Get the free Year-End Information - UF Procurement - University of Florida

Show details

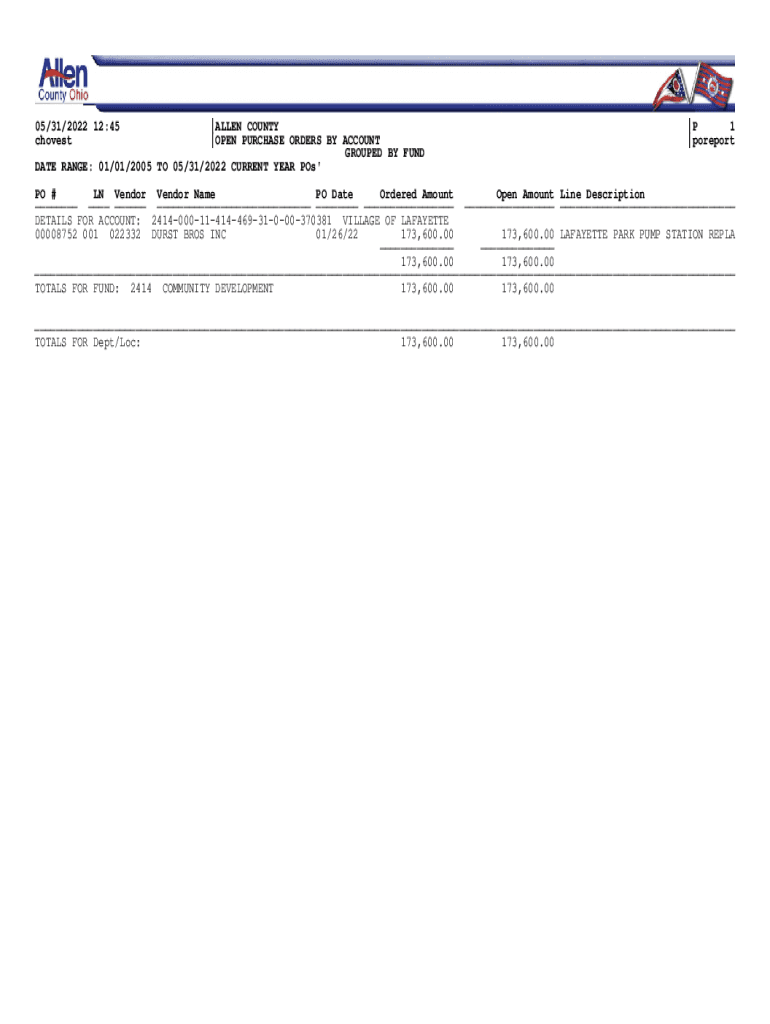

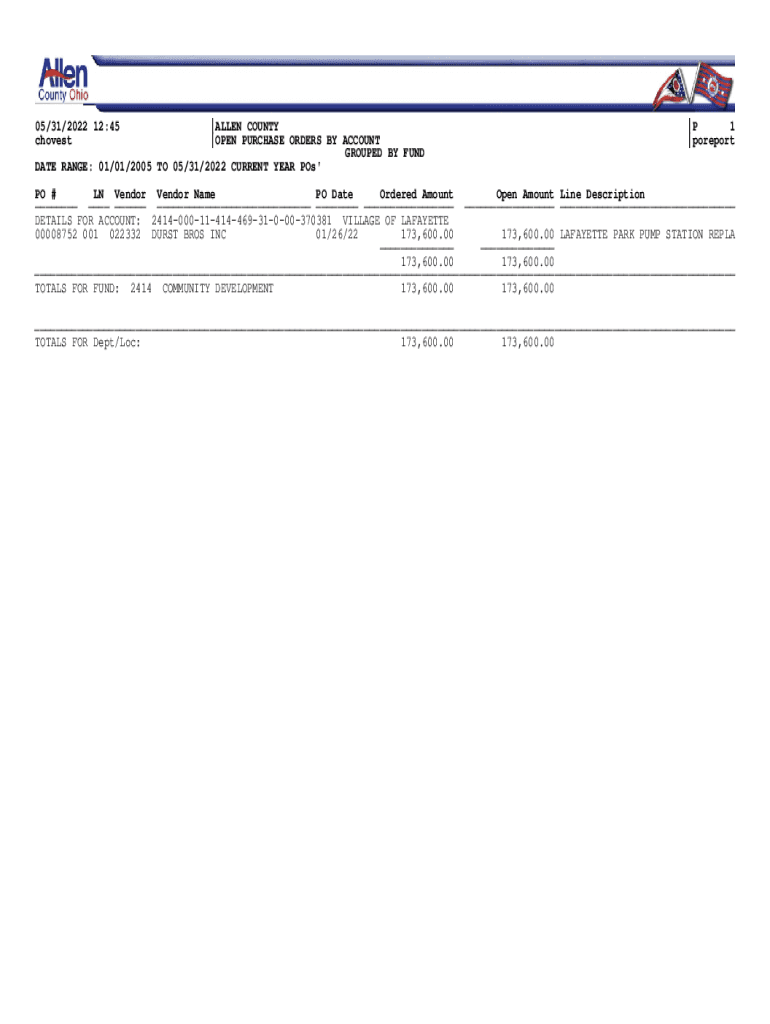

05/31/2022 12:45

chest|ALLEN COUNTY

|OPEN PURCHASE ORDERS BY ACCOUNT

GROUPED BY FUND

DATE RANGE: 01/01/2005 TO 05/31/2022 CURRENT YEAR PO's\'|P

1

|poreportPO #

LN Vendor Name

PO Date

Ordered Amount

Open

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign year-end information - uf

Edit your year-end information - uf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year-end information - uf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing year-end information - uf online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit year-end information - uf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year-end information - uf

How to fill out year-end information - uf

01

To fill out year-end information, follow these steps:

02

Gather all relevant financial documents, such as income statements, balance sheets, and cash flow statements.

03

Review and reconcile the financial statements to ensure they are accurate and complete.

04

Verify the correctness of all revenue and expense entries, ensuring they are recorded in the correct accounting period.

05

Identify any necessary adjusting entries, such as accruals or deferrals, and make them accordingly.

06

Calculate and record any necessary depreciation or amortization expenses.

07

Prepare a detailed schedule of any outstanding liabilities, such as loans or unpaid expenses.

08

Compile a list of all assets, including their current values and any changes made during the year.

09

Review any changes to the company's equity, including additional investments, distributions, or retained earnings.

10

Confirm that all tax-related information, such as payroll reports and tax forms, is accurate and up to date.

11

Once all the necessary information is gathered and reviewed, complete the year-end financial statements, including the income statement, balance sheet, and cash flow statement.

12

Finally, ensure that all required disclosures and footnotes are included in the financial statements.

13

Once the year-end information is complete, it can be used for various purposes, including tax filings, financial reporting, and decision-making.

Who needs year-end information - uf?

01

Year-end information is needed by various stakeholders, including:

02

- Business owners and shareholders who want to evaluate the financial health of the company and assess its profitability and growth.

03

- Tax authorities who require accurate financial statements for tax filing purposes.

04

- Banks and lenders who need to assess the creditworthiness of the company before providing loans or credit.

05

- Investors and potential investors who want to assess the company's financial performance before making investment decisions.

06

- Auditors who need the year-end information to conduct financial audits and ensure compliance with accounting standards.

07

- Management and executives who use the year-end information to make strategic decisions and plan for the future.

08

- Regulatory bodies and government agencies who may require the year-end information for compliance and reporting purposes.

09

- Suppliers and creditors who need to evaluate the company's ability to fulfill its financial obligations.

10

- Employees who may want to assess the financial stability and performance of their employer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute year-end information - uf online?

pdfFiller makes it easy to finish and sign year-end information - uf online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out year-end information - uf using my mobile device?

Use the pdfFiller mobile app to fill out and sign year-end information - uf. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit year-end information - uf on an Android device?

The pdfFiller app for Android allows you to edit PDF files like year-end information - uf. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is year-end information - uf?

Year-end information - uf refers to the financial and tax-related documents that reflect an entity's financial performance and tax obligations for the year, typically summarizing income, deductions, credits, and other relevant financial data.

Who is required to file year-end information - uf?

Entities such as businesses, nonprofit organizations, and individuals who meet certain income thresholds are required to file year-end information - uf to report their earnings and fulfill tax obligations.

How to fill out year-end information - uf?

To fill out year-end information - uf, collect all necessary financial records, follow the provided forms and guidelines, accurately report all income and deductions, and ensure all figures are correct before submission.

What is the purpose of year-end information - uf?

The purpose of year-end information - uf is to provide an accurate summary of an entity’s financial activities over the year for taxation, compliance, and financial transparency.

What information must be reported on year-end information - uf?

Year-end information - uf must report total earnings, expenses, deductions, credits, and sometimes additional data like assets, liabilities, and shareholder equity, depending on the filing entity.

Fill out your year-end information - uf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year-End Information - Uf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.