the additional tax obligations that may arise from the conversion.

08

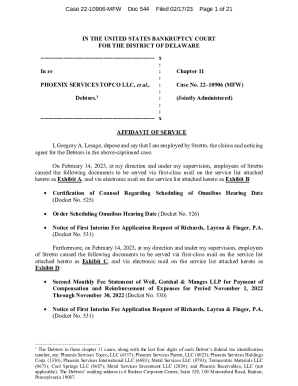

Report the conversion on your tax return: When filing your tax return for the year of conversion, you need to report the amount converted from a traditional IRA to a Roth IRA. This will be done using IRS Form 8606.

09

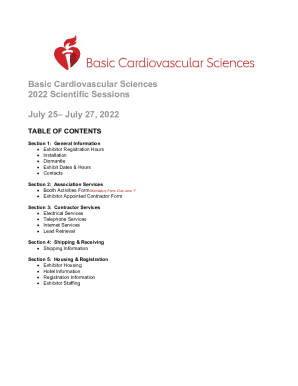

Track your conversions: Keep a record of all your Roth IRA conversions for future reference and to assist you in tracking your basis in the account.

10

Consult a financial advisor: If you are unsure about any aspect of the Roth IRA conversion rules or need personalized advice, consider consulting a qualified financial advisor.

11

Review and update your investment strategy: After completing the conversion, reassess your investment strategy to align with your new Roth IRA goals and objectives.

Who needs roth ira conversion rules?

01

Roth IRA conversion rules are suitable for individuals who:

02

- Want to take advantage of tax-free growth and tax-free withdrawals in retirement

03

- Expect their tax rate to be higher in the future

04

- Have a traditional IRA or an employer-sponsored retirement plan and wish to convert it to a Roth IRA

05

- Seek to leave a tax-free inheritance for their beneficiaries

06

- Have non-deductible contributions in their traditional IRA and want to convert them to a Roth IRA

07

- Are looking for additional retirement savings options beyond traditional IRAs or employer-sponsored plans

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit roth ira conversion rules online?

With pdfFiller, it's easy to make changes. Open your roth ira conversion rules in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the roth ira conversion rules electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your roth ira conversion rules in minutes.

How can I fill out roth ira conversion rules on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your roth ira conversion rules from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is roth ira conversion rules?

Roth IRA conversion rules refer to the guidelines and regulations governing the process of converting a traditional IRA into a Roth IRA. This involves paying taxes on the converted amount, as contributions to a Roth IRA are made with after-tax dollars.

Who is required to file roth ira conversion rules?

Individuals who convert their traditional IRA to a Roth IRA need to file their tax returns, including reporting the converted amount as taxable income.

How to fill out roth ira conversion rules?

To fill out Roth IRA conversion rules, individuals should report the converted amount on IRS Form 1040, specifically on line 4b, indicating the taxable amount of the conversion.

What is the purpose of roth ira conversion rules?

The purpose of Roth IRA conversion rules is to provide a legal framework for individuals to convert their retirement savings into a Roth IRA, allowing for tax-free growth and tax-free withdrawals in retirement.

What information must be reported on roth ira conversion rules?

Information that must be reported includes the amount converted from the traditional IRA, the taxable amount, and any tax owed on the conversion.

Fill out your roth ira conversion rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Conversion Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.