Get the free CREDITS FOR GROWING BUSINESSES (ARTICLE 3J ...

Show details

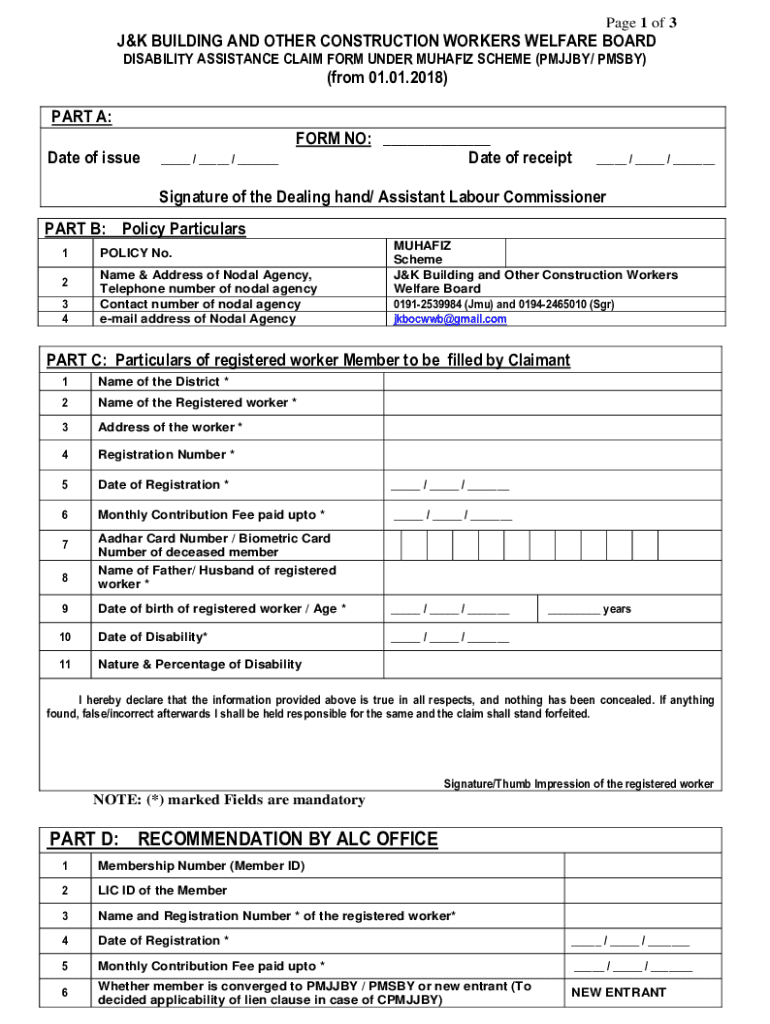

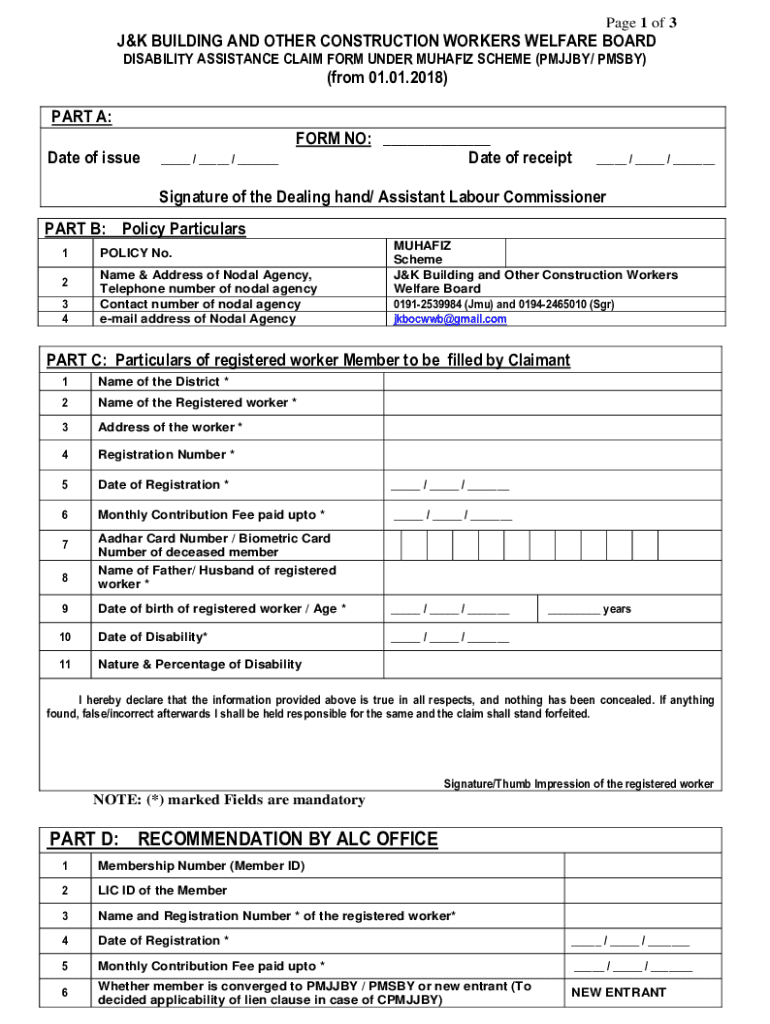

Page 1 of 3J&K BUILDING AND OTHER CONSTRUCTION WORKERS WELFARE BOARD

DISABILITY ASSISTANCE CLAIM FORM UNDER HAFIZ SCHEME (PHILBY/ COSBY)(from 01.01.2018)

PART A:

Date of issue___ / ___ / ___FORM NO:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credits for growing businesses

Edit your credits for growing businesses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credits for growing businesses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credits for growing businesses online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credits for growing businesses. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credits for growing businesses

How to fill out credits for growing businesses

01

Step 1: Identify the specific credit needs of your growing business. Determine how much funding you require and what the funds will be used for, such as expansion, equipment purchases, or inventory.

02

Step 2: Research and compare different credit options available for growing businesses. This could include traditional bank loans, lines of credit, small business administration loans, or alternative financing options.

03

Step 3: Gather all the necessary documentation required by lenders or financial institutions, such as financial statements, cash flow projections, business plans, and tax returns.

04

Step 4: Prepare a convincing business case or proposal that highlights the growth potential and profitability of your business. Clearly explain how the credit will be utilized to achieve business goals and generate positive returns.

05

Step 5: Approach potential lenders or financial institutions and submit your credit application. Be prepared to provide additional information or answer any questions they may have.

06

Step 6: Evaluate the credit offers received and negotiate the terms and conditions that best suit your business needs. Pay attention to interest rates, repayment terms, and any associated fees.

07

Step 7: Once approved, carefully review the credit agreement before signing it. Make sure you fully understand the terms and obligations involved.

08

Step 8: Use the credit wisely and as planned. Monitor your business's financial performance to ensure timely repayments and manage cash flow effectively.

09

Step 9: Regularly assess the impact of the credit on your growing business. Determine if the funds are being utilized effectively and if additional credit may be required in the future.

10

Step 10: Maintain a good relationship with your lenders or financial institutions by keeping them informed about your business's progress and promptly addressing any issues or concerns.

Who needs credits for growing businesses?

01

Small and medium-sized enterprises (SMEs) that are experiencing steady growth and require additional funds to support their expansion plans.

02

Entrepreneurs or business owners who want to invest in new equipment, technology, or infrastructure to enhance their production capabilities.

03

Startups or early-stage businesses that have proven their market viability and need capital to scale their operations and capture a larger market share.

04

Companies experiencing short-term cash flow gaps but have a positive outlook on their future earnings and ability to repay the credit.

05

Businesses operating in industries with high capital requirements, such as manufacturing, technology, construction, or healthcare.

06

Entrepreneurs looking to seize growth opportunities, such as acquiring a competitor, entering new markets, or launching new product lines.

07

Established businesses aiming to consolidate their market position by investing in marketing and branding activities, research and development, or talent acquisition.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credits for growing businesses online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your credits for growing businesses to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit credits for growing businesses straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing credits for growing businesses right away.

How do I edit credits for growing businesses on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign credits for growing businesses right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is credits for growing businesses?

Credits for growing businesses are financial incentives provided by the government or other entities to promote the expansion of small and medium-sized enterprises. These credits can help reduce tax liabilities and improve cash flow.

Who is required to file credits for growing businesses?

Typically, small and medium-sized businesses that meet certain criteria set by the government or organization providing the credits are required to file for these credits.

How to fill out credits for growing businesses?

To fill out credits for growing businesses, businesses need to complete the designated application form accurately, provide necessary documentation, such as tax returns and financial statements, and submit them to the appropriate authority.

What is the purpose of credits for growing businesses?

The purpose of credits for growing businesses is to encourage economic growth by supporting business expansion, job creation, and innovation in various sectors.

What information must be reported on credits for growing businesses?

Businesses must report information such as their revenue, number of employees, expenses, and specific details regarding the project or investment for which they are claiming credits.

Fill out your credits for growing businesses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credits For Growing Businesses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.