Get the free TRANSFER ON DEATH (TOD) FORM - cloudfront.net

Show details

TRANSFER ON DEATH (TOD) FORM

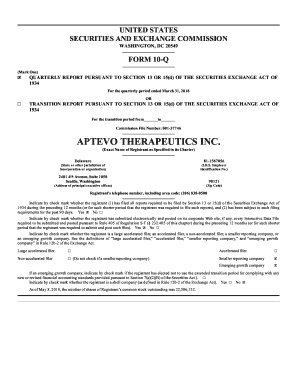

Gladstone Land Corporation (the Company) is selling up to a maximum of 20,000,000 shares of Series C Cumulative Redeemable

Preferred Stock (the Shares or Series C Preferred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death tod

Edit your transfer on death tod form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death tod form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death tod online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer on death tod. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death tod

How to fill out transfer on death tod

01

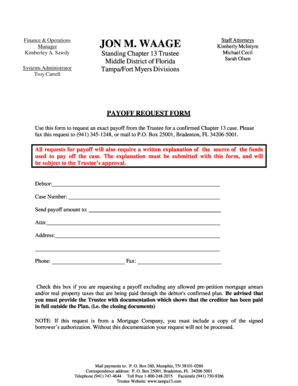

To fill out a transfer on death (TOD) form, follow these steps:

02

Obtain the TOD form: Contact your financial institution or brokerage firm to request a transfer on death form. They may have it available online or send it to you.

03

Fill in your personal information: Enter your full name, address, date of birth, and social security number. This information will identify you as the account owner.

04

Designate beneficiaries: Specify the individuals or organizations you want to inherit the assets upon your death. Provide their full names, addresses, and social security numbers or tax identification numbers.

05

Determine the percentage allocation: Indicate the percentage of assets you want each beneficiary to receive. The total allocation must add up to 100%.

06

Add contingent beneficiaries: Optionally, you can name backup beneficiaries who will receive the assets if the primary beneficiaries are unable to inherit.

07

Sign and date the form: Read the instructions carefully and sign the TOD form in the presence of a notary public or witness, as required by state law.

08

Submit the form: Send the completed form to your financial institution or brokerage firm. Keep a copy for your records.

09

Note: It is advisable to consult with an attorney or financial advisor when filling out a TOD form to ensure it meets your estate planning goals and complies with applicable laws.

Who needs transfer on death tod?

01

Transfer on death (TOD) is useful for individuals who want to simplify the transfer of their assets upon their death. It is particularly beneficial for:

02

- Individuals who want to avoid probate: TOD allows assets to pass directly to designated beneficiaries, bypassing probate court and potentially saving time and costs.

03

- Individuals with specific inheritance wishes: TOD allows you to specify who should inherit your assets and in what proportion, ensuring your wishes are followed.

04

- Individuals with complex family situations: TOD can help address complicated family structures, such as blended families or individuals with multiple dependents.

05

- Individuals with high-value assets: TOD can be utilized to transfer significant financial assets, such as investment accounts or real estate properties, to designated beneficiaries.

06

- Individuals who value privacy: TOD transfers occur outside of the public probate process, providing a higher level of privacy and confidentiality.

07

It's important to evaluate your individual circumstances and consult with professionals to determine if a transfer on death (TOD) is suitable for your estate planning needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit transfer on death tod online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your transfer on death tod and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out transfer on death tod using my mobile device?

Use the pdfFiller mobile app to fill out and sign transfer on death tod on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit transfer on death tod on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign transfer on death tod right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is transfer on death tod?

Transfer on Death (TOD) is a legal mechanism that allows an individual to transfer assets directly to a designated beneficiary upon their death, avoiding the probate process.

Who is required to file transfer on death tod?

Typically, the individual who owns the asset—such as real estate or financial accounts—must file the Transfer on Death (TOD) designation.

How to fill out transfer on death tod?

To fill out a Transfer on Death (TOD) form, the owner must provide their personal information, identify the asset being transferred, designate the beneficiary, and sign the document according to local laws.

What is the purpose of transfer on death tod?

The purpose of Transfer on Death (TOD) is to facilitate the direct transfer of assets to beneficiaries after the owner's death, thereby simplifying the process and bypassing probate.

What information must be reported on transfer on death tod?

A Transfer on Death (TOD) must typically include the owner's name, the description of the asset, the beneficiary's name, and signatures of the owner and a witness if required.

Fill out your transfer on death tod online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Tod is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.