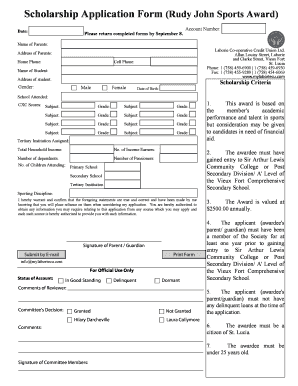

Get the free 401(k) Retirement Investment Plan

Show details

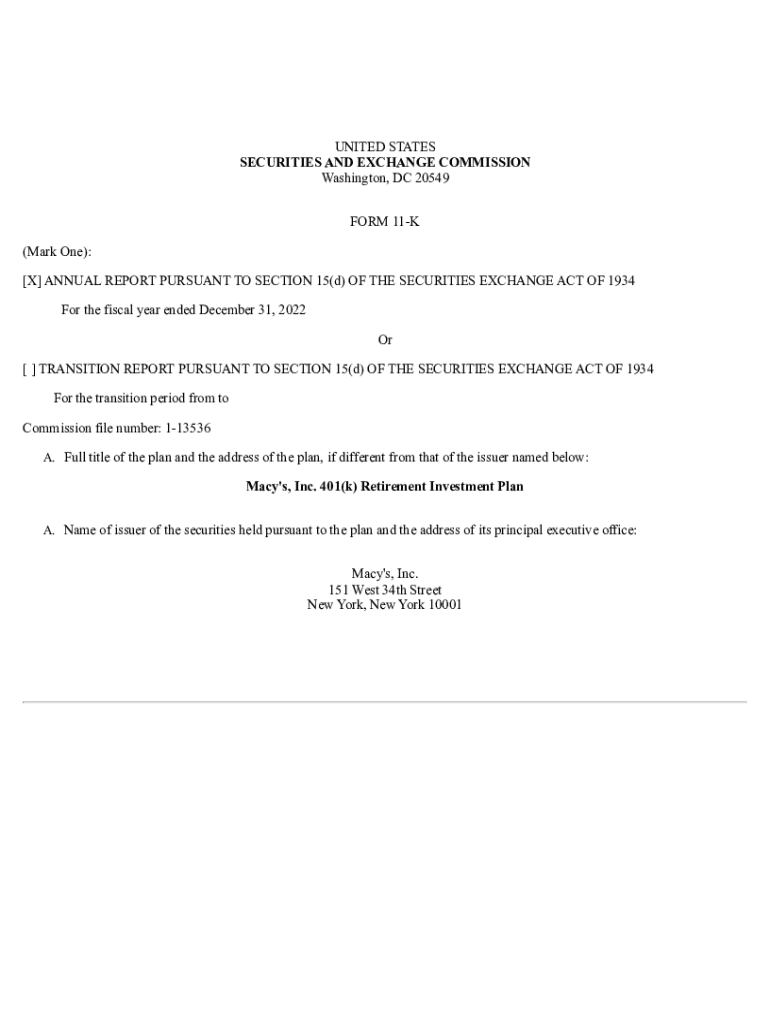

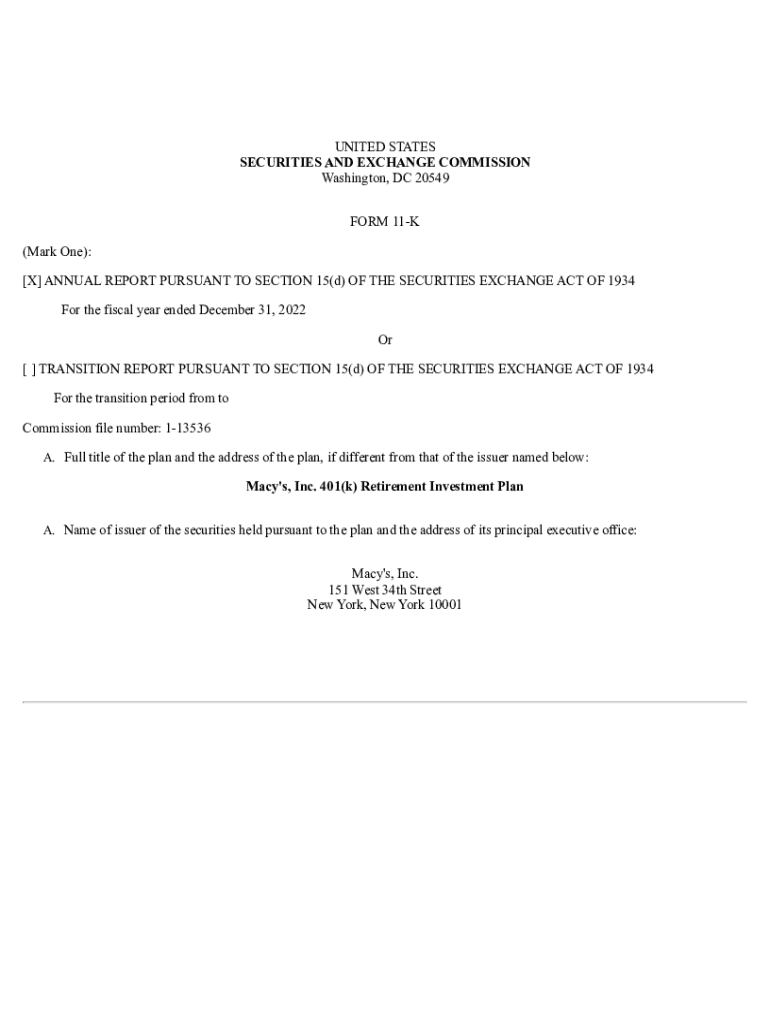

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 11K (Mark One): [X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k retirement investment plan

Edit your 401k retirement investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k retirement investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k retirement investment plan online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 401k retirement investment plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k retirement investment plan

How to fill out 401k retirement investment plan

01

To fill out a 401k retirement investment plan, follow these steps:

02

Enroll in a 401k plan offered by your employer. You may need to provide personal information such as your name, contact details, social security number, and employment details.

03

Determine the contribution amount you wish to make towards your 401k plan. This is typically a percentage of your salary, and there may be employer matching contributions as well.

04

Choose your investment options from the available funds provided by the 401k plan. These funds can include stocks, bonds, mutual funds, and more. Consider your risk tolerance and long-term financial goals when making your selection.

05

Review and select the beneficiaries who will receive your 401k savings in the event of your death.

06

Complete any necessary paperwork, such as beneficiary designation forms or investment allocation forms.

07

Keep track of your contributions and monitor your 401k investment regularly to ensure it aligns with your financial objectives. Make any necessary adjustments over time as your circumstances change.

08

Understand the rules and regulations related to your 401k plan, such as withdrawal options, penalties for early withdrawals, and tax implications. Consult with a financial advisor if needed.

09

Continuously educate yourself about retirement planning and the benefits of your 401k plan to make informed decisions for your future financial security.

Who needs 401k retirement investment plan?

01

A 401k retirement investment plan is beneficial for individuals who:

02

- Are employed by companies offering a 401k plan as part of their employee benefits package.

03

- Want to save for retirement and have a tax-advantaged investment vehicle.

04

- Desire to take advantage of potential employer matching contributions and maximize their retirement savings.

05

- Are willing to make long-term investments and understand the potential risks associated with market fluctuations.

06

- Seek to diversify their investment portfolio by including stocks, bonds, and other assets.

07

- Are looking for a retirement savings plan that offers flexibility and control over their investment decisions.

08

- Are focused on building a financially secure future and maintaining a comfortable retirement lifestyle.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 401k retirement investment plan directly from Gmail?

401k retirement investment plan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit 401k retirement investment plan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 401k retirement investment plan, you need to install and log in to the app.

How do I fill out the 401k retirement investment plan form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 401k retirement investment plan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is 401k retirement investment plan?

A 401(k) retirement investment plan is a employer-sponsored defined contribution pension account that allows employees to save and invest a portion of their paycheck before taxes are taken out, providing tax advantages for retirement savings.

Who is required to file 401k retirement investment plan?

Employers who offer a 401(k) plan are required to file various documents with the IRS, including Form 5500, which provides information about the plan's finances, operations, and compliance with federal regulations.

How to fill out 401k retirement investment plan?

To fill out a 401(k) retirement investment plan, an employee must complete the enrollment form provided by their employer, which typically includes personal information, contribution amounts, and investment choices.

What is the purpose of 401k retirement investment plan?

The purpose of a 401(k) retirement investment plan is to provide employees with a tax-advantaged way to save for retirement, encouraging long-term savings and investment for financial security in retirement.

What information must be reported on 401k retirement investment plan?

Information that must be reported on a 401(k) retirement investment plan includes plan assets, liabilities, income, expenses, participant counts, and compliance with various regulations, typically on forms like Form 5500.

Fill out your 401k retirement investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Retirement Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.