Get the free 1st Quarter 2024 Sales Tax Rates - Combined List. Sales Taxes - tax utah

Show details

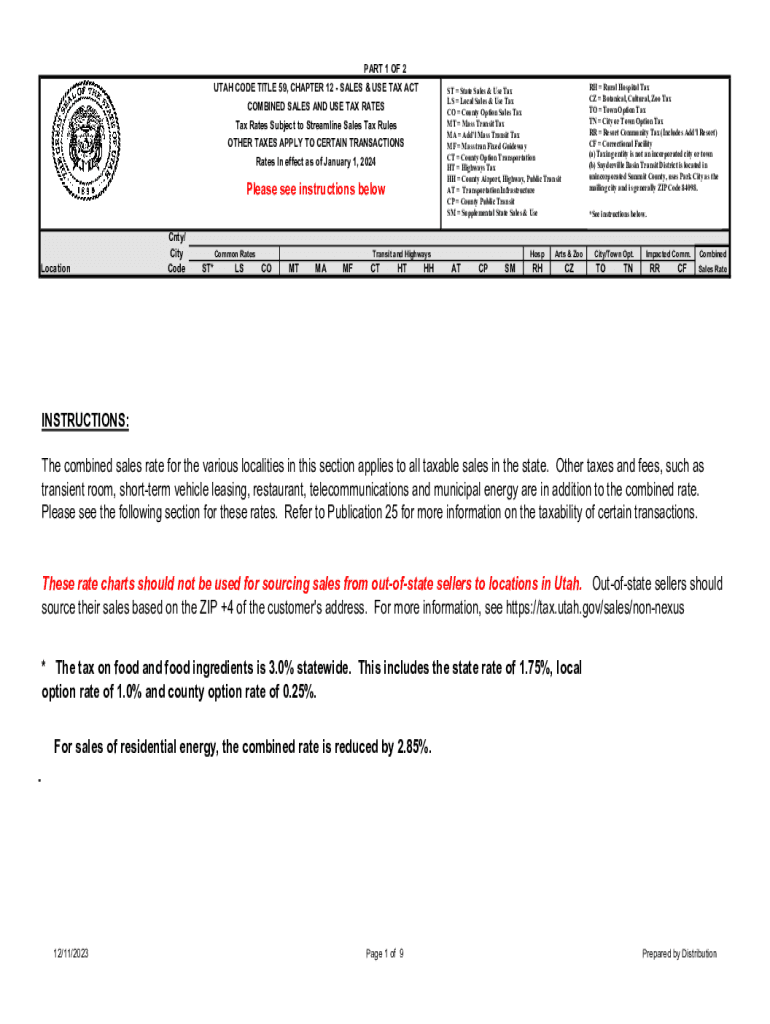

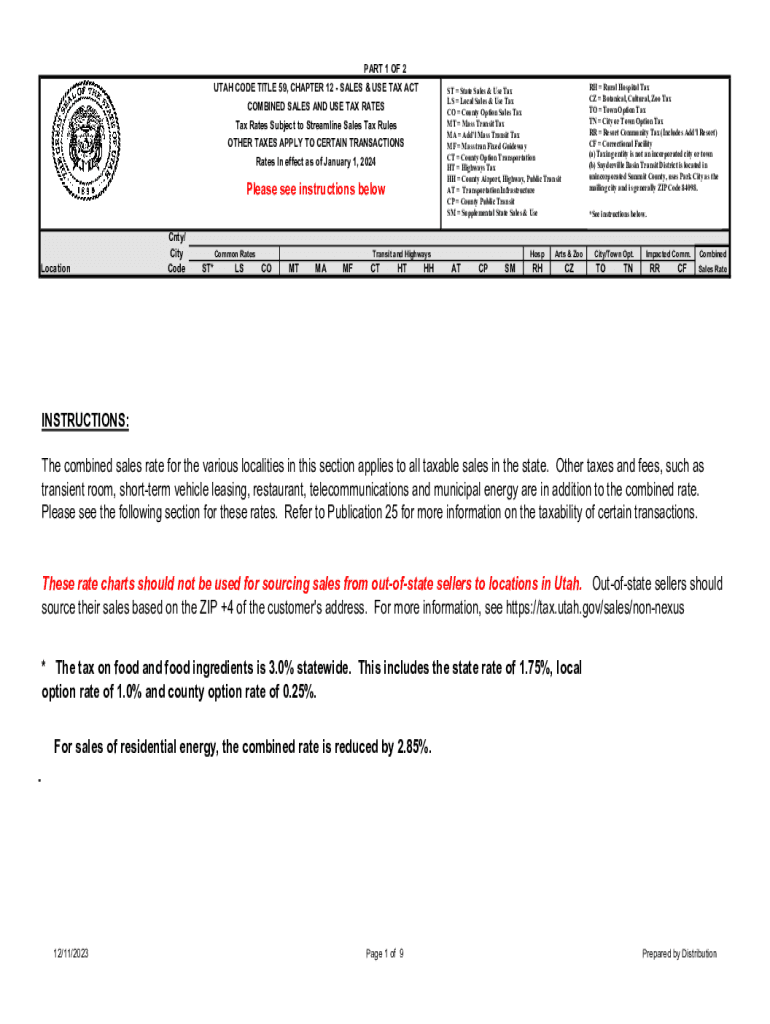

PART 1 OF 2

UTAH CODE TITLE 59, CHAPTER 12 SALES & USE TAX ACT

Tax Rates Subject to Streamline Sales Tax Rules

OTHER TAXES APPLY TO CERTAIN TRANSACTIONS

Rates In effect as of January 1, 2024Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1st quarter 2024 sales

Edit your 1st quarter 2024 sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1st quarter 2024 sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1st quarter 2024 sales online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1st quarter 2024 sales. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1st quarter 2024 sales

How to fill out 1st quarter 2024 sales

01

To fill out the 1st quarter 2024 sales report, follow these steps:

02

Collect all the sales data for the 1st quarter of 2024, including revenue, units sold, and customer information.

03

Organize the data in a spreadsheet or sales report template.

04

Calculate the total revenue and units sold for the quarter.

05

Analyze the sales performance by comparing it to previous quarters or targets.

06

Identify any trends or patterns in the sales data.

07

Prepare a summary of the sales performance, including key findings and recommendations.

08

Present the report to relevant stakeholders, such as the sales team, management, or investors.

09

Keep a copy of the report for future reference.

10

Update any sales forecasting or planning documents based on the findings from the report.

11

Use the insights from the 1st quarter 2024 sales report to make informed business decisions and improve future sales strategies.

Who needs 1st quarter 2024 sales?

01

Various stakeholders might need the 1st quarter 2024 sales report, including:

02

- Sales managers or directors to track the team's performance and identify areas for improvement.

03

- Executives or business owners to assess the overall sales performance and make strategic decisions.

04

- Investors or shareholders to evaluate the company's financial health and growth potential.

05

- Marketing teams to understand the impact of their campaigns on sales.

06

- Financial analysts to analyze the company's revenue and profitability.

07

- Sales representatives to track their individual performance and set targets for future quarters.

08

- Suppliers or partners to assess the demand for their products or services.

09

- Competitors to benchmark their own sales performance against the industry average.

10

- Government agencies or regulatory bodies for compliance and reporting purposes.

11

- Researchers or market analysts studying the industry or market trends.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 1st quarter 2024 sales from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 1st quarter 2024 sales into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit 1st quarter 2024 sales on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 1st quarter 2024 sales, you can start right away.

How do I edit 1st quarter 2024 sales on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share 1st quarter 2024 sales on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is 1st quarter sales tax?

1st quarter sales tax refers to the sales tax collected by businesses during the first quarter of the fiscal year, typically covering the months of January, February, and March.

Who is required to file 1st quarter sales tax?

Businesses that are registered to collect sales tax and have taxable sales during the first quarter are required to file the 1st quarter sales tax.

How to fill out 1st quarter sales tax?

To fill out the 1st quarter sales tax return, businesses must report their total sales, taxable sales, and the amount of sales tax collected during the quarter on the designated tax form provided by the state.

What is the purpose of 1st quarter sales tax?

The purpose of the 1st quarter sales tax is to collect revenue for state and local governments, which is used for public services and infrastructure.

What information must be reported on 1st quarter sales tax?

Businesses must report total sales, taxable sales, exempt sales, sales tax collected, and any adjustments or credits on their 1st quarter sales tax return.

Fill out your 1st quarter 2024 sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1st Quarter 2024 Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.